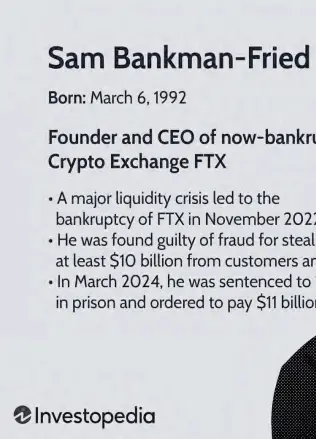

Sam Bankman-fried, as soon as hailed because the prodigy of the cryptocurrency realm, catapulted to prominence because the CEO of FTX, the world’s second-most beneficial crypto alternate. Nevertheless, his trajectory took a tumultuous flip when FTX plummeted right into a monetary abyss, sending shockwaves by means of the crypto neighborhood and triggering a cascade of authorized repercussions.

Bankman-fried’s journey into the crypto sphere started towards the backdrop of altruistic pursuits. Initially considering a profession in animal welfare throughout his school days, his path shifted after encountering influential figures inside the animal rights motion. Transitioning from activism to finance, he launched into a trajectory that finally led him to the helm of FTX.

Within the nascent levels of his profession, Bankman-fried demonstrated philanthropic inclinations, donating a good portion of his earnings to charitable causes, together with animal welfare organizations. His foray into crypto commenced with the founding of Alameda Analysis, a cryptocurrency buying and selling agency that garnered appreciable success, boasting a peak BTC transaction worth of $25 million.

The inception of FTX in 2019 marked a pivotal second in Bankman-fried’s entrepreneurial journey. Positioned as a platform for buying and selling crypto tokens and derivatives, FTX swiftly ascended to prominence, attracting substantial funding and reaching a valuation of $25 billion by 2021.

But, beneath the veneer of success lurked a fancy internet of economic intricacies and regulatory controversies. FTX’s relocation to the Bahamas, purportedly motivated by regulatory constraints within the US, raised eyebrows inside the trade. Reviews emerged suggesting that the platform employed buying and selling mechanisms prohibited in sure jurisdictions, additional complicating its regulatory standing.

Bankman-fried’s persona as a tech billionaire, characterised by informal apparel and lofty philosophical musings, belied the mounting authorized troubles surrounding FTX. Allegations of economic impropriety and misconduct culminated in a devastating reckoning for the once-celebrated CEO.

The unraveling of FTX’s fortunes was swift and dramatic. A leaked steadiness sheet in November 2022 uncovered vulnerabilities inside the firm’s monetary infrastructure, precipitating a precipitous decline in its native token, FTT. Subsequent revelations of misappropriated funds and fraudulent actions tarnished Bankman-fried’s repute and precipitated a litany of authorized woes.

In a landmark ruling on March 28, 2024, Bankman-fried was sentenced to 25 years in jail for orchestrating a scheme that defrauded FTX clients of billions of {dollars}. The decision underscored the severity of economic crimes within the crypto sphere and served as a cautionary story for trade stakeholders.

As FTX grapples with the aftermath of its precipitous downfall, the specter of regulatory scrutiny looms giant over the crypto panorama. With the fallout from FTX’s collapse reverberating globally, the saga serves as a cautionary reminder of the perils inherent in unbridled monetary hypothesis and the crucial of strong regulatory oversight.