Blockchain

The Avalanche crypto ecosystem permits the creation of subnets: let’s see what a subnet is and the way it works.

Avalanche subnets are sovereign networks with their very own guidelines, composed of a dynamic subset of Avalanche validators.

Every subnet can have many blockchains, however every particular person blockchain is validated solely by a single subnet. A validator in flip generally is a member of a number of subnets, however all subnet validators should additionally validate the first Avalanche community.

Subnets have been launched to have the ability to be impartial, that’s, with their very own execution logic that doesn’t depend upon the first community. In truth, they will independently decide their very own pricing scheme, keep their very own state, facilitate their very own community and supply their very own stage of safety. Additionally they don’t share the execution thread and transactions with different subnets or the first community, thus enabling straightforward scalability, with decrease latency, larger TPS and decrease transaction prices.

In different phrases, Avalanche’s subnets act independently of the Avalanche community itself, in order that they don’t intrude with it and, conversely, don’t have any interference from the first community or different subnets. After all, they do want their very own validator nodes to function, partly as a result of validators on the principle community usually don’t additionally work on subnets.

Tokens

On this manner, subnets can have their very own token financial system impartial of that of Avalanche, with their very own native tokens. They’ll even launch new blockchains with custom-made digital machines.

Since anybody can create an Avalanche subnet, they will additionally create their very own autonomous and explicit token financial system on this manner, with tokens that won’t even exist on the principle Avalanche blockchain.

What’s a subnet within the crypto world and what position do validators play

The coverage on validators can be custom-made.

In truth, amongst its personal distinctive guidelines, a subnet can have the requirement that validators should be positioned in a sure nation, or that they need to go KYC/AML checks, or that they need to maintain a sure license.

This makes it potential to construct a form of permissioned blockchain primarily based on a permissionless and trustless ecosystem.

This may be helpful for blockchain-based purposes that require validators to have sure properties, akin to an software that requires massive quantities of RAM or computing energy: a subnet on this case can require validators to satisfy sure {hardware} necessities in order that the applying doesn’t have decreased efficiency.

What’s a subnet and the way it interacts with digital machines and the creation of crypto alternate options

Subnets have digital machines (VMs) that outline the blockchain logic on the software stage, specifying the blockchain state, state transition operate, transactions, and APIs with which customers can work together with the blockchain. Successfully on Avalanche, every blockchain is an occasion of a VM.

The benefit is that it’s potential to create VMs with out having to fret about growing the lower-level logic, akin to networking, consensus and blockchain construction, as a result of that’s achieved by the upstream Avalanche ecosystem.

VMs must be thought of as tasks for particular person blockchains, such that one may even use the identical VM to create many blockchains with the identical algorithm, however logically impartial.

The explanation VMs have been launched is that normally basic blockchains have just one, with an inevitably predefined and static function set. Thus those that wished to create customized decentralized purposes with their very own guidelines have been pressured to create a brand new blockchain community from scratch.

Ethereum has partially solved this drawback with sensible contracts, though they depend upon a single VM that inevitably imposes restrictions on builders.

Conversely, with Avalanche’s VMs, it’s simpler to create decentralized blockchains and purposes with utterly new guidelines that don’t have to depend upon exterior blockchains.

