Over time, the crypto market has maintained a detailed relationship with the inventory market. Ethereum, the second-largest cryptocurrency, rose in lockstep with U.S. shares for the primary time in February. Because of this, the token’s 40-day correlation coefficient with the S&P 500 reached 0.65.

Regardless of the brake anxious buyers have placed on value exercise prior to now week, the Ethereum (ETH) value is poised to rise over the weekend. Though buying and selling quantity has elevated over the past week, and thus ought to have resulted in additional constant fluctuations, value responsiveness has been affected by geopolitical information, earnings, and inventory market whipsaws.

Ethereum Worth Witnesses Turbulence

The value of Ethereum has had a grueling week for buyers and merchants, with giant swings in response to earnings, geopolitical occasions, and buyers turning from risk-on to risk-off like a light-weight change. However with volatility comes alternative, and as all of those occasions wind down in the direction of the weekend, bulls could have the playground to themselves and may drive the worth as much as $3,500 in the event that they choose the suitable entry ranges. Anticipate the RSI to rise over 50 once more, with a lot of room earlier than buying and selling into overbought territory.

In line with statistics from Santiment, a crypto market habits evaluation instrument, Ethereum has a powerful (+ve) correlation with the S&P 500 index. Following a 1.8 p.c drop within the S&P 500 index’s figures, the worth of ETH elevated by 3%.

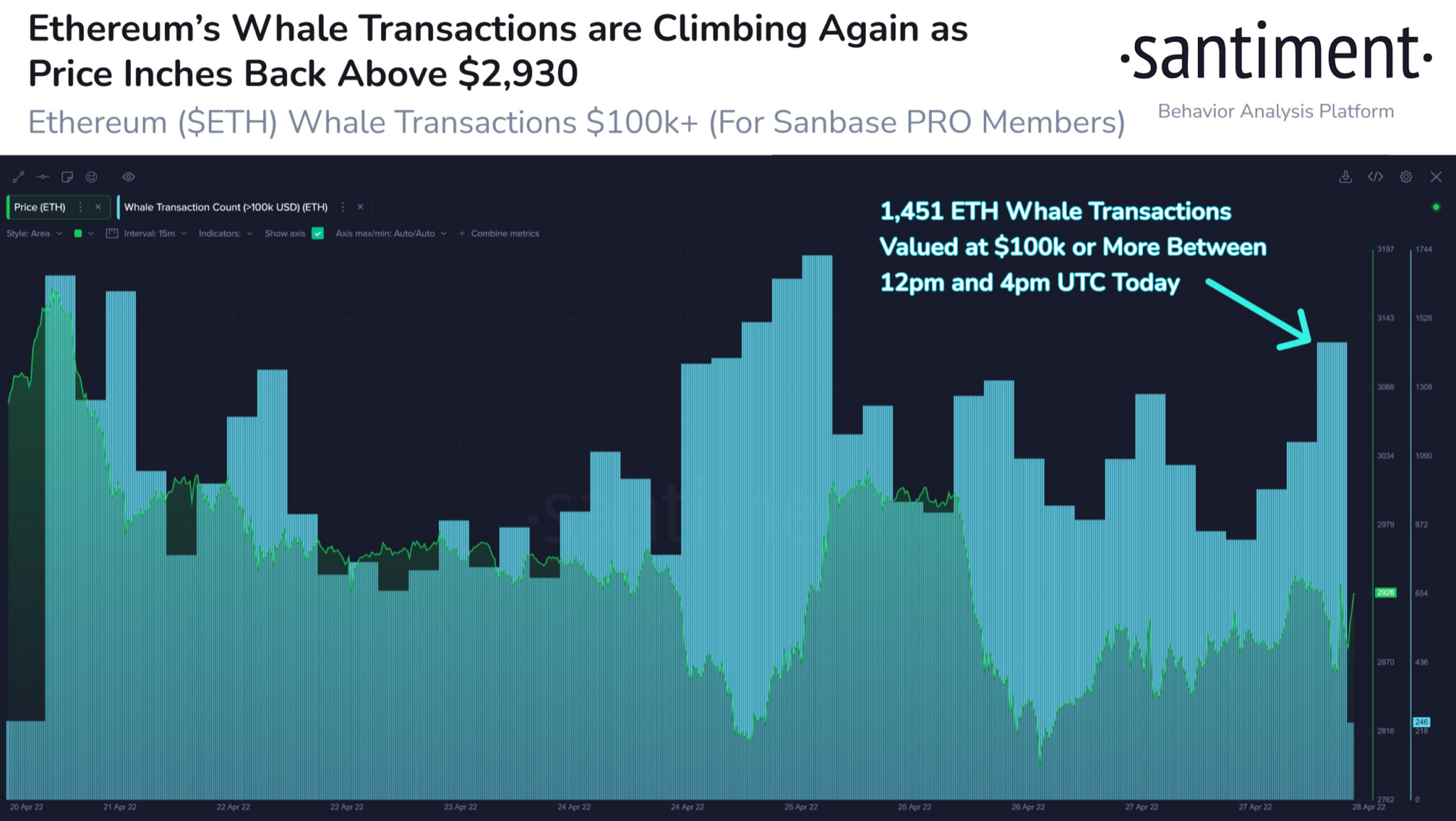

Supply: Santiment

The tweet from April twenty ninth added,

“Aided by a +1.8% day within the SP500, Ethereum has jumped again above $2,930 with its tight correlation to equities markets.”

Now, as seen within the graph above, ETH’s strongest consumers, the whales, have retaliated by shopping for extra ETH. On that day, the variety of whale transactions price greater than $100,000 surged dramatically.

In a four-hour interval, 1,451 such transactions had been documented. The bounce, based on Santiment, urged that key stakeholders had been listening to the worth improve.

Advised Studying | Metaverse Tokens On Overdrive, Outpace Bitcoin And Ethereum

Is Equities Market Correlation Good For ETH?

This wasn’t the primary time ETH had proven indicators of a growing relationship with the inventory market. The 2 sank collectively on March thirty first, as reported three weeks earlier, however started climbing once more after April 1st. Ether surged in tandem with the SP500 since mid-March.

Each optimistic state of affairs within the crypto-verse is accompanied with a damaging counterpart. That’s, in spite of everything, a reality. This situation is not any exception. Crypto’s robust affiliation with equities, particularly, may work wonders. Completely different respected entities, then again, have censored cautionary conditions for a similar.

ETH/USD has remained beneath $3k. Supply: TradingView

Arthur Hayes, the previous CEO of BitMex, raised warning flags about this hyperlink on this occasion. Surprisingly, the inventory market seems to be headed for an enormous drop by means of 2022 because the Federal Reserve tightens financial coverage to battle inflation.

Associated Studying | Bitcoin Futures Foundation Nears One-12 months Lows, How Will This Have an effect on BTC?

Featured picture from Pixabay, Santiment, chart from TradingView.com