Sanctions can solely work if those that are alleged to implement them perceive precisely what to take action that they can’t be circumvented simply. Russia’s intensive community of Over-The-Counter (OTC) suppliers requires an intensive assessment by sanction committees, as they is likely to be adopted to avoid sanctions.

As described within the earlier launch, because of the restricted liquidity of cryptocurrencies and Decentralized Finance area normally, it stays near inconceivable for Russia to avoid SWIFT-based methods by utilizing crypto. Nonetheless, Russians would possibly nonetheless maintain as much as $200 Billion USD in crypto belongings, moreover operating the third-largest crypto mining trade on the earth. These funds can doubtlessly be cashed out with Russian OTC suppliers.

The fifth EU sanction bundle on Russia limits the crypto asset holdings of Russian nationals, people, and authorized entities established in Russia to €10,000 (with the identical account, pockets or custody supplier). The usage of Russian OTC suppliers, which represents a community of bodily suppliers providing money payouts from crypto, could possibly be adopted to avoid these sanctions.

In oversimplified phrases, OTC refers to a course of during which people theoretically may agree on a worth and meet to finish a transaction. An instance of such a course of could possibly be a private assembly during which one facet brings luggage with money or some other pre-agreed technique of worth, and the opposite facet may conduct a transaction on the blockchain on the spot. Transactions primarily with bigger sums of cash could possibly be dangerous, to say the least. Contrarily to peer-to-peer exchanges (P2P) which contain impartial events, OTC exchanges act corresponding to bodily pawn outlets. At devoted bodily areas with introduced opening hours, people can go to and change their cryptocurrencies in Russia for money or financial institution transfers.

Relying on the enterprise fashions of digital belongings service suppliers (VASPs), each OTC and P2P suppliers have existed in numerous jurisdictions because the starting of economic interactions between people. An instance of such a platform within the EU is LocalBitcoin, registered with the Finnish Monetary Supervisory Authority. In contrast to Russian OTC suppliers that are topic to the sixth Anti Cash Laundering Directive of the EU and linked to its so-called Counter-Terrorism Financing (CTF) laws, LocalBitcoin is a singular case.

Existence of such a platform within the EU is simply doable in Finland, as the remainder of the EU has adopted the advice of the Monetary Motion Process Pressure (FATF) to outline and embody Digital Property within the nationwide laws and created an oversight program as a regulator. It may be argued that the present regulatory frameworks stay removed from good, however there’s elevated curiosity in incorporating DeFi into conventional monetary compliance applications.

Such necessities to register a P2P or OTC change are method completely different inside the Russian Federation. On the one hand, Russia authorised use of cryptocurrency as an funding instrument or a cost methodology as of Q1 2021 however on the opposite its nationwide financial institution proposed a protracted checklist of bans that ought to outlaw the circulation of cryptocurrencies inside the nation.

As a consequence of such unclear authorized circumstances, licensing and supervisory applications are near non-existent. Within the absence of platforms which have chosen ‘compliance excellence’ as their differentiating enterprise technique, for instance, Coinbase or some Scandinavian VASPs, many Russian suppliers should function within the grey area to say the least.

What’s shocking is the truth that despite the fact that Russians retailer as much as one fifth of the nationwide financial institution’s reserves in digital belongings, the general public facet has determined to not present a lot readability for the VASPs or some other gamers in Decentralized Finance (DeFi).

By not offering readability for gamers within the Digital Property area, the governments in Moscow and Minsk proceed to lose on potential tax revenues and regulatory oversight of over 623 crypto platforms recognized to this point, related to Russia and Belarus. The logic to proceed to lose out on simply taxable capital acquire from crypto investments stays questionable.

“Is it not paradoxical that regardless of the Russian Prime Minister stating that Russians maintain $200 Billion USD in crypto, Russia has not but formulated a complete laws to legalize crypto or set a taxation course of for it?” — Dominika Kuberska, PhD, College of Financial Sciences, College of Warmia and Mazury in Olsztyn.

With the absence of regulated gamers in Russia, there’s a well-developed grey market of OTC exchanges that facilitate the commerce of Digital Property in change for rubles utilizing each money and financial institution transfers. Sources, who need to stay nameless, underline that financial institution transfers to people or entities from OTC brokers are labeled as funds for IT or consultancy companies. The Russian authorities will formally tax earnings from such transfers with private or company revenue tax (PIT, CIT).

