Key Takeaways

- Bitcoin is caught between $21,500 and $21,000.

- In the meantime, Ethereum is buying and selling between $1,250 and $1,190.

- Closing exterior these buying and selling ranges will decide the pattern’s route.

Share this text

The cryptocurrency market had a quiet weekend as the highest two property by market cap, Bitcoin and Ethereum, continued consolidating. Nonetheless, a major value motion seems to brew.

Bitcoin and Ethereum Primed for Volatility

Bitcoin and Ethereum remained stagnant over the weekend, however a couple of indicators recommend that volatility is about to renew.

BTC is caught in a decent value vary between $21,500 and $21,000 whereas ETH continues to commerce between $1,250 and $1,190. Each cryptocurrencies have seen their costs squeeze in the previous couple of days because the market sentiment stays in “excessive concern.” Curiously, a selected technical indicator hints on the likelihood of a downswing.

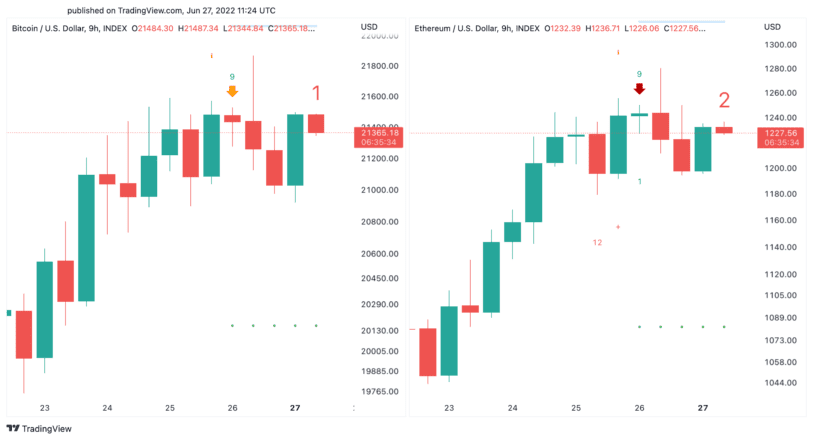

The Tom DeMark (TD) Sequential indicator just lately offered promote indicators on Bitcoin and Ethereum’s nine-hour chart. The bearish formations developed as inexperienced 9 candlesticks, indicative of 1 to 4 candlesticks correction. Though BTC and ETH took a quick nosedive after the technical growth, there hasn’t been a transparent violation of assist or resistance.

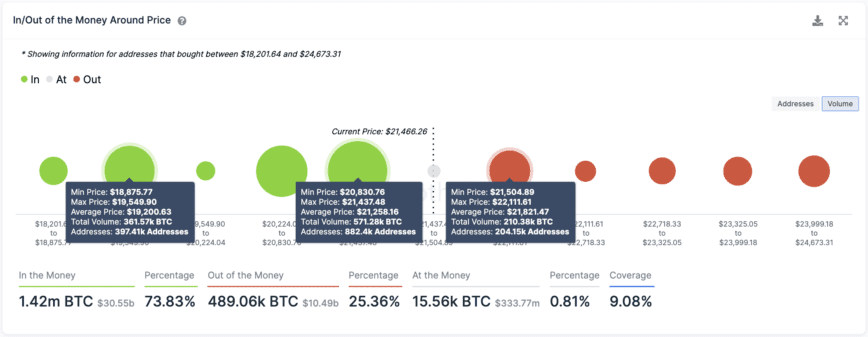

Transaction historical past reveals two essential value factors that will assist decide the place Bitcoin goes subsequent. Roughly 882,400 addresses had beforehand bought over 570,000 BTC between $20,800 and $21,500. In the meantime, greater than 200,000 addresses are holding over 210,000 BTC $21,500 and $22,100.

Given the dearth of resistance forward, a sustained nine-hour candlestick shut above $22,100 may very well be vital sufficient to set off a bullish breakout towards $25,000 and even $27,000. But when the $20,800 assist degree had been to surrender, the subsequent essential curiosity zone sits at $19,000.

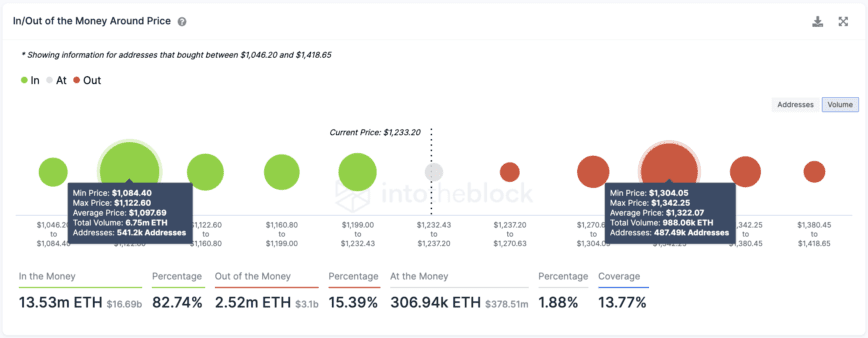

Transaction historical past additionally reveals that Ethereum can’t afford to lose the $1,100 assist degree. Breaching such an important demand zone can set off one other sell-off that sends ETH to $600. Due to this fact, it’s crucial for Ether to slice by the $1,320 resistance barrier to have an opportunity of advancing towards $1,700.

The macroeconomic outlook nonetheless doesn’t look favorable as recession fears heighten. For that reason, it’s crucial to attend for a decisive shut under resistance or above assist to enter the markets. Though a couple of metrics recommend that the underside is close to, there may very well be extra downward motion earlier than the pattern reverses.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.

For extra key market tendencies, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.