The first community

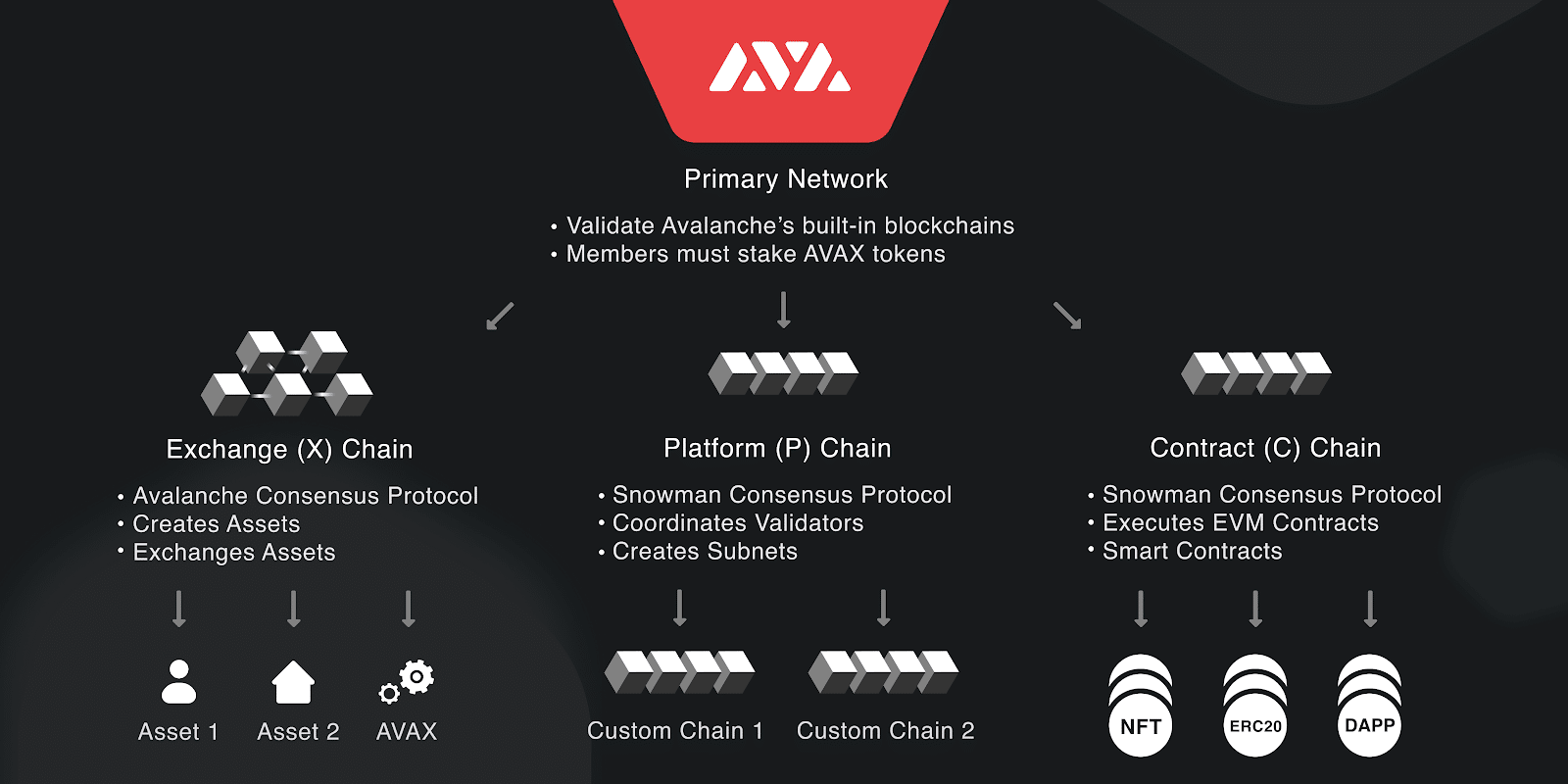

Avalanche’s major community itself was created with three subnets: Change Chain (X-Chain), Platform Chain (P-Chain) and Contract Chain (C-Chain).

The first community can be a subnet, although a particular one, as a result of all members of all subnets should even be members of the first community, they usually should be staking no less than 2,000 AVAX.

The first community operates utterly independently of all different subnets, in order that they can not intrude with its correct operation. The one restriction is exactly that the validators of the subnets should even be validators of the mainnet.

It’s value noting that the variety of transactions recorded every day on Avalanche’s C-Chain elevated enormously throughout 2022.

Avalanche is a comparatively latest venture, born in 2020, so the primary full information is barely from 2021.

Till mid-August final 12 months, that’s, on the top of bull run, there have been not often greater than 15,000 transactions per day. However then they instantly soared, in order that by the top of August they’d risen to as many as 230,000.

The actual growth got here from October 2021, with a peak of 1.1 million every day transactions on the finish of January 2022.

In Might, because of the implosion of the Terra/Luna ecosystem, they plummeted to 250,000, then dropped once more to the present 110,000. Nonetheless, this determine continues to be nearly ten instances larger than in July final 12 months.

Which means though the bubble has deflated since Might, the usage of Avalanche’s Contract Chain continues to be very excessive in comparison with earlier years.

The crypto AVAX

Against this, the value development of Avalanche’s native cryptocurrency, specifically AVAX, has adopted a really comparable development to that of different cryptocurrencies.

Ignoring 2020, i.e., the launch 12 months, by January 2021 the worth had already risen to $12, with a powerful first spike to $55 the next month.

After a pointy retracement, a big speculative bubble started to inflate in August of that 12 months, main as much as an all-time excessive of $145 in November.

Then the bubble burst, with the worth falling to $57 in early Might this 12 months.

The actual crash got here in the course of the implosion of the Terra/Luna ecosystem, in some methods just like Avalanche, with the worth plummeting to $15 in June and dropping out of the highest 10 cryptocurrencies with the biggest market capitalization.

Since then, an extended part of downward lateralization has been triggered, resulting in new annual lows on 20 December at $11.2. The present value is -92% from the highs, and is in keeping with that of January 2021.