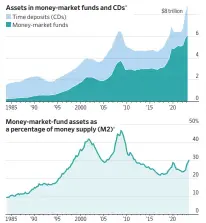

In a monetary panorama marked by rising rates of interest, the attract of over $8.8 trillion mendacity dormant in money-market funds and certificates of deposit (CDs) has Wall Road anticipating a possible market enhance. As of the third quarter of 2023, this substantial money pile awaits deployment, and buyers are optimistic that with the approaching fall of rates of interest, a redirection of those funds will propel the markets to new heights.

Vivek Trivedi, a 37-year-old pharmacist from Indianapolis, exemplifies this sentiment, with over 10% of his belongings, roughly $80,000, parked in money-market funds and inflation-adjusted U.S. financial savings bonds. Trivedi envisions using this money to accumulate a rental property ultimately however contemplates channeling it into blue-chip shares if yields drop beneath 1.5 proportion factors above inflation.

The choices of people like Trivedi are pivotal in shaping market dynamics. Market expectations of a Federal Reserve rate of interest lower later this yr prompted substantial rallies in direction of the top of 2023, propelling main indexes to near-record ranges. Some buyers warning that markets may already be priced for a perfect state of affairs, anticipating moderated inflation with out important job losses.

Wall Road is banking on the motion of money from money-market funds to inject contemporary momentum into the market. Beforehand, engaging rates of interest, exceeding 5%, lured funds away from shares into money-market funds. The potential fall of those charges may entice buyers again into U.S. shares, traditionally identified for offering strong long-term returns.

Whereas bond yields have seen a decline from their peaks, the charges provided on Wall Road stay comparatively excessive, drawing funds into money-market funds. Regardless of the attract of shares, the perceived costly nature of the inventory market may make charges on CDs extra engaging for discount hunters, a minimum of in the intervening time.

Randy Gwirtzman, a portfolio supervisor at Baron Capital, emphasizes the staggering quantity of belongings in money-market funds, describing it as “all that dry powder…on the sidelines and ready to speculate.”

Nevertheless, Elizabeth Cathcart, a 26-year-old company finance skilled from Denver, emphasizes the significance of an aggressive funding technique for homeownership. Whereas acknowledging the attraction of CDs providing over 5.5%, she stays cautious about locking away money for prolonged intervals.

The anticipation of money flowing into the market as soon as charges decline is perhaps overly optimistic. Earlier Fed-tightening cycles witnessed inflows into money-market funds, however a subsequent easing didn’t result in large outflows. Belongings skilled a retreat however maintained elevated ranges.

Francisco Pena, a 30-year-old knowledge scientist in New York Metropolis, adopts short-term Treasurys, CDs, and I bonds as non permanent repositories for his cash whereas saving for a down cost. He emphasizes the avoidance of money depreciation attributable to inflation.

The excellence between cash-like merchandise as potential investments versus financial institution deposits for future spending is a topic of debate. Whereas complete deposits at U.S. lenders have declined, rates of interest’ trajectory will play a vital function in figuring out how a lot cash shifts from fixed-income merchandise.

Mark Wiggins, a 27-year-old administration guide in Miami Seashore, is intently monitoring the scenario, adjusting his funding technique primarily based on rate of interest actions. If charges fall beneath 3.5%, he contemplates redirecting a portion of his financial savings into funding brokerage or cryptocurrencies, highlighting the sensitivity of investor choices to rate of interest dynamics.