A preferred analyst is predicting if and when three cryptos can escape of the lingering market downtrend to attain a short-term rally.

Pseudonymous crypto dealer Altcoin Sherpa tells his 180,000 Twitter followers he’s not inspired by altcoins on their one-hour to day by day excessive timeframe [HTF] charts however thinks there might be non permanent upside potential for sure tasks.

Sherpa thinks each Cosmos (ATOM) and layer-1 scaling answer NEAR Protocol (NEAR) can do effectively.

“The HTF market construction remains to be extremely bearish for a lot of altcoins but when we see a bit extra chop/grinding + these backside kind of patterns enjoying out, I believe we’ll see a short-term transfer up.

Some potential double bottoms/[cup and handle]/and so on. kind of charts on the market for now.”

At time of writing, Cosmos is up by 4.33% over the past 24 hours and buying and selling for $9.06.

Subsequent Altcoin Sherpa offers a have a look at Ethereum (ETH) competitor NEAR.

NEAR Protocol is down simply shy of two% on the day with an asking value of $3.44.

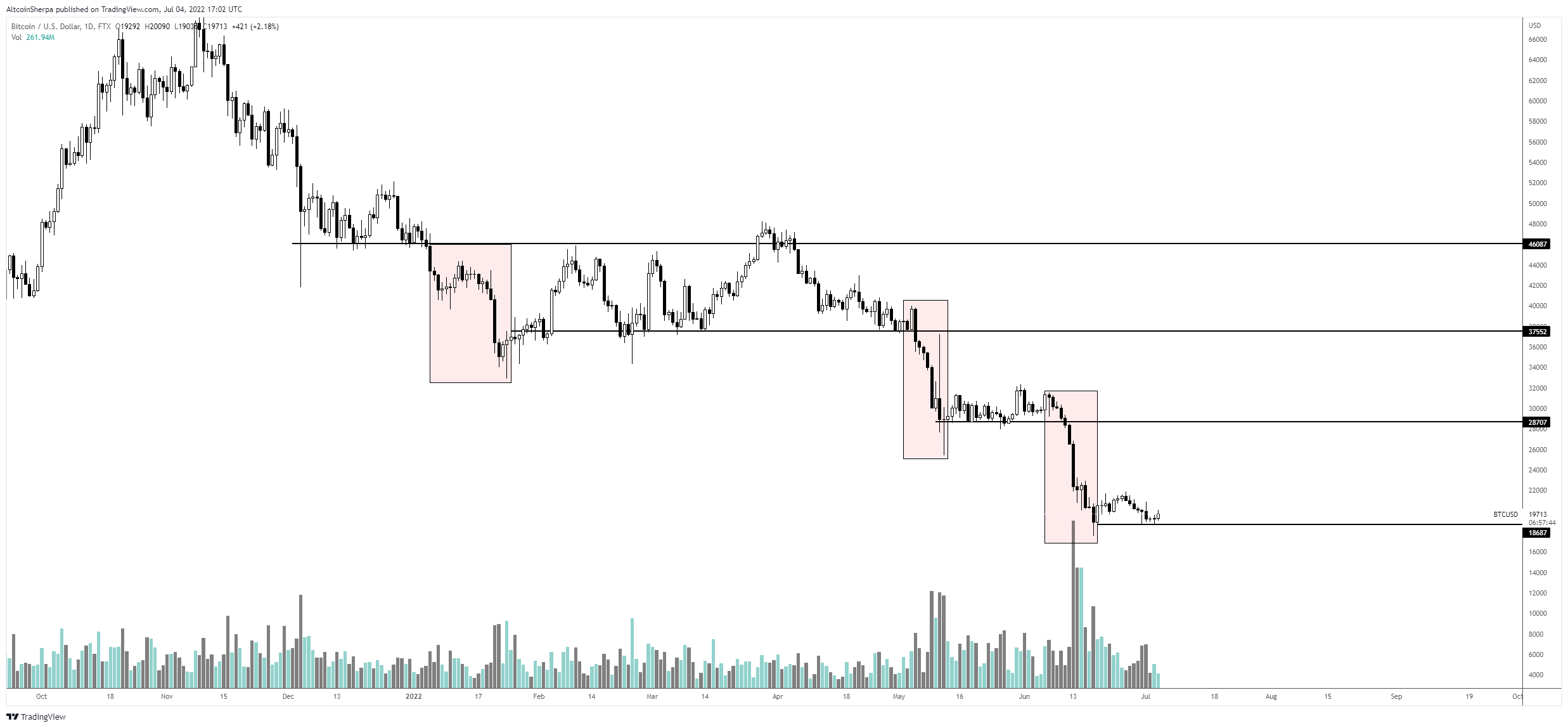

Transferring on to the biggest crypto asset by market cap Bitcoin (BTC), Altcoin Sherpa says that regardless of Bitcoin’s six-month-plus downward trajectory, he foresees one other BTC rally mirroring its rise in late March and early April.

“Each single consolidation has resulted in a breakdown on high-time-frame charts. Is that this time going to be the identical?

There’s going to be one other bear-market rally just like March/April 2022; I don’t know when/the place it’ll occur although (or how excessive).”

The analyst then tells his 10,300 YouTube subscribers he thinks it’s doable Bitcoin might rally as excessive as $30,000 throughout the subsequent upswing.

“You’re actually on the lookout for probably a bear market rally the place value goes to probably rally tougher than you suppose.

It might appear like a transfer all the way in which as much as $30,000. I don’t know if it has the power to rise up there, however it’s a state of affairs that I’m viewing.”

Altcoin Sherpa concludes his remarks by pinpointing $12,000 as a possible bear cycle low for Bitcoin, earlier than including that BTC’s value may in the end be decided by the equities markets reasonably than its deserves or demand alone.

“This final type of bearish retest that we noticed in late March, that was type of the final actual bearish retest that we noticed. Every little thing else has simply been consolidation, breakdown, consolidation, breakdown. Now we’re at consolidation.

We definitely might simply see one other breakdown to $12,000 or wherever. However there’s going to be one other bear market rally, I don’t know what it’s going to appear like or how sturdy it’s going to be, however as I mentioned it’s actually going to largely rely upon equities, in my view.

That’s actually simply the character of it, sadly.”

Bitcoin is at present up by 2.12% over the past 24 hours and altering arms for $20,400.

I

I

Test Value Motion

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/vvaldmann