Within the realm of financial coverage, the Federal Reserve finds itself at a crossroads because it navigates the complexities of an evolving financial panorama. Regardless of prevailing expectations for rate of interest cuts, dissenting voices are rising, suggesting that such measures may not be warranted given the present state of the economic system.

The confluence of things sometimes related to a bullish market—rising inflation, a strong labor market, and a thriving inventory market—has sparked debate amongst economists and buyers relating to the need of Federal Reserve charge cuts.

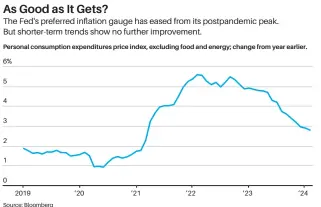

On the coronary heart of the dialogue is the trajectory of inflation, a key indicator carefully monitored by the Fed. Latest information from the non-public consumption expenditures worth index reveal a modest enhance in core costs, signaling a possible slowdown in inflationary pressures. Michael Lewis of Free Market Inc. underscores the importance of this pattern, noting a rebound within the three-month core PCE pattern to three.5% annual development.

Whereas issues persist relating to customers’ steadiness sheets amidst strong spending and modest revenue development, the wealth accumulation spurred by the bull market presents a contrasting narrative. Torsten Sløk of Apollo International Administration emphasizes the substantial positive aspects in asset values, notably within the inventory and bond markets, which have far exceeded client spending figures.

Nonetheless, questions come up relating to the efficacy of charge cuts in curbing inflationary pressures amidst the proliferation of paper wealth in monetary markets. Marko Kolanovic of J.P. Morgan highlights the potential disconnect between free financial circumstances and inflation dynamics, suggesting a protracted interval of upper charges.

In opposition to this backdrop, market sentiment relating to the chance of charge cuts by year-end stays divided. Whereas some anticipate minimal cuts or none in any respect, others advocate for a single charge reduce, presumably in June, to preempt potential financial headwinds. Louis-Vincent Gave of Evergreen Gavekal underscores the case towards charge cuts, citing inflationary issues, speculative fervor in crypto and fairness markets, and the resilience of the labor market.

Federal Reserve Chairman Jerome Powell reiterates a cautious stance, emphasizing the necessity for prudence in mild of unsure financial circumstances. With indicators of labor market energy and bettering hiring developments, Powell emphasizes the significance of data-driven decision-making, hinting at a reluctance to ease coverage prematurely.

Because the Federal Reserve awaits forthcoming labor market information, the controversy surrounding charge cuts intensifies. Whereas financial indicators paint a blended image, the Fed’s deliberations underscore the fragile steadiness between supporting development and addressing inflationary dangers in an more and more advanced world economic system.