Key Takeaways

- Bitcoin and Ethereum have dropped by over 22% over the previous month.

- Each tokens now present bullish indicators on their three-day charts.

- Nonetheless, shopping for stress has but to select as much as assist BTC and ETH rebound.

Share this text

Bitcoin and Ethereum have incurred important losses over the previous month and seem to have reached oversold territory. Though purchase indicators are beginning to seem, it’s cheap to attend for affirmation given the dearth of buying and selling quantity.

Bitcoin, Ethereum at Key Help

Bitcoin and Ethereum are presenting purchase indicators whereas buying and selling at a important assist zone.

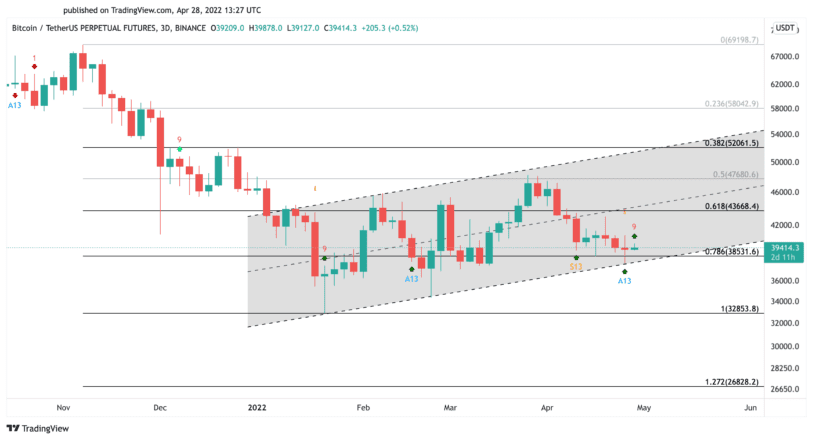

The flagship cryptocurrency has retraced by practically 22% over the previous month, going from a excessive of $48,223 to hit a low of $37,693 lately. Regardless of the temporary dip under the 78.6% Fibonacci retracement stage at $38,530, it seems this assist space was in a position to maintain. Additional indicators of energy across the present value ranges may result in a sustained bullish impulse.

The Tom DeMark (TD) Sequential indicator anticipates that sidelined buyers may benefit from the current correction to re-enter the market and assist BTC rebound. This technical index has introduced a purchase sign on Bitcoin’s three-day chart, which is indicative of a one to 4 candlesticks upswing.

If Bitcoin can keep above the $38,530 assist stage, it will seemingly gather the liquidity to validate the optimistic outlook and rebound towards $43,670 and even $52,000.

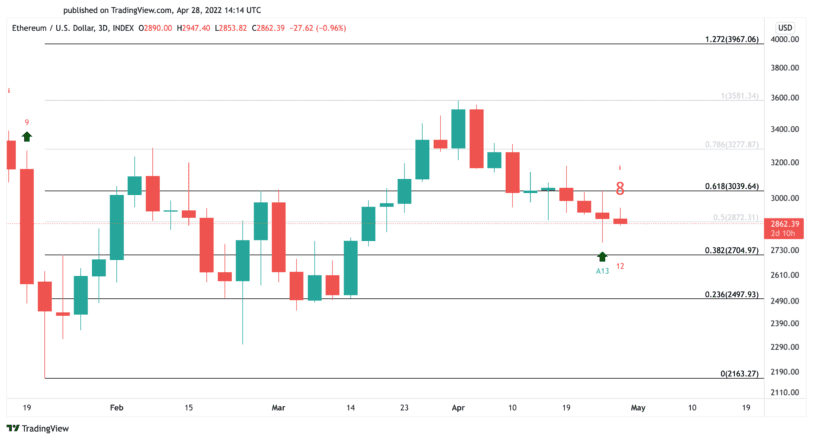

Ethereum has additionally incurred important losses over the previous month. Since early April, it retraced by practically 23%, shedding greater than 800 factors in market worth. The second-largest cryptocurrency by market cap now seems to be approaching a vital demand zone which will assist it rebound.

The TD setup has already flashed a purchase sign within the type of an aggressive 13 on ETH’s three-day chart, whereas a purple 9 candle would seemingly develop within the subsequent three-day buying and selling session. These bullish formations anticipate that momentum is constructing for an upswing. Nonetheless, Ethereum may dip to $2,700 earlier than it rebounds.

Solely a decisive three-day candlestick shut above $3,000 can verify the optimistic outlook. If this have been to occur, sidelined buyers may very well be inspired to re-enter the market, pushing Ethereum to $3,600 and even $4,000.

Though a number of purchase indicators are beginning to seem after the steep correction Bitcoin and Ethereum noticed over the previous month, the dearth of buying and selling quantity seen in the previous few days means that retail buyers are usually not concerned with getting into the market on the present value ranges.

If purchase orders don’t choose up quickly, BTC may breach the $38,530 assist and fall to $32,850 or $26,830 whereas ETH may dip under $2,700 and goal $2,500 and even $2,160.

Disclosure: On the time of writing, the writer of this piece owned ETH and BTC.