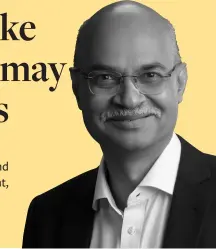

In a dynamic market atmosphere, seasoned traders regularly search revolutionary methods to optimize returns and mitigate dangers. Kenneth Andrade, famend for his astute funding acumen, shares insights into OldBridge Asset Administration’s distinctive strategy and the challenges and alternatives in in the present day’s funding panorama.

Addressing the transition from Portfolio Administration Providers (PMS) to launching a mutual fund, Andrade elucidates on the regulatory necessities and the attract of diversification supplied by mutual funds. He emphasizes the significance of danger administration and sustaining a disciplined funding strategy, underscoring the efficacy of capturing execution cycles in driving efficiency.

The launch of a centered fairness fund aligns with Andrade’s funding philosophy, characterised by a concentrated portfolio centered on value-driven alternatives. By adhering to stock-specific publicity limits, Andrade emphasizes the significance of mitigating dangers related to momentum bias, a method pivotal for sustained outperformance.

Opposite to prevailing sentiments, OldBridge Asset Administration opts for energetic administration over passive funds, citing the potential for vital alpha era. Andrade stays bullish on India’s energetic administration panorama, figuring out area of interest alternatives for alpha creation amid evolving market dynamics.

Reflecting on market exuberance and the timing of the fund launch, Andrade acknowledges pockets of frothiness however stays optimistic about sector-specific alternatives. He attracts parallels with India’s resilience post-pandemic, highlighting favorable structural benefits and strong company stability sheets as catalysts for sustained market momentum.

Amid considerations over monetary sector valuations and mid- to small-cap inventory overvaluation, Andrade emphasizes the significance of prudent inventory choice and sectoral diversification. With a eager eye on rising tendencies and inflection factors, OldBridge Asset Administration navigates the funding panorama with agility and foresight.

In essence, Kenneth Andrade’s strategic insights provide a roadmap for traders navigating in the present day’s complicated monetary terrain. With a steadfast dedication to worth creation and danger administration, OldBridge Asset Administration charts a course for sustainable progress and prosperity in an ever-evolving market ecosystem.