Within the aftermath of authorized challenges and regulatory turmoil surrounding main crypto exchanges, together with the current acceptance of a $4 billion high-quality by Binance, skeptics of cryptocurrencies would possibly anticipate a major collapse of their market worth. Nevertheless, the market information suggests a special narrative, elevating questions concerning the underlying components supporting the resilience of cryptocurrencies, notably Bitcoin.

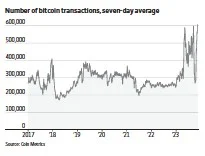

Whereas Bitcoin did expertise a modest decline following Binance’s authorized developments, it has proven resilience, nonetheless buying and selling above ranges noticed simply final week. The variety of Bitcoin transactions has even reached a file excessive for the seven days main as much as Tuesday. This obvious stability prompts an exploration into the varied components contributing to the cryptocurrency’s worth.

One notable pattern is the surge in small Bitcoin transactions related to the rise of digital artwork, often called Bitcoin “ordinals.” This unconventional type of digital artwork, nearly inscribed on fractions of a Bitcoin inside the blockchain, has garnered reputation, driving elevated Bitcoin purchases and decreasing the median transaction measurement. The information means that this sudden demand could also be supporting Bitcoin’s worth, though the long-term sustainability of this pattern stays unsure.

The rise in small Bitcoin transactions, nevertheless, has additionally underscored the restrictions of Bitcoin as a forex. With median charges surpassing $5 prior to now week and transaction sizes plunging, questions come up about its performance as a fee technique. Regardless of this, Bitcoin has persevered as a speculative asset and retailer of worth, albeit with ongoing debates about its effectiveness in comparison with conventional investments.

Initially promoted as a forex various, Bitcoin has shifted its narrative to being a retailer of worth, with its capped issuance touted as safety towards inflationary considerations. Nevertheless, current developments problem this narrative, as Bitcoin’s value actions align extra intently with the S&P 500 than conventional safe-haven property like gold.

The idea of Bitcoin as a “pet rock” or a safe retailer of worth is additional difficult by the emergence of quite a few various cryptocurrencies, diluting the shortage issue related to Bitcoin. Moreover, the rise of stablecoins, pegged to conventional currencies just like the greenback, has diminished the attraction of cryptocurrencies in nations with unstable currencies.

The crypto market’s affiliation with playing and hypothesis additionally performs a major position in figuring out its worth. Cryptocurrencies’ inherent volatility attracts speculators, and the notion of crypto as an funding asset offers a facade for speculative actions. The hyperlink between the S&P and Bitcoin additional underscores the speculative nature of cryptocurrency investments.

Whereas felony actions corresponding to cash laundering and illicit transactions had been as soon as thought to underpin the worth of cryptocurrencies, current authorized actions towards main exchanges point out a shift away from this narrative. Cryptocurrencies, notably Bitcoin, are present process transformations and reinventions, but their true function and worth within the broader monetary panorama stay enigmatic. The technical attract of crypto continues, leaving observers to ponder its potential options and functions.