As the third week of April unfolds, cryptocurrency enthusiasts worldwide are poised for a significant juncture in bitcoin’s evolution: the much-anticipated “halving.” Amidst the fervent anticipation, investors and analysts alike are scrutinizing the potential implications of this scheduled reduction in the issuance of new bitcoins.

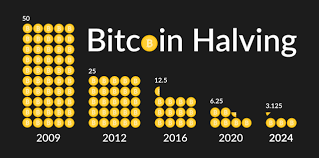

The essence of the halving lies in its role as a deliberate mechanism to curb the influx of new bitcoins into circulation. Occurring roughly every four years, this event holds profound implications for the digital currency’s supply dynamics and, by extension, its market value.

Amidst a backdrop of resurgent prices and renewed investor optimism, this year’s halving has garnered unprecedented attention within the crypto ecosystem. Bitcoin’s recent surge to record highs, peaking at $73,000 in March, has galvanized market sentiment, propelled by a confluence of factors including the approval of novel financial products tied to bitcoin.

But what exactly does the halving entail, and why does it command such profound interest?

Understanding the Halving Mechanism

At the heart of bitcoin’s ethos lies the aspiration to facilitate peer-to-peer transactions devoid of traditional intermediaries like banks. Crucially, the decentralized network underpinning bitcoin relies on a distributed cadre of computers to verify transactions through a process known as mining. In exchange for their computational efforts, miners are rewarded with new bitcoins. However, this reward undergoes periodic halving events, reducing its magnitude by half.

The Intrinsic Value Proposition of Bitcoin

Embedded within bitcoin’s DNA is a staunch commitment to a fixed supply schedule, capped at 21 million coins. Advocates herald this finite supply as a bulwark against inflationary pressures endemic to traditional fiat currencies. As the halving progressively diminishes the issuance of new bitcoins, proponents argue that this scarcity will underpin the digital currency’s long-term value proposition.

Implications for Bitcoin’s Price Trajectory

Predicting the precise impact of the halving on bitcoin’s price trajectory remains a subject of intense speculation. While conventional wisdom suggests that a reduction in supply should spur price appreciation, some analysts caution that market expectations may have already factored in the halving’s effects. Nevertheless, prevailing sentiment within the crypto community remains buoyant, with many envisaging continued upward momentum for bitcoin’s valuation.

Disruption in the Mining Landscape

The halving reverberates beyond price dynamics, profoundly impacting the bitcoin mining industry. From its nascent origins, characterized by hobbyist miners operating on laptops, to its current iteration dominated by sophisticated mining operations, the sector has undergone seismic transformations. However, the halving poses a formidable challenge to the economic viability of smaller mining operations, potentially precipitating industry consolidation and reshaping the competitive landscape.

In the words of Adam Sullivan, CEO of Core Scientific, the halving may herald a period of upheaval, with smaller players facing existential threats while larger entities consolidate their market position.

As the countdown to the halving reaches its crescendo, the global crypto community braces for a pivotal moment in bitcoin’s narrative, underscoring the enduring allure and volatility of the digital currency landscape.