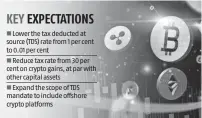

Indian cryptocurrency firms are voicing their longstanding expectations for a discount in tax charges on crypto property, putting their wishlist on the upcoming Union Finances. Their key demand is the enlargement of the Tax Deducted at Supply (TDS) mandate to embody offshore crypto platforms, aligning earnings from digital digital property (VDAS) with that derived from capital property.

With Finances 2024 anticipated to be a vote on account, the crypto business is looking forward to substantial bulletins that might reshape their tax panorama.

Sumit Gupta, co-founder of COINDCX, a outstanding crypto alternate, emphasised the necessity for strategic measures, suggesting a discount within the TDS charge from 1% to 0.01% and aligning the tax charge with different property at 30%. Gupta acknowledged, “Undoubtedly, it will invigorate the crypto sector. We urge the federal government to develop the scope of the TDS mandate to explicitly embody offshore platforms.”

Echoing this sentiment, Rahul Pagidipati, CEO of Zebpay, one other main crypto alternate agency, highlighted {that a} extra favorable tax surroundings would entice a broader vary of buyers, fostering progress within the business. Pagidipati acknowledged, “Lowering TDS and capital beneficial properties taxes would encourage extra inclusive participation within the crypto market. A supportive regulatory surroundings will stimulate innovation, empowering the business by way of blockchain know-how integration.”

The taxation norms launched in February 2022, imposing a 30% tax on earnings from cryptocurrencies and a 1% TDS on all crypto transactions, have been deemed stringent by business gamers. Many consider these laws have pushed Indian crypto customers towards non-compliant international exchanges, risking their investments and probably violating the regulation.

Ashish Singhal, co-founder and Group CEO of Peepalco (previously Coinswitch), expressed issues, stating, “Excessive TDS charges and the dearth of offset have led many Indian VDA customers to maneuver to non-compliant international exchanges. They put themselves liable to shedding their funding and breaking the regulation, leading to lesser tax revenues for the exchequer.”

Sumit Gupta of COINDCX known as for a rise within the threshold restrict for tax deduction, proposing a revision from ~10,000 or ~50,000 to ~500,000. He emphasised the necessity for equitable taxation and instructed lowering the tax charge from 30%, aligning it with property in different industries.

Rajagopal Menon, Vice President of WazirX, shared related expectations, advocating for the allowance of offsetting losses towards beneficial properties. Menon acknowledged, “The underlying goal is to make sure a level-playing area within the cryptocurrency house, devoid of regulatory or tax arbitrage for any participant.”

In a separate growth, the Monetary Intelligence Unit (FIU) underneath the finance ministry issued present trigger notices to 9 VDA firms, signaling a crackdown on non-compliant crypto platforms. The FIU has requested the Ministry of Electronics and Info Know-how to dam their web sites.