Key Takeaways

- Bitcoin has dropped by practically 70% from its all-time excessive.

- A number of metrics now recommend that the market backside is close to.

- Nonetheless, BTC might fall to $15,670 earlier than the development reverses.

Share this text

Worry has struck the cryptocurrency market after Bitcoin dropped to $20,800 at present. Now, a number of technical and on-chain metrics recommend that the highest cryptocurrency may very well be approaching a backside.

Bitcoin Exhibits Early Indicators of a Backside

Bitcoin has reached an important assist zone that would result in a development reversal.

The pioneer cryptocurrency has seen its worth drop practically 70% over the previous seven months. It went from buying and selling at an all-time excessive of $69,200 in mid-November 2021 to lately reaching a brand new yearly low of $20,800.

Though the macroeconomic surroundings stays bearish given the looming uncertainty within the world monetary markets, BTC seems to be nearing a market backside.

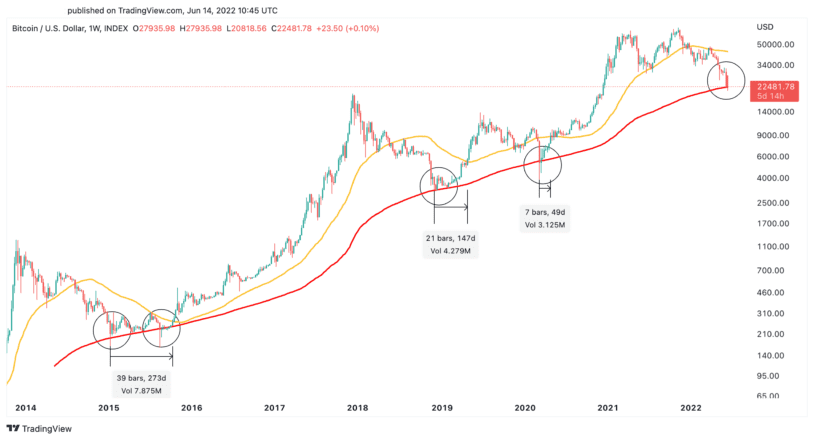

The 200-week shifting common has served because the final line of protection in earlier bear markets. Since 2015, every time Bitcoin has retraced in the direction of this essential assist stage, costs have begun to consolidate, forming a market backside earlier than a brand new bullish cycle begins.

BTC at present sits near its 200-week shifting common, which may very well be an preliminary signal that the development is about to reverse.

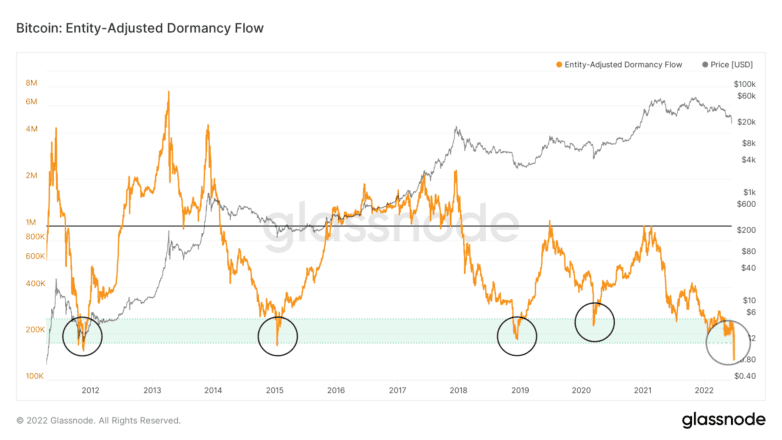

Bitcoin’s Entity-Adjusted Dormancy Movement additionally means that the flagship cryptocurrency may very well be forming a market backside. It considers the ratio of the present market capitalization to the annualized dormancy worth to find out whether or not skilled market contributors are spending their BTC.

