In a dramatic flip of occasions, Sam Bankman-Fried, the once-celebrated founding father of the cryptocurrency trade FTX, was convicted on all seven counts on Thursday, in a landmark case that has gripped the monetary and digital foreign money sectors. The federal jury in New York delivered its verdict, marking the end result of a high-profile trial that highlighted the extraordinary rise and fall of the younger entrepreneur, who, till not too long ago, was thought to be a key determine within the crypto realm.

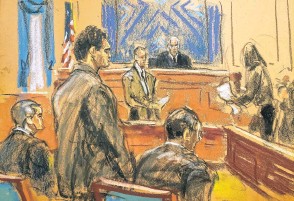

The jury’s resolution, reached after only some hours of deliberation, left Bankman-Fried, 31, dealing with a doubtlessly prolonged jail sentence, with the sentencing date set for March 28. The result reverberated by the courtroom, with Bankman-Fried and his household visibly distraught on the verdict. Regardless of the frustration, his authorized group remained resolute, vowing to proceed their battle towards the costs leveled towards him.

“We respect the jury’s resolution. However we’re very dissatisfied with the end result,” Mark Cohen, Bankman-Fried’s lawyer, said firmly. “Mr. Bankman-Fried maintains his innocence and can proceed to vigorously battle the costs towards him.”

The case, which prosecutors labeled some of the important monetary frauds in U.S. historical past, alleged that Bankman-Fried had orchestrated a fancy scheme that resulted within the misappropriation of billions of {dollars} from prospects, alongside varied cases of deceit and monetary misconduct. All through the trial, prosecutors painted a vivid portrait of Bankman-Fried’s alleged wrongdoing, accusing him of using buyer funds for private acquire, together with the acquisition of luxurious actual property, high-value property, and intensive political contributions.

Caroline Ellison, an important authorities witness and Bankman-Fried’s former associate, recounted a harrowing story of deception and monetary malpractice, underscoring the unsettling realities that unfolded throughout the corridors of FTX. Her testimony, bolstered by incriminating contemporaneous paperwork and digital communications, depicted a tradition of deceit and risk-taking that permeated the operations of the once-vaunted trade.

Bankman-Fried’s protection group sought to painting him as an earnest entrepreneur navigating the complexities of the crypto business, emphasizing his real efforts to ascertain a reputable enterprise inside an evolving panorama. Nonetheless, the prosecution’s relentless cross-examination challenged this narrative, highlighting cases of obvious inconsistencies and discrepancies in Bankman-Fried’s testimony.

The repercussions of the trial prolong past the speedy authorized ramifications, casting a shadow over the cryptocurrency sector and prompting a reassessment of regulatory frameworks and danger administration practices throughout the business. As Bankman-Fried grapples with the implications of the decision, the broader implications for digital foreign money markets and investor belief stay on the forefront of ongoing discussions, underscoring the vital want for transparency and accountability throughout the quickly evolving monetary panorama.