Key Takeaways

- Solana and Terra have seen their market worth drop by greater than 23% over the previous week.

- Each Layer 1 tokens at the moment are sitting at make-or-break factors that can decide their fates.

- A break of help or resistance may end in a big transfer for each belongings.

Share this text

Solana and Terra have reached important help areas after incurring vital losses over the previous week. Nonetheless, shopping for stress is but to choose up for each belongings.

Solana and Terra Attain Essential Factors

Solana and Terra have discovered vital help ranges.

The Layer 1 tokens seem like buying and selling at make-or-break factors after retracing by greater than 23% over the previous week.

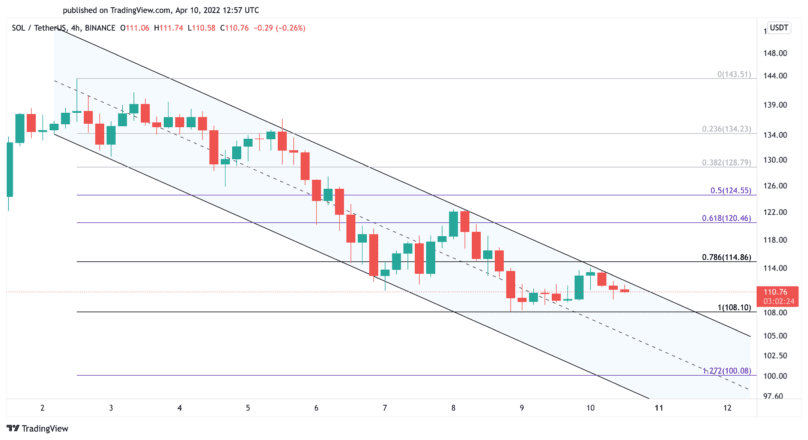

Solana is at the moment testing the higher boundary of the parallel channel that developed on its four-hour chart. Buying and selling historical past reveals {that a} rejection has occurred each time SOL has surged to this resistance trendline, main costs to tug again to the channel’s decrease edge.

An analogous market response may see the Layer 1 token slice by means of the $108 help degree and retrace 10% towards the channel’s decrease trendline at round $100.

Nonetheless, as Solana has examined the channel’s higher boundary thrice since Mar. 5, resistance might be weakening. SOL’s present value ranges are important as a result of a decisive four-hour candlestick shut above $115 may invalidate the pessimistic outlook. Breaching the essential provide wall may end in an upswing to $124.

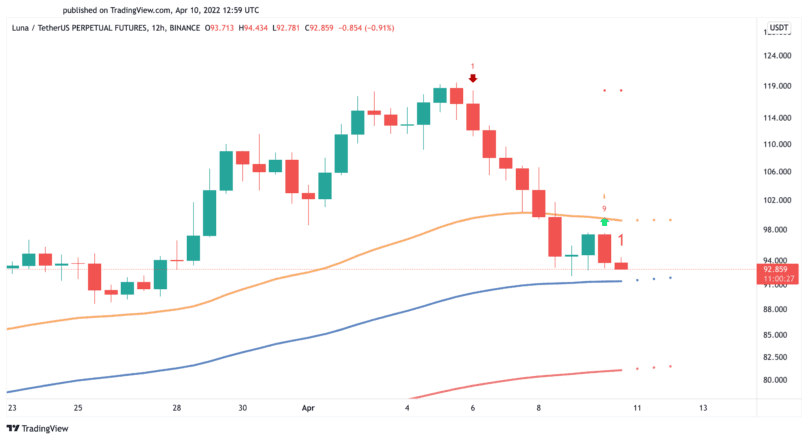

Terra’s native token can also be sitting at a pivotal level on its development. The Tom DeMark (TD) Sequential indicator not too long ago offered a purchase sign within the type of a pink 9 candlestick on LUNA’s 12-hour chart. The bullish formation anticipates a one to 4 candlesticks upswing, however shopping for stress has not but picked up.

The 100-hour exponential transferring common at $91 inside this timeframe is the one degree of help stopping LUNA from dropping additional. In the meantime, the 50-hour exponential transferring common at $100 is performing as resistance, rejecting any upward value motion. Solely a 12-hour candlestick shut outdoors of this value pocket can decide whether or not the optimistic thesis offered by the TD setup could be validated.

As a result of ambiguous outlook, merchants will likely be seeking to train endurance across the present value ranges. A decisive shut above resistance may catapult LUNA to $110, whereas a breach of help may end in a downswing to $82.

Disclosure: On the time of writing, the writer of this piece owned BTC and ETH.