Key Takeaways

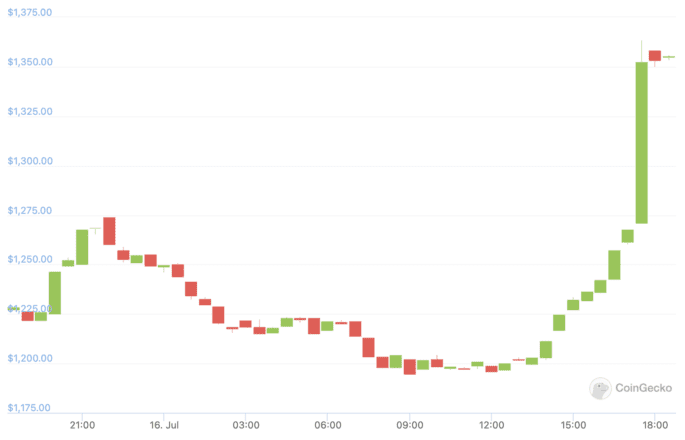

- ETH is outperforming available in the market. It touched $1,363 immediately following a 12% surge.

- The most recent rally comes days after the Ethereum Basis set a tentative September 19 launch date for “the Merge.”

- Ethereum’s Merge to Proof-of-Stake is the community’s most anticipated replace in historical past.

Share this text

The rally comes two days after Tim Beiko advised a tentative September 19 launch date for Ethereum’s long-awaited Merge to Proof-of-Stake.

Ethereum Rallies Amid Merge Hype

Ethereum is breaking out.

The quantity two crypto put in a 12% rally Saturday, briefly touching $1,363 for the primary time in a month. It’s since posted a slight cool-off, at present buying and selling at about $1,355.

The ETH rally has led to a bounce throughout the market, serving to property like Synthetix and Avalanche hit double-digit beneficial properties. Lido-staked ETH additionally jumped nearly 12.6%, whereas LDO, the governance token for the Lido DAO, is up 22.8%. Curiously, BTC gained round 3.2%, hinting that Ethereum is main the present rally regardless of Bitcoin’s dominance over the market.

Whereas the precise purpose for the soar is unclear, bettering sentiment surrounding Ethereum and its forthcoming “Merge” to Proof-of-Stake could also be one issue. On Thursday, the Ethereum Basis held its newest Consensus Layer Call through which the Merge was mentioned. Ethereum Basis member Tim Beiko advised a provisional launch date of September 19, dropping the strongest trace but that the Merge may very well be just some weeks away.

Earlier than the Merge can happen on mainnet, Ethereum is ready to undergo one closing check run on the Goerli community within the subsequent few weeks. The ultimate launch will observe that, although Beiko has identified that the mid-September date is barely tentative and will change.

The Merge replace entails merging Ethereum’s execution layer and consensus layer to maneuver the community away from Proof-of-Work and onto Proof-of-Stake. That is anticipated to scale back the community’s vitality consumption by 99.95%, however the Merge has additionally extensively been seen as a bullish catalyst for ETH because it’s set to scale back the community’s issuance by round 90%. In switching to Proof-of-Stake, the community will now not pay miners and as a substitute provide charges completely to validators. As Ethereum additionally burns a portion of its provide in gasoline charges through EIP-1559, it’s estimated that ETH might change into a deflationary asset following the replace. Based on ultrasound.money, if the Merge ships on September 19, the ETH provide will peak at 120.2 million and slowly start to deflate over time.

With the Merge narrative starting to take maintain following the most recent Ethereum Basis name, the market might now be pricing within the impression of the replace regardless of the months-long hunch that’s hit ETH and different crypto property this yr.

Disclosure: On the time of writing, the creator of this piece owned ETH and a number of other different cryptocurrencies.