Furthermore, for patrons that need to buy or change a major quantity of digital belongings, there are a minimum of ten bodily brokers in Moscow and even worth comparability web sites like BestChange.ru that show the present charges of OTC suppliers in numerous areas. As a result of nature of the enterprise mannequin, prospects can typically change money for digital belongings on the bodily places of work of those exchanges which will be visited by each people and the members of the Russian monetary supervisory authorities, in case they’d acknowledge their existence. Nearly all of OTC suppliers function with out figuring out their prospects. A number of sources report on direct cooperation between devoted Ponzi schemes or sanctioned brokers with OTC suppliers. Even when onerous proof reminiscent of an settlement or e mail change between confirmed events is constantly being collected, blockchain based mostly analytics continues to supply indications for illicit transactions.

Russia has been linked with an elevated quantity of illicit actions for a rustic that has a inhabitants of 144 million, which is 1.5 occasions greater than that of Germany.

“Russia has surprisingly massive quantities of confirmed illicit “Unicorns” like BTC-e/WEX change, Hydra darkish net market, dozens of pyramid schemes like PRIZM, the most important ransomware assaults and different cybercrimes which consultants contemplate to be presumably components of state-sponsored-activities” – Oleksii Fisun, Co-founder of International Ledger Protocol.

With so many confirmed illicit actions popping out of 1 jurisdiction, it stays value investigating how earnings from unlawful actions could possibly be doubtlessly cashed out. As described extensively within the earlier article, the benefit of a public blockchain is that it stays seen and traceable.

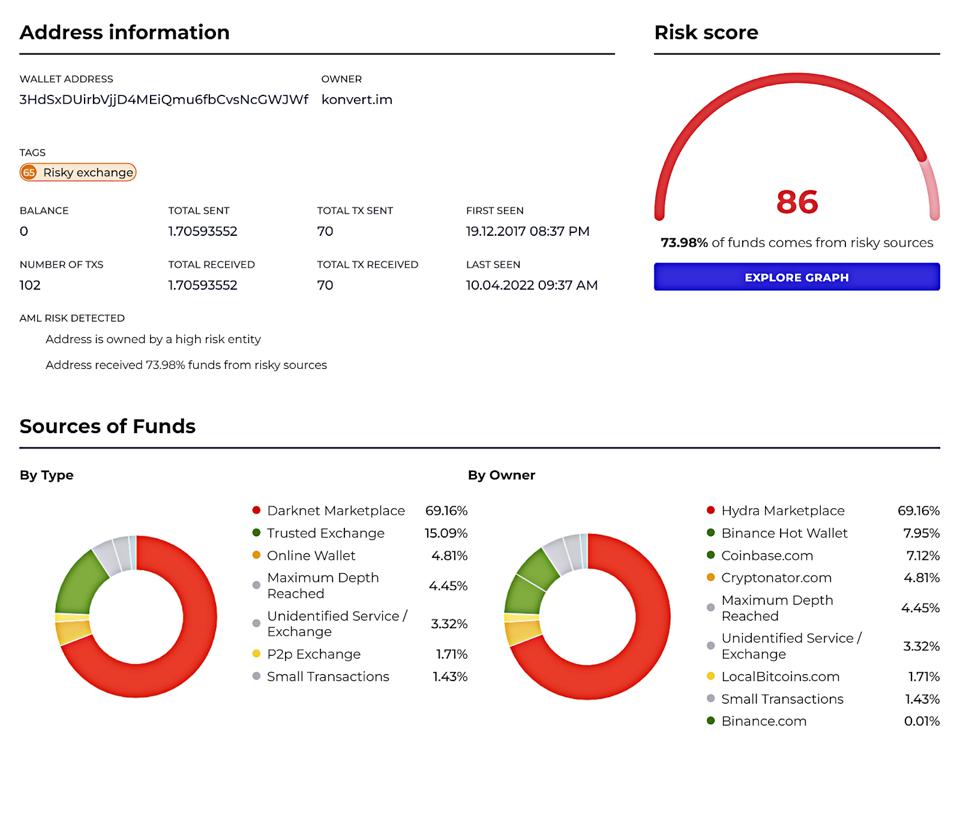

An instance of such confirmed illicit exercise that could possibly be cashed out with a Russian OTC supplier, can be funds allotted in a cryptocurrency pockets supplier referred to as Konvert.im. It consists of greater than 100 transactions and has greater than 69% publicity to funds originating from newly sanctioned Hydra Darknet Market.

