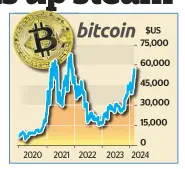

Bitcoin, the flagship cryptocurrency, has surged previous the $57,000 mark for the primary time in over two years, signaling a resurgence in investor confidence and reigniting hypothesis about its future trajectory. The digital asset’s meteoric rise comes in opposition to a backdrop of mounting investor curiosity and regulatory developments reshaping the panorama of the cryptocurrency market.

With Bitcoin reaching a excessive of $57,462, marking a ten% achieve for the week and a exceptional 35% improve for the yr, analysts and buyers alike are scrutinizing its ascent with cautious optimism. This surge brings Bitcoin to ranges not seen since December 2021, when it was receding from its report excessive of almost $69,000.

Whereas some analysts venture a bullish trajectory for Bitcoin, forecasting a possible surge to $100,000 by summer time, others stay circumspect, emphasizing the inherent volatility and uncertainty that outline the cryptocurrency market. Walid Koudmani, an analyst at dealer XTB, underscores the unpredictability of cryptocurrency valuations, cautioning in opposition to overzealous projections amid market fluctuations.

The latest rally gained momentum earlier within the week following information that software program agency MicroStrategy had acquired 3,000 Bitcoin tokens, totaling roughly £120 million, bolstering its already substantial holdings to over £9 billion. MicroStrategy’s sizable funding was interpreted as a vote of confidence within the broader cryptocurrency sector, fueling optimism amongst buyers.

Greta Yuan, head of analysis at digital asset platform VDX, highlights the influential position of market sentiment, citing the affect of endorsements from distinguished figures like MicroStrategy on investor confidence. The ripple impact of MicroStrategy’s funding was evident not solely in Bitcoin’s surge but additionally within the upward trajectory of its competitor, Ether.

Furthermore, Bitcoin’s rally has been bolstered by a wave of investments in exchange-traded funds (ETFs) linked to its worth, following regulatory approval from U.S. authorities. The latest inexperienced mild from the Securities and Trade Fee (SEC) for 11 Bitcoin ETFs, together with choices from Wall Avenue heavyweights BlackRock and Constancy, has expanded entry to Bitcoin for retail and institutional buyers alike.

Trying forward, Bitcoin might obtain additional impetus from an upcoming “halving” occasion, a periodic incidence whereby the reward for Bitcoin mining is halved. This occasion, designed to manage the provision of Bitcoin, usually triggers elevated demand and heightened investor curiosity, additional propelling the digital asset’s worth.

As Bitcoin continues its upward trajectory, navigating the unstable terrain of the cryptocurrency market requires a considered steadiness of optimism and prudence, as buyers brace for the twists and turns that lie forward on this ever-evolving panorama of digital finance.