Because the high-stakes trial of Sam Bankman-fried, the once-revered founding father of the collapsed FTX cryptocurrency change, unfolds in a Manhattan federal court docket, the suspense reaches a crescendo, accentuated by Bankman-fried’s calculated authorized maneuvers which have captured the eye of the monetary and authorized communities alike. In what’s being deemed a dangerous authorized gamble, Bankman-fried’s choice to take the stand and defend himself towards allegations of orchestrating a large monetary fraud has intensified the drama surrounding the case.

Bankman-fried, identified for his unconventional and audacious method to risk-taking, has been battling a litany of expenses associated to the alleged misappropriation of funds from FTX clients. Regardless of the prosecution’s compelling case, replete with testimonies from witnesses who implicated Bankman-fried within the mismanagement of buyer accounts, the defendant’s resolute choice to forgo a plea deal and proceed to trial underscores his unwavering confidence in his innocence.

All through the trial, the contrasting narratives surrounding Bankman-fried’s character have unfolded, portraying him as both a visionary entrepreneur or a calculated swindler, relying on one’s perspective. Bankman-fried’s protection technique, characterised by portraying him as a well-intentioned however in the end flawed chief, sought to underscore his dedication to advancing the crypto business and fostering technological innovation, albeit marred by an obvious lack of oversight and threat administration.

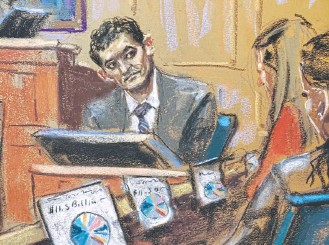

The trial witnessed a compelling second when Bankman-fried, beneath the steerage of his lawyer Mark Cohen, tried to current himself as a well-meaning determine who had entrusted his colleagues with important tasks, solely to be let down by their incompetence. The protection narrative centered on Bankman-fried’s purported ignorance of the felony implications of his actions, attributing the monetary downfall of FTX to mismanagement quite than malice.

Nonetheless, the cross-examination initiated by the prosecution unearthed important inconsistencies in Bankman-fried’s assertions, elevating doubts about his narrative’s credibility. The relentless scrutiny of Bankman-fried’s statements and actions intensified the authorized battle, exposing the intricacies of economic jargon and regulatory nuances that permeated the trial proceedings.

Because the trial inches nearer to its conclusion, the destiny of Sam Bankman-fried stays within the fingers of the jury, whose deliberations will in the end decide the trajectory of one of the crucial high-profile monetary trials in current reminiscence. Bankman-fried’s unwavering conviction within the righteousness of his actions, juxtaposed towards the mounting proof offered by the prosecution, provides an intriguing layer of complexity to an already fascinating authorized saga.

The intersection of non-public accountability and systemic oversight on this planet of digital finance stands on the forefront of this trial, serving as a stark reminder of the important significance of sturdy regulatory frameworks and moral conduct in safeguarding the pursuits of traders and clients. Because the trial’s conclusion attracts close to, the implications of the jury’s verdict are poised to reverberate throughout the monetary and authorized spheres, influencing the discourse surrounding company accountability and regulatory compliance.