Terra’s current crash seems to have undermined investor confidence in different main layer-1 (L-1) blockchains, knowledge exhibits.

The blockchain’s worth imploded within the first two weeks of Might, and is now buying and selling at a fraction of the billions it was initially valued at.

However this implosion seemingly fuelled broader scrutiny in direction of different L-1 blockchains, significantly these which had been valued equally to Terra. Merchants seemingly feared the same implosion in different L-1s, given the continued weak point available in the market.

Coupled with a extreme crypto market crash up to now two weeks, a majority of tokens dumped by merchants got here from L-1 blockchains. Even within the DeFi house, L-1 protocols noticed the sharpest drop in complete worth locked (TVL).

Terra causes L-1 rout

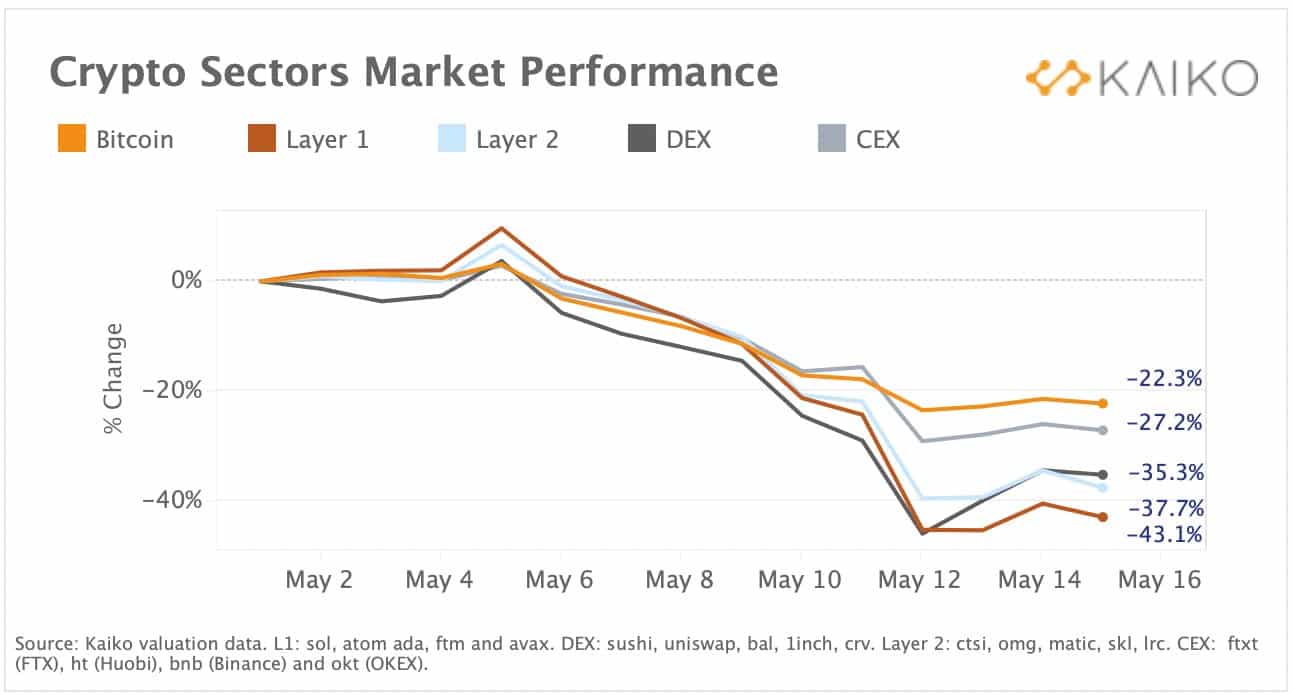

Knowledge from blockchain analysis agency Kaiko exhibits that amid a broader crypto crash, L-1 blockchains, excluding Bitcoin, had been the worst performers within the first two weeks of Might. This pattern additionally occurred concurrently with Terra’s crash.

L-1 blockchains misplaced a mean of 43% up to now two weeks, effectively above losses in layer-2 chains and Bitcoin. As compared, Bitcoin misplaced about 22%.

Supply: Kaiko

In accordance with Kaiko, Avalanche (AVAX) and Fantom (FTM) had been the worst performers, dropping over 40% every in Might. Their DeFi TVL additionally noticed declines in the same magnitude.

However Avalanche was seemingly an outlier on account of its shut ties to Terra. The Luna Basis Guard holds about $66 million of AVAX tokens, which it may promote.

Crypto crash additionally causes concern

Whereas Terra could have invited extra scrutiny in direction of L-1 blockchains, the broader causes behind their sell-off stays the identical. Crypto markets had been offered en masse by Might on fears of rising inflation, and extra rate of interest hikes by the Federal Reserve.

A bulk of crypto losses had been triggered simply after the Fed hiked charges in Might. One other wave of promoting strain got here after knowledge confirmed U.S. inflation will take for much longer to chill.

The crypto market has now misplaced about $400 billion in Might.