In a yr fraught with challenges for the US bond market, November has emerged as a beacon of restoration, witnessing probably the most substantial bond rally because the Nineteen Eighties. Traders, searching for refuge amid market uncertainties, fervently elevated the costs of Treasuries, company, and mortgage debt, sparking an expansive market surge throughout shares, credit score, and even obscure cryptocurrencies.

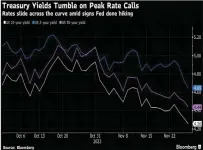

For bond traders grappling with the prospect of a 3rd consecutive yr of losses, the rally, harking back to the Nineteen Eighties, offered much-needed respite. The Bloomberg US Mixture Index has reported a sturdy 4.9% return this month alone, accompanied by a notable dip of 0.65 share factors within the 10-year bond yield to 4.29%, influencing every part from residence loans to company debt.

The trajectory of this rally into December and the upcoming yr hinges on persistent financial and inflationary slowdown alerts, coupled with the Federal Reserve’s obvious conclusion of rate of interest hikes. Encouraging indicators, similar to softening jobs knowledge and subdued shopper inflation, have fueled this market resurgence. Dovish sentiments expressed by Fed Chair Jerome Powell and Governor Christopher Waller additional propelled the rally.

Rebecca Patterson, former Chief Funding Strategist at Bridgewater Associates, remarked on the reinforcing financial knowledge, suggesting a possible “Goldilocks slowdown,” the place inflation subsides with out unduly hindering development.

This unprecedented comfortable touchdown narrative for the US and world financial system, coupled with plummeting borrowing prices, has propelled the MSCI World Index by 8.9% and bolstered emerging-market shares, up 7.4%. Even the Bloomberg Galaxy Crypto Index, measuring main digital currencies, skilled a noteworthy 18% surge.

Inside the credit score area, US junk bonds noticed a outstanding 4% rally, probably the most vital since July 2022. Traders poured a file $11.9 billion into exchange-traded funds monitoring this asset class, marking the very best inflow so far.

Treasuries, performing because the epicenter of this world monetary story, have spurred a 5% return on a Bloomberg gauge of sovereign and company debt in November—probably the most substantial achieve since 2008. The ripple impact prolonged to European authorities bonds, as merchants anticipate fee cuts by the European Central Financial institution, fueling a deeper easing cycle.

Throughout the Atlantic, comfortable knowledge and dovish Fedspeak have heightened expectations for US rate of interest cuts. Merchants are actually pricing in roughly 1.15 share factors of coverage easing for 2024, with the primary lower anticipated in Might. Famend investor Invoice Ackman even suggests potential cuts as early as the primary quarter.

This speedy market shift might induce a wave of quick protecting, with long-time bears adjusting their positions. Vineer Bhansali, founding father of asset-management agency LongTail Alpha, means that these colossal strikes are indicative of great positioning adjustments. Because the market navigates these shifts, the strong rally in bonds seems to have reshaped investor methods, resulting in a marked transformation within the monetary panorama.