The Philippines has emerged as a trailblazer in international cryptocurrency adoption, boasting one of many highest charges of crypto possession worldwide. With a burgeoning inhabitants of retail traders, the nation stands on the forefront of embracing digital belongings.

As mainstream adoption surges, the Philippine crypto market witnesses a surge in complexity, institutional involvement, and a concentrate on compliance and danger administration.

Notably, as a hub for remittances, the Philippines hosts a number of main onramp platforms like Cash.ph, which have modernized the monetary panorama. Moreover, the Bangko Sentral ng Pilipinas (BSP) introduced plans for a wholesale central financial institution digital foreign money (CBDC) challenge, signaling the combination of digital belongings on a nationwide scale.

One vital improvement inside this panorama is the emergence of crypto structured merchandise, revolutionizing funding avenues for retail traders. Whereas structured merchandise usually are not novel in conventional finance, their software within the crypto realm represents a paradigm shift. These devices provide diversification, danger administration, and tailor-made funding methods, offering retail traders a novel alternative to capitalize on the crypto market’s development potential.

Structured merchandise, whether or not conventional or crypto-based, provide a stability between danger and reward throughout various market circumstances. They empower traders to customise their method based mostly on particular person danger tolerance and market views.

Within the nascent crypto ecosystem, structured merchandise are tied to digital belongings like BTC, ETH, or USDT. Their attract lies in flexibility, providing advantages corresponding to portfolio diversification, potential for increased yields, and efficient danger administration.

Portfolio Diversification: Crypto structured merchandise allow traders to diversify past conventional asset lessons, facilitating broader portfolio diversification and probably increased returns.

Potential for Excessive Returns: The heightened volatility of the cryptocurrency market presents alternatives for substantial yields, with structured merchandise tailor-made to harness market swings.

Danger Administration: Designed with danger mitigation mechanisms, crypto structured merchandise assist traders handle publicity to market volatility, aligning with their danger tolerance and funding targets.

Selecting the best structured product entails assessing danger urge for food and market perceptions. Passive wealth accumulation favors merchandise prioritizing draw back and principal safety, whereas energetic hypothesis leans in the direction of leveraged returns.

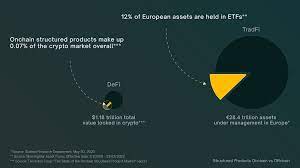

Regardless of their comparatively small market dimension in comparison with conventional finance counterparts, crypto structured merchandise have gained traction, providing avenues to amplify returns and mitigate volatility dangers.

As crypto continues to combine into monetary markets, the adoption of structured merchandise is predicted to persist. For traders within the Philippines, embracing these revolutionary instruments might unlock better entry to the cryptocurrency market and a extra accessible monetary future.