Share this text

Balancer’s governance token jumped 20% Friday following the protocol’s change to a vote-escrow tokenomics mannequin.

Introducing veBAL

One other DeFi protocol has adopted Curve Finance’s vote-escrow token mannequin.

Balancer, an automatic market maker on Ethereum, has accomplished its change to a vote-escrow tokenomics mannequin. BAL holders should now lock up their tokens in alternate for veBAL to have the ability to vote on governance proposals and the Balancer swimming pools to obtain boosted rewards. As outlined within the proposal posted to the Balancer boards on Feb. 3, the minimal lock-up interval is one week, with voting energy growing the longer holders conform to lock their tokens.

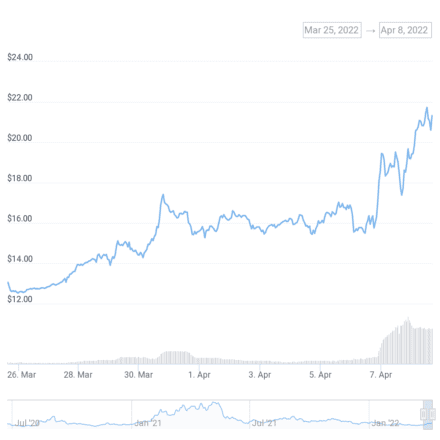

By requiring BAL holders to lock up their tokens to vote, the brand new system has decreased the availability of liquid BAL tokens. Consequently, because the replace went stay on Mar. 28, the value of BAL has steadily elevated. As holders began to lock up extra BAL tokens forward of the primary emissions vote on Apr. 7, the value elevated additional. Over the previous 24 hours, Balancer has climbed one other 21%, placing the token’s complete acquire because the new system’s launch at over 50%.

The vote-escrow token system was first carried out by the like-asset DeFi alternate Curve Finance. Like in Balancer’s current replace, holders of the CRV governance token should lock it up within the protocol’s sensible contract to be able to obtain untradeable veCRV tokens. These “ve” tokens can be utilized to vote on the buying and selling swimming pools that obtain probably the most CRV emissions.

The vote-escrow system helps align the incentives of governance token holders with these of liquidity suppliers and has confirmed efficient in enhancing capital effectivity in DeFi. By means of pioneering the vote-escrow strategy, Curve has grown into the biggest DeFi protocol throughout all chains with $20.75 billion in complete worth locked.

Along with Curve and Balancer, different DeFi protocols have experimented with comparable vote-escrow fashions. At first of the yr, former DeFi developer Andre Cronje launched a brand new decentralized alternate referred to as Solidly that used vote-escrow tokenomics to extend capital effectivity. Whereas curiosity in Solidly has waned since Cronje left the DeFi house in March, the vote-escrow system stays a robust power in decentralized finance.

Disclosure: On the time of scripting this piece, the writer owned ETH and a number of other different cryptocurrencies.