This on-chain metric has nearly completely timed each market backside since 2011. Each time there’s a substantial lower in spending from long-term holders, or “outdated fingers,” the Entity-Adjusted Dormancy Movement drops under the 250,000 threshold, representing a wonderful historic purchase zone.

The Entity-Adjusted Dormancy Movement at present sits at an all-time low of 149,150, and will sign the top of the present downtrend.

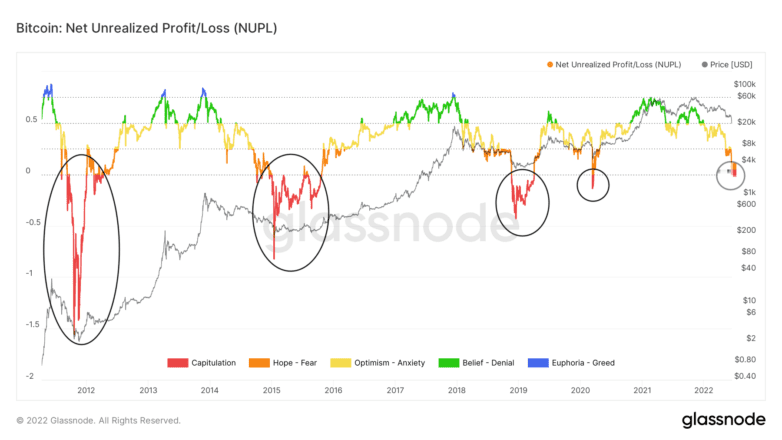

The Web Unrealised Revenue/Loss (NUPL) indicator can be useful when anticipating shifts in market sentiment and predicting market tops and bottoms. It depends on a number of on-chain knowledge factors to display potential buyers’ feelings at a given time, which helps decide worth actions.

The market sentiment round Bitcoin seems to have shifted from “Worry” to “Capitulation” after costs dropped to $20,800. This represents the final stage of a bearish cycle earlier than the market sentiment shifts into “Hope” to sign the start of a brand new bull market.

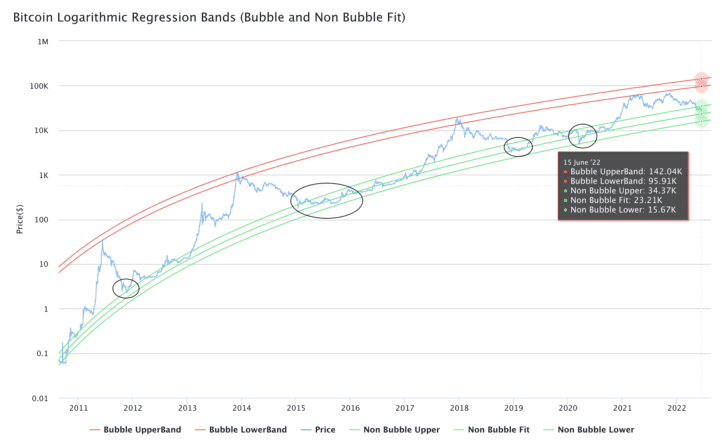

Whereas technical and on-chain knowledge reveals a number of indicators of a market backside, there should still be room for Bitcoin to drop additional earlier than a restoration can start. Logarithmic Regression Traces outline two key worth ranges the place Bitcoin might backside out. The non-bubble match regression band sits at $23,210, whereas the non-bubble decrease regression band hovers round $15,670.

Bitcoin at present trades between the non-bubble match regression band and the non-bubble decrease regression band, a sign that has marked the market backside in earlier downtrends. Though costs can drop towards the non-bubble decrease regression band like in March 2020, this indicator means that BTC may very well be presenting a singular alternative for sidelined buyers to re-enter the market.

It stays to be seen whether or not Bitcoin is getting into a consolidation interval earlier than it enters a brand new uptrend or if it’ll see an additional correction to $15,670 first. Regardless, the risk-to-reward ratio seems favorable for these seeking to take an opportunity at timing the market backside.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.

For extra key market traits, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.