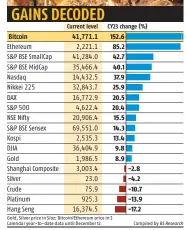

Bitcoin has seen a exceptional surge of 152.6% year-to-date, reaching roughly $44,000, outshining different asset lessons resembling equities and treasured metals in 2023.

Main fairness indices globally, together with S&P BSE Sensex, Nifty50, S&P BSE Smallcap, Nasdaq, Nikkei 225, CAC 40, and the Korea Composite Inventory Worth Index, have returned between 12% to 43% throughout the identical interval.

In distinction, treasured metals like gold, silver, and platinum have recorded returns starting from a detrimental 14% to 11%, in response to obtainable information.

Analysts attribute the sharp rally in cryptocurrencies, significantly Bitcoin and Ethereum (up 97% YTD), to the simultaneous rise in international fairness markets amidst hawkish central financial institution insurance policies. One other important issue contributing to the surge is the anticipated launch of the world’s first Bitcoin exchange-traded fund (ETF) within the coming months.

Christopher Wooden, the worldwide head of fairness technique at Jefferies, expressed optimism in regards to the potential launch of the world’s first Bitcoin ETF and added a 1 share level to the prevailing funding in Grayscale Bitcoin Belief within the international long-only fairness portfolio. Wooden sees optimistic indicators for the cryptocurrency asset class, significantly within the lack of a detrimental market response to the latest Binance settlement with the US Division of the Treasury and Division of Justice.

Wooden acknowledged in his weekly observe to traders, GREED & concern, “The settlement appears extra akin to a smack over the knuckles than something extra dramatic. This, and the dropping of the SEC’S case towards Grayscale in October, suggests the trail is now clear for the approval of a bitcoin ETF.”

Bitcoin is anticipated to bear a halving occasion in April 2024. Traditionally, after earlier halving occasions, Bitcoin witnessed substantial features, additional fueling the optimistic sentiment out there.

Rahul Pagidipati, the CEO at Zebpay, envisions appreciable pleasure inside the cryptocurrency group concerning the upcoming bitcoin halving occasion and improvements within the decentralized finance (DeFi) house. He acknowledged, “Bitcoin’s YTD development presently stands at 165 per cent, which marks a transparent shift in sentiment in direction of crypto. The approvals of spot ETF functions filed by numerous institutional traders are additionally different key occasions the business is trying ahead to.”