COINDCX, a number one home cryptocurrency alternate that when boasted a valuation surpassing US$2 billion, has raised issues over the antagonistic results of India’s stringent tax insurance policies on digital-asset buying and selling. The imposition of a 1% tax deducted at supply (TDS) on crypto transactions roughly 16 months in the past has considerably curtailed the native crypto market’s vibrancy, prompting COINDCX’s CEO, Sumit Gupta, to advocate for a discount within the tax price.

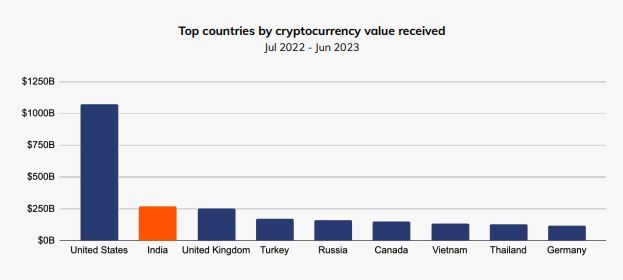

Initially launched as a measure to watch and doc crypto transactions quite than generate income, the TDS coverage has yielded unintended penalties, driving an awesome 95% of Indian buying and selling volumes to abroad platforms past the purview of native regulatory oversight.

Gupta highlighted the unintended ramifications of the tax, stating, “The entire objective of the TDS was to trace and hint transactions, however that’s getting defeated.” He expressed his hope that the Indian authorities would acknowledge the challenges posed by the present tax construction and transfer in direction of revising it sooner or later.

The influence of the tax levy has been acutely felt throughout the Indian crypto ecosystem, main market makers to withdraw from Indian exchanges resulting from elevated operational prices. Consequently, this exodus has not solely diminished market liquidity but additionally discouraged lively buying and selling throughout the home market.

Regardless of the resurgence of bitcoin and heightened buying and selling volumes globally following the 2022 crypto downturn, the Indian crypto panorama stays mired in uncertainty, with native platforms grappling with the implications of the TDS coverage and looking for a conducive setting for sustainable development.

Recognizing the necessity for a complete regulatory framework, India has known as for a coordinated strategy to cryptocurrency rules, urging collaboration with multilateral establishments to plan a strong and coherent coverage framework.

Gupta anticipates that the regulatory panorama will witness higher readability and path put up the nation’s normal election in 2024, with expectations set for extra specific pointers and revisions to the present tax insurance policies by the tip of 2025.

Notably, the Finance Ministry spokesperson of India shunned providing feedback when contacted through emails and textual content messages looking for clarification on the nation’s stance and future trajectory relating to crypto tax insurance policies.

In April final 12 months, COINDCX secured substantial backing by a US$135 million funding spherical led by Pantera Capital and Steadview Capital Administration LLC, cementing its standing as a distinguished participant within the evolving international cryptocurrency market. India’s implementation of the 1% TDS coverage from July 2022 has since underscored the urgency for recalibrating the nation’s regulatory framework to make sure the sustainable development and resilience of the home crypto ecosystem.