Key Takeaways

- Acala is a cross-chain interoperable Polkadot parachain that is aiming to develop into crypto’s main DeFi hub.

- Its ecosystem is centered across the decentralized, Maker-inspired, overcollateralized stablecoin, Acala Greenback.

- Acala is constructed utilizing Polkadot’s Substrate framework, which means sure purposes may be constructed into the chain as a substitute of on high of it.

Share this text

Acala Community is an Ethereum-compatible Polkadot parachain aspiring to develop into an all-in-one DeFi hub for Web3. Its ecosystem is centered across the Acala Greenback (aUSD) stablecoin and hosts an array of economic purposes, together with a built-in decentralized trade and a liquid staking service for native tokens of Proof-of-Stake primarily based chains.

Acala Defined

Acala Community is a scalable, Ethereum-compatible DeFi-optimized platform natively interoperable with the whole Polkadot ecosystem.

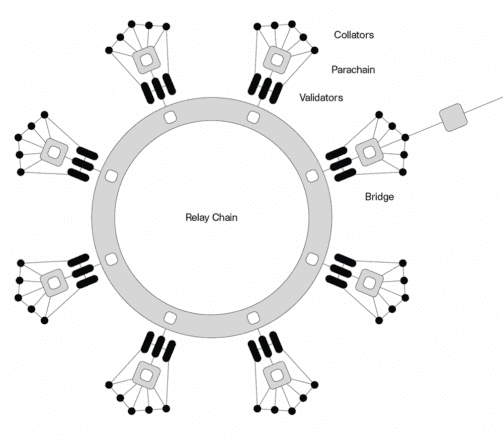

To grasp Acala’s worth proposition, it’s value highlighting that the mission inherits most of its benefits over different Layer 1 protocols by advantage of being constructed on Polkadot utilizing Substrate. The Polkadot community may be described as a scalable, heterogeneous, multi-chain ecosystem with a so-called bedrock “Relay Chain” at its middle. The place most different Layer 1 blockchains are designed with various levels of generality regarding potential purposes, the Polkadot Relay Chain has no inherent software performance in any respect. As a substitute, it’s an uncomplicated chain that serves because the foundational safety layer for a community of interconnected, interoperable blockchains.

In different phrases, the Polkadot Relay Chain may be considered a Layer 0 framework that hosts and connects an increasing, parallelized community of both generalized or application-specific Layer 1 blockchains referred to as parachains. These are modular and simply customizable unbiased blockchains that may have distinctive architectures, tokenomics, and governance buildings. That is the place Acala’s moat lies—it’s a scalable, high-throughput parachain that helps forkless upgradability and customized optimizations.

Whereas there are a whole lot of DeFi purposes on dozens of various Layer 1 chains, they’re all theoretically restricted of their capabilities as a result of they’re hosted on generalized chains. In these instances, decentralized software builders should adapt to the constraints of their specific environments. In the event that they’re constructing DeFi apps on Ethereum, for instance, there are particular issues that their protocols will and gained’t have the ability to do due to how Ethereum is designed.

Acala turns this precept on its head. As a substitute of the purposes adapting to the constraints of fastened, generalized blockchains, Acala can adapt to the wants of the purposes by regularly evolve to develop into extra application-specific. Acala’s Chief Progress Officer Dan Reecer sat down with Crypto Briefing to debate the mission, and he defined how the community is geared towards DeFi. He mentioned:

“As a result of Acala is constructed with Substrate, we’ve been in a position to construct a series that’s optimized for decentralized finance. Considered one of many issues that this enables us to do, for instance, is that customers pays charges on Acala in any token supported by the native, built-in decentralized trade. One other distinctive factor is the on-chain transaction scheduling. This enables us to construct native rails for automated and recurring funds supporting subscription providers, automated profit-taking, reinvestment mechanisms, liquidation mechanisms not reliant on exterior keepers, and so forth.”

The “Substrate” Reecer refers to is a framework developed by the corporate behind Polkadot, Parity Applied sciences. Builders can use it to construct their blockchains after which use pre-built, plug-and-play modules referred to as “pallets” so as to add customized functionalities on high. Substrate pallets enable sure purposes comparable to decentralized exchanges or worth oracles to be constructed straight into the blockchain reasonably than on high of it, making them considerably extra versatile and environment friendly.

Acala’s Native DeFi Infrastructure

The Acala ecosystem is constructed round a decentralized, Maker-inspired, crypto-collateralized stablecoin referred to as Acala Greenback (aUSD). It’s constructed utilizing the Honzon stablecoin protocol that leverages a number of customized modules or Substrate pallets to handle a number of features of the protocol, together with the provision and demand balancing and the danger administration mechanisms.

To mint aUSD, customers must deposit collateral and open a Collateralized Debt Place (CDP) utilizing accepted reserve property, which may be cross-chain by nature and embody Polkadot, Acala, Ethereum-native property, and Bitcoin. The market worth of the crypto collateral should at all times exceed the worth of the aUSD mortgage, and it can’t be eliminated till the mortgage is repaid to the protocol in full.

