Within the aftermath of a polarizing U.S. presidential election, sudden victors are rising on the monetary battleground. Bitcoin and gold, typically touted as various havens throughout occasions of financial uncertainty, are gaining traction as buyers search refuge from the turmoil of the established order.

Historically considered as a sanctuary asset immune to inflation and forex devaluation, gold has cemented its standing as a retailer of worth. Equally, Bitcoin, typically hailed as digital gold, provides buyers an escape from the constraints of conventional finance, working exterior the purview of central banks and governmental affect.

The latest surge in Bitcoin and gold costs coincides with the backdrop of the Tremendous Tuesday primaries, the place hundreds of thousands of People forged their votes. This convergence underscores the rising enchantment of other belongings in an more and more unstable geopolitical panorama.

Whereas the attract of gold is well-established, Bitcoin’s ascent represents a departure from typical monetary paradigms. As MicroStrategy, a number one expertise agency, declares plans to problem $600 million in convertible debt to accumulate extra Bitcoin, institutional curiosity within the cryptocurrency market reaches unprecedented ranges.

Regardless of Bitcoin’s tumultuous journey, characterised by dramatic value fluctuations, institutional gamers corresponding to BlackRock and Constancy have ventured into the house, introducing exchange-traded funds (ETFs) to facilitate mainstream adoption. The emergence of ETFs provides buyers a handy avenue to entry Bitcoin, additional bolstering its legitimacy as an investable asset.

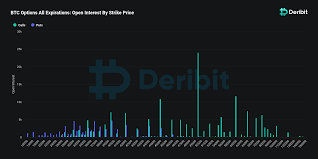

Nonetheless, amidst Bitcoin’s meteoric rise, volatility stays a defining attribute of the cryptocurrency market. With MicroStrategy’s implied volatility hovering to roughly 150%, in comparison with the S&P 500 index’s modest 12%, buyers navigate treacherous waters in pursuit of potential returns.

For these intrigued by Bitcoin’s anti-establishment narrative and optimistic about its evolving market dynamics, a daring technique involving MicroStrategy presents a chance. By promoting the April $1,100 put at a premium of round $110, buyers categorical confidence in Bitcoin’s resilience, betting on its capability to thrive amidst political turmoil and mounting debt issues.

Because the specter of a Joe Biden and Donald Trump rematch looms giant, the enchantment of Bitcoin as a protest forex intensifies. Amidst America’s escalating debt disaster and deepening political divides, Bitcoin emerges as a beacon of hope, providing buyers a hedge towards financial uncertainty and political discord.

In an period outlined by uncertainty, Bitcoin and gold stand as pillars of stability, providing solace to buyers navigating the tumultuous currents of worldwide finance. Because the world grapples with unprecedented challenges, the attract of other belongings grows stronger, beckoning buyers in direction of a brand new frontier of economic risk.