Key Takeaways

- Bitcoin has dropped by practically 13% since Mar. 28.

- Likewise, Ethereum has incurred greater than 12% in losses.

- Each tokens at the moment are approaching key assist areas which will include the bleeding.

Share this text

Bitcoin and Ethereum are struggling to search out assist, whereas merchants within the futures markets are displaying indicators of optimism. Such market habits may lead to a quick upswing earlier than one other retrace.

Bitcoin Prepares to Bounce

Bitcoin seems to be gaining momentum for a rebound after the steep correction it has endured over the previous two weeks.

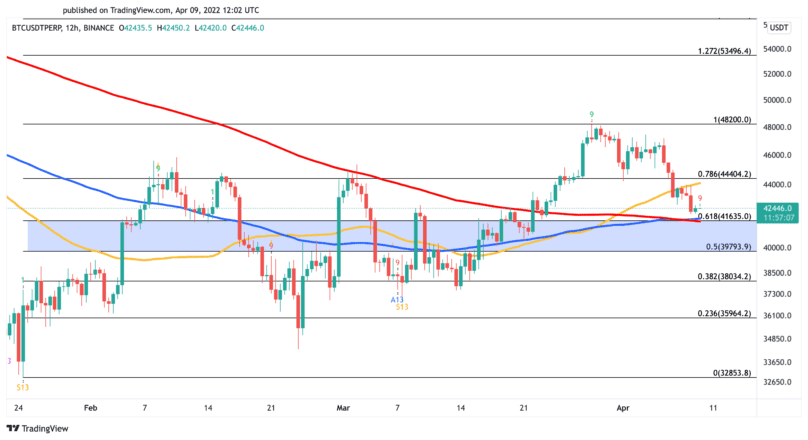

The highest crypto suffered a major downturn after reaching a excessive of $48,000 on Mar. 28. Its value dropped by practically 13%, shedding greater than 6,000 factors in market worth. Regardless of the numerous losses incurred, it seems that market members are nonetheless optimistic.

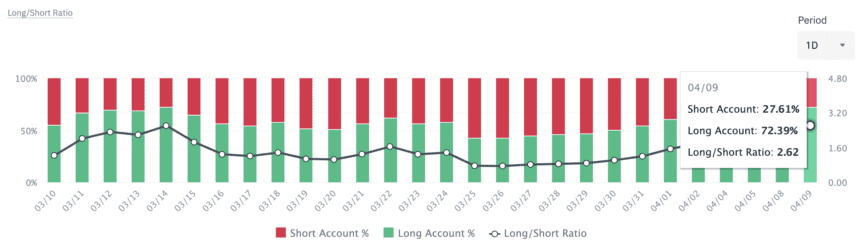

On Binance Futures, the BTCUSDT Lengthy/Quick Ratio has continued to surge, hitting a 2.62 ratio on Apr. 9. Roughly 72.4% of all accounts on the world’s largest crypto derivatives change by buying and selling quantity are net-long on Bitcoin.

Though Bitcoin doesn’t are likely to comply with the herd, the bulls may very well be confirmed proper this time round.

The Tom DeMark (TD) Sequential at the moment presents a purchase sign on Bitcoin’s 12-hour chart. The bullish formation developed within the type of a crimson 9 candlestick, which is indicative of a one to 4 candlesticks upswing.

A spike in shopping for strain may assist validate the optimistic outlook and push Bitcoin towards the $44,400 resistance stage. A decisive 12-hour candlestick shut above this hurdle may lead to a extra vital upswing to retest the current excessive of $48,200.

Nonetheless, whereas the chances seem to favor the bulls, Bitcoin may nonetheless lengthen its losses earlier than it rebounds. Essentially the most vital foothold beneath Bitcoin lies between $41,600 and $40,000. If this assist space is breached, it could set off a liquidations cascade, sending costs to $38,000 and even $36,000.

Ethereum at a Crossroads

Ethereum is consolidating inside a $140 value vary with out offering a transparent sign of its subsequent transfer.

The second-largest cryptocurrency by market cap has been caught between $3,300 and $3,160 over the past three days after struggling a 12.27% correction. This value pocket doesn’t look like attracting sidelined traders regardless of the importance of Ethereum’s upcoming plans. Although the launch date remains to be unknown, Ethereum is at the moment getting ready to finish “the Merge” from a Proof-of-Work to a Proof-of-Stake consensus mechanism, one thing the blockchain’s followers have been anticipating for a number of years. It’s anticipated to ship someday in 2022.

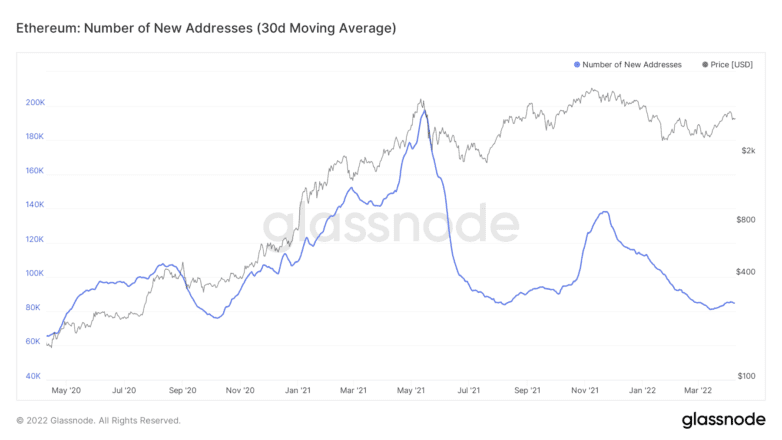

The community’s present growth price displays the shortage of curiosity. The variety of new each day addresses created on the Ethereum blockchain has remained stagnant at a median of 85,000 addresses over the previous month. A sustained uptrend on this on-chain metric may result in additional upward value motion as it might sign the doorway of retail traders.

Till that occurs, transaction historical past exhibits vital provide and demand areas to be careful for.

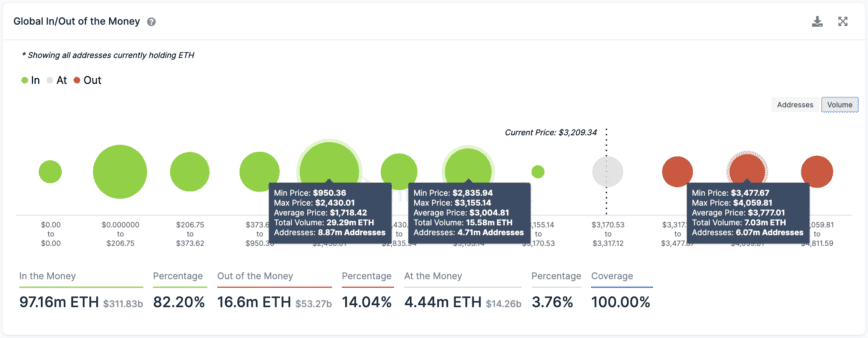

IntoTheBlock’s International In/Out of the Cash (GIOM) mannequin reveals that essentially the most vital assist stage for Ethereum sits at a median value of $3,000, the place 4.71 million addresses are holding 15.58 million ETH. In the meantime, essentially the most vital resistance zone is $3,780, the place 6.07 million addresses have beforehand bought over 7 million ETH.

Ethereum wants to interrupt by way of assist or resistance to resolve its ambiguity. Slicing by way of the $3,000 demand zone may see ETH drop towards $2,400. Nonetheless, if the bulls break previous the $3,780 provide wall, costs may advance towards $4,600.

Disclosure: On the time of writing, the creator of this piece owned BTC and ETH.