The mechanics of the Acala stablecoin protocol are nearly totally primarily based on Maker’s DAI and, in that regard, aren’t groundbreaking by any means. Nevertheless, aUSD itself is considerably distinctive as a result of it’s a cross-chain interoperable asset, which means it may be used throughout the whole Polkadot parachain ecosystem with out counting on cross-chain bridges or needing to be wrapped. Commenting on the necessary function aUSD performs within the Polkadot ecosystem, Reecer mentioned:

“There’s an enormous alternative for Acala to be the primary in offering a completely decentralized, crypto-backed stablecoin native to the Polkadot ecosystem. We opted for this mannequin as a result of algorithmic stablecoins are nonetheless largely an experiment, even right this moment, whereas collateralized ones are a confirmed mannequin.”

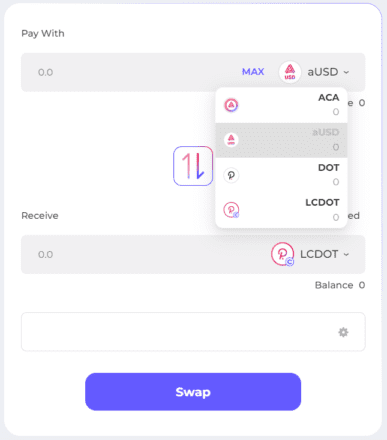

One other in-house DeFi software that has been constructed into the Acala parachain is the decentralized trade AcalaSwap. Like Uniswap on Ethereum, AcalaSwap can be a continuing perform, automated market maker-based decentralized trade. Nevertheless, as a substitute of being constructed as a sensible contract protocol on high of the blockchain, it’s constructed into the blockchain as a Substrate pallet.

As AcalaSwap is built-in into the Acala parachain itself, it could actually do issues that related decentralized exchanges on different Layer 1 ecosystems can’t. For instance, it gives liquidity and backend performance for different decentralized purposes within the Polkadot ecosystem, together with an environment friendly liquidation mechanism for the aUSD stablecoin system, MEV safety for swaps because of integration with a separate in-house Oracle pallet, and the flexibility to pay transaction charges on Acala with any token supported on the trade.

The final function is particularly necessary as a result of it significantly lowers the barrier to entry to decentralized finance. As a substitute of being required to personal Acala’s native token ACA (a risk-on, unstable asset) to pay for transaction charges, customers can preserve their complete portfolios in, for instance, aUSD and pay for transaction charges with a stablecoin. Within the background, the aUSD can routinely be swapped for ACA by way of AcalaSwap after which paid to the so-called collators accountable for validating transactions on Polkadot parachains.

On high of that, as a result of Acala is natively interoperable with the whole Polkadot ecosystem, customers can use the AcalaSwap trade to swap native property from different blockchains with out bridging or wrapping them. Commenting on the significance of AcalaSwap, Reecer mentioned that the trade would possible play a central function inside the ecosystem. He defined:

“There’s going to be a ton of liquidity on Acala due to the decentralized trade and the liquid DOT staking protocol. So when somebody’s constructing a decentralized software on the EVM+, they will faucet into the liquidity of AcalaSwap and have composability with some other decentralized software inside the EVM setting there. It’s utterly open in that regard.”

Acala has additionally constructed one other protocol referred to as Homa that focuses on providing liquid DOT staking. Homa is a non-custodial, trustless, and cross-chain liquid staking protocol built-in into the Acala blockchain as a Substrate pallet. It’s designed to resolve the widespread illiquidity of staked property. It lets customers stake native tokens of Proof-of-Stake-based chains in trade for liquid tokens representing the precept staked asset plus the constantly accruing staking yield. For instance, utilizing Homa, customers may stake DOT in trade for transferable yield-bearing L-DOT tokens, then use the L-DOT tokens as collateral for aUSD loans or elsewhere in DeFi on Polkadot.

Last Ideas

As Acala is a stablecoin-focused ecosystem, creating demand for aUSD each inside and outdoors the Polkadot universe is vital to its success. For that reason, the mission has launched a grants program that focuses on DeFi improvement that advantages the Acala ecosystem. The thought is to spawn a thriving ecosystem with all the required DeFi primitives, together with cash markets, decentralized exchanges, yield optimizers, and NFT marketplaces.

Past crypto, Acala desires to bridge the hole between decentralized and conventional finance and develop into the main hub for so-called hybrid finance or “HyFi.” One of many methods it plans to try this is by partnering with fintech corporations and neobanks that might make the most of Acala’s infrastructure to offer higher providers for his or her prospects. As a place to begin, Reecer mentioned that Acala has already partnered with the U.S.-based fintech firm Current to construct a DeFi backend for his or her Web2 financial savings account. “Present desires to have the ability to supply a high-yield financial savings account the place {dollars} move out of financial institution accounts into DeFi on Acala, earn a yield there, after which that yield is liquidated and despatched again to Present and distributed to prospects in a Web2 software,” he defined.

Acala’s most compelling worth proposition could be its capacity to improve with none forks. It is a full game-changer. Generalized blockchains that attempt to do all the pieces on a single chain are basically constrained by their design decisions and pressure software builders to churn inelegant workarounds as a substitute of constructing specialised options. “Think about Aave or Uniswap with the ability to inform the core builders what they want from the Ethereum blockchain—after which truly get it,” Reecer mentioned. “Nicely, now we have a full wishlist from our app builders and the aptitude to improve the chain to accommodate them.” The speed of acceleration and potential for enchancment that this function gives is unparalleled.

Disclosure: On the time of writing, the writer of this function owned ETH and several other different cryptocurrencies.