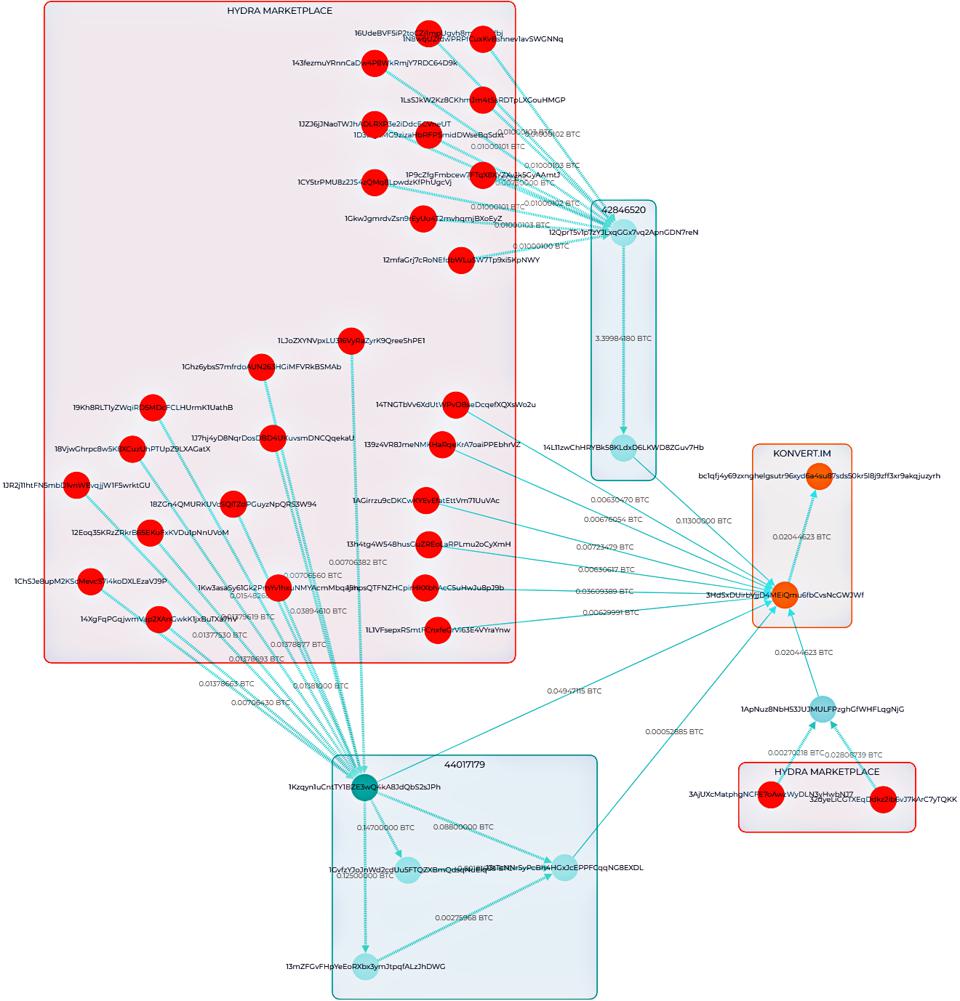

The illustration on the graphic above shows transactions originating from the already sanctioned Hydra cluster (represented by – pink dots) which are performed by intermediate wallets 1Kzqyn1uCntTY1BZE3wQ4kA8JdQbS2sJPh and 13eTeNNrSyPcBh4HGxJcEPP

As Konvert.im represents an change, most actually, their compliance should pay attention to the origination of these funds from sanctioned Hydra. It’s inside such schemes the funds is likely to be combined with different funds that would doubtlessly be forwarded to OTC suppliers for money out.

Whatever the selection of the supplier used for Blockchain based mostly analytics, because of the nature of Blockchain based mostly investigations that accumulate the entire funds and its traces on the Blockchain between completely different brokers, there’ll at all times be a sure publicity to illicit visitors, which probably will likely be at a single digit proportion clever. Just like accepting a bodily banknote on the native farmer’s market, there could possibly be a risk that this banknote was used to conduct illicit exercise previously. This connection to illicit exercise stays invisible on the banknote itself, however such a transaction is completely seen on the Blockchain.

Having mentioned that, it stays inconceivable to state that an publicity of 69% to Hydra has been a technical mistake. It ought to moderately be perceived as a devoted motion and tracing the cash from Konvert.im to a Russian OTC supplier would possibly function a logo that this technique can and is likely to be adopted to avoid SWIFT-based sanctions and simply bypass a limitation specified within the fifth EU sanction bundle.