intermediate

A useless cat bounce is a really helpful market jargon to know — in any case, it’s a relatively frequent prevalence, particularly within the crypto market.

Definition of Lifeless Cat Bounce

A useless cat bounce refers to a short lived worth restoration of an asset that has been in decline for fairly some time. It’s characterised by a short-lived nature and all the time adopted by a continued downward development.

Its identify comes from the saying, “even a useless cat will bounce if it falls from a fantastic top.”

Technical Evaluation

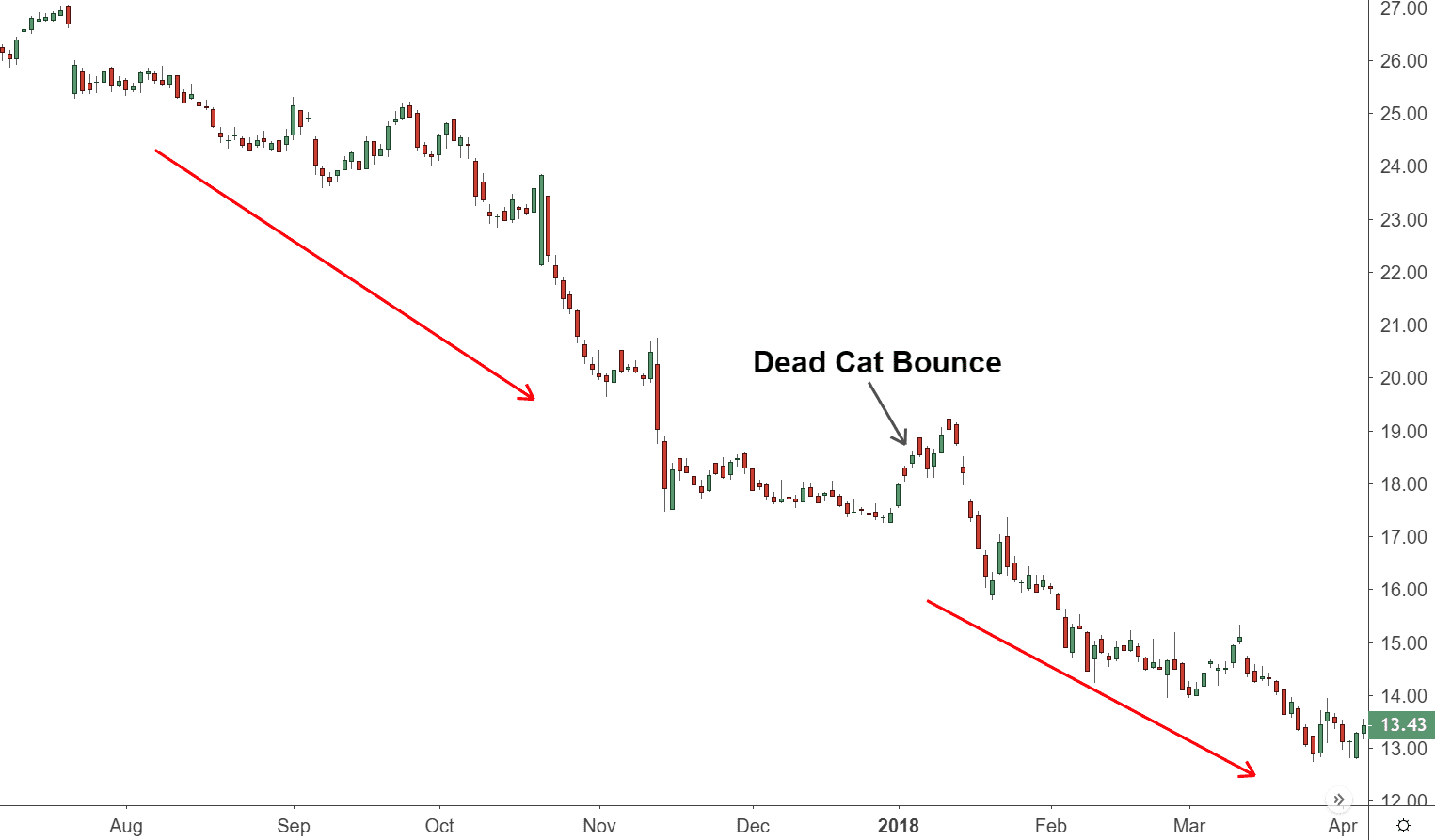

A useless cat bounce is a sample that’s actually helpful within the technical evaluation of each crypto and inventory costs. It reveals a short lived restoration of a bearish asset that’s adopted by additional decline.

Instance of a Lifeless Cat Bounce

The useless cat bounces very often within the crypto market, so there are a number of examples of this phenomenon. Right here’s an instance that occurred in January 2022: the BTC worth was clearly in decline, and we had been within the center (or at the start, relying on whom you ask) of a bear market.

Bitcoin’s worth briefly went as much as $43K, however as a substitute of a step en path to restoration, it turned out to be a useless cat bounce: BTC promptly went again to shedding its worth, happening to as little as $33K.

What Causes a Lifeless Cat Bounce?

There are two essential causes for a useless cat to bounce within the crypto/inventory market:

- bearish merchants closing their brief positions en masse;

- numerous traders which can be bullish sufficient on an asset to try to purchase the dip regardless of a bear market/the asset being clearly overvalued at that second.

How Can You Inform if a Lifeless Cat Is Bouncing?

It’s onerous to establish a useless cat bounce proper from the beginning whereas it’s nonetheless occurring. If there’s a bear market, and also you assume {that a} inventory worth or a cryptocurrency will proceed to fall sooner or later, then a short worth rise is likely to be a DCB.

Nonetheless, not each upward worth motion after a protracted worth drop is a useless cat bounce or a market reversal. It may very well be only a regular fluctuation, particularly within the crypto market, the place costs are unstable as a rule.

Limitations in Figuring out a Lifeless Cat Bounce

It’s simpler to acknowledge a useless cat bounce on a inventory worth since this asset class normally has a way more secure and simply identifiable basic worth. Resulting from their volatility, cryptocurrency costs are quite a bit more durable to foretell.

Nonetheless, even in terms of figuring out a DCB for a inventory worth, most traders can solely be certain it occurred submit hoc. One would wish not solely tons of day buying and selling and market analysis expertise but additionally a substantial quantity of luck to establish a useless cat bounce appropriately.

Any useless cat bounce can develop into a real rally and an upward development, so newbie traders are normally suggested in opposition to making an attempt to benefit from them.

How Lengthy Does a Lifeless Cat Bounce Often Final?

Though useless cat bounces are normally short-lived, they will typically final up to a couple months. That mentioned, most often, a useless cat bounce will solely happen for a couple of days earlier than the asset’s worth drops once more.

What Occurs After a Lifeless Cat Bounce?

A useless cat bounce is all the time adopted by the continuation of a downtrend that preceded it and a protracted decline.

What Is the Reverse of a Lifeless Cat Bounce?

The alternative of a useless cat bounce known as a supernova — this time period refers to property whose worth goes just about simply straight up. It usually happens after brief squeezes.

Who Invented the Lifeless Cat Bounce?

The time period “useless cat bounce” was coined by a monetary author known as Raymond DeVoe Jr.

Disclaimer: Please notice that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.