Key Takeaways

- Binance CEO Changpeng Zhao has shared a brand new notice with a few of his reflections from final week’s Terra collapse.

- Zhao warned towards tasks providing excessive yields and advocated for fundamentals.

- He additionally took purpose at Terraform Labs for Terra’s flawed design and questionable response to the disaster.

Share this text

Zhao didn’t maintain again in criticizing the staff behind Terra as he contemplated on final week’s occasions.

CZ Talks Terra Once more

Changpeng Zhao has shared extra ideas on Terra’s implosion.

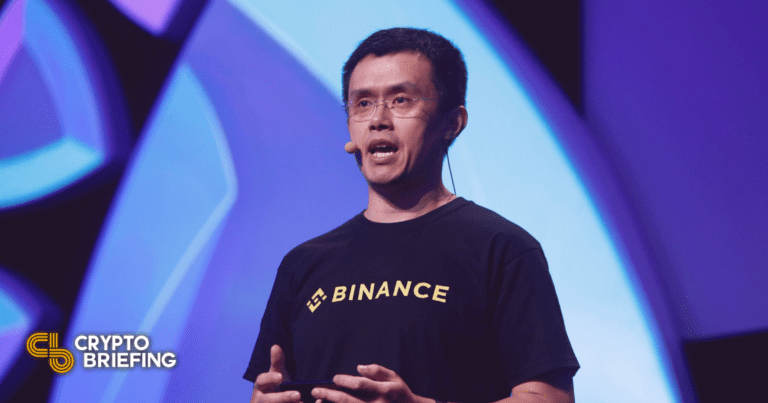

The Binance CEO, who’s fiercely criticized Terraform Labs over the previous few days, revealed a new note Friday reflecting on the occasions that performed out final week as Terra’s UST stablecoin misplaced its peg to the greenback, leading to a $40 billion wipeout that affected the whole crypto trade.

In it, Zhao mentioned the “classes to be discovered” from the catastrophe, providing a few of his private takeaways and suggestions for cryptocurrency buyers. He mentioned Terra’s twin token mechanism, which was designed to permit LUNA to be minted at any time when UST was buying and selling under peg. “Once you peg to 1 asset utilizing a special asset as collateral, there’ll at all times be an opportunity for below collateralization or depegging,” he wrote. He then took direct purpose at Terraform Labs over Terra’s tokenomics mannequin. “Printing cash doesn’t create worth; it simply dilutes current holders,” he wrote. “Exponentially minting LUNA made the issue so much worse. Whoever designed this could have their head checked.”

Zhao additionally described “over-aggressive incentives” in reference to Anchor Protocol, the lending platform that promised UST depositors 20% APY. Terraform Labs made up the income shortfall to pay Anchor’s customers, a mannequin Zhao stated was unsustainable. “Ultimately, you have to generate “earnings” to maintain it… In any other case, you’ll run out of cash and crash,” he wrote.

Zhao issued a warning towards excessive yields, saying they “don’t essentially imply wholesome tasks.” He went on to explain Terra’s design as “a self-perpetuating, shallow idea,” and added that buyers ought to at all times “have a look at fundamentals.”

Terraform Labs Slammed

Zhao criticized Terraform Labs as soon as once more for its response to the disaster, arguing that its choice to make use of LFG’s Bitcoin reserves to stabilize UST after it had misplaced its peg was “silly.” He added that groups ought to “at all times be operationally extraordinarily responsive.”

He additionally questioned Terraform Labs’ communication technique after it posted solely a handful of updates in the course of the meltdown. “At all times talk ceaselessly along with your customers, particularly in instances of disaster.”

Though Zhao was vital in his takeaways, he additionally shared many optimistic ideas. He clarified that Binance would assist the Terra group and famous that crypto had proven relative resilience regardless of a drop in costs and temporary USDT depeg occasion. “The mixed dimension of UST and LUNA was greater than Lehman Brothers when it failed,” he identified, noting that Bitcoin shed solely 20% of its market cap within the fallout.

He additionally acknowledged the necessity for stablecoin regulation, earlier than rounding out with a glance to the way forward for the house. “Whereas cases just like the one with LUNA and UST are regrettable, we’re dedicated to enjoying an important half in constructing a sustainable, enriching blockchain ecosystem for all,” he wrote.

Disclosure: On the time of writing, the creator of this piece owned ETH and several other different cryptocurrencies.