Amid reviews of Twitter ceasing its crypto-integration scheme, Dogecoin [DOGE] misplaced over 11% of its worth in 24 hours. The memecoin had surged by greater than 130% following Twitter’s acquisition by outspoken DOGE supporter Elon Musk, Binance‘s assist for the buy-out, and a short market restoration.

Right here’s AMBCrypto’s Worth Prediction for Dogecoin for 2022-2023

Now, Silicon Valley’s Platformer has noted that Twitter plans to develop a crypto-wallet past the present Bitcoin [BTC] integrations which have been paused.

Whales to avoid wasting the day or not?

Regardless of Platformer’s insider report, Dogecoin whales didn’t halt their actions. On the time of writing, Dogecoin Whale Alert revealed that over $18 million value of the memecoin had moved from pockets to pockets over a 24-hour interval.

????

12,354,379 $DOGE ($1,451,986 USD) was transferred from a number of wallets to an unknown pockets.

Price: 5.00 ($0.59 USD)

Tx: https://t.co/eMJ6J83gWJ#DogecoinWhaleAlert #WhaleAlert #Dogecoin #CryptoNews

— Ðogecoin Whale Alert (@DogeWhaleAlert) November 4, 2022

????

4,699,967 $DOGE ($554,201 USD) was transferred from a number of wallets to an unknown pockets.

Price: 4.72 ($0.56 USD)

Tx: https://t.co/XJS03dGbTV#DogecoinWhaleAlert #WhaleAlert #Dogecoin #CryptoNews

— Ðogecoin Whale Alert (@DogeWhaleAlert) November 4, 2022

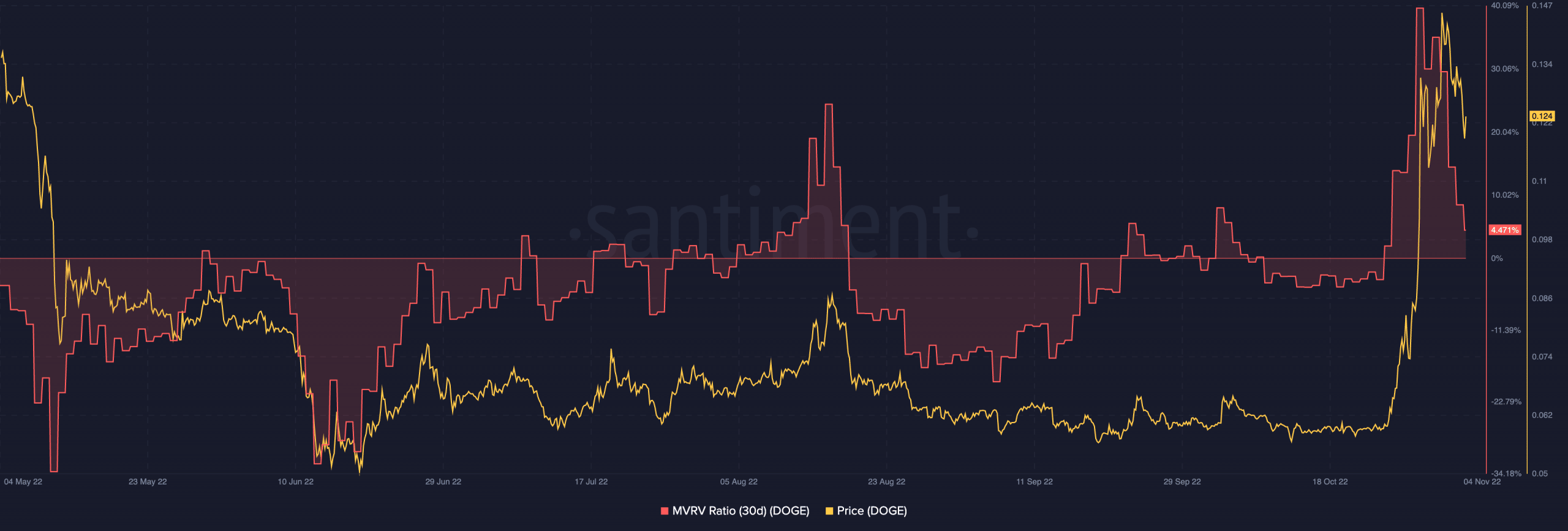

With giant transactions, traders may need anticipated DOGE to stabilize or, at worst, lower minimally. Nonetheless, these weren’t the circumstances that adopted. In actual fact, in line with Santiment, the market may need taken again the revenue recorded by traders in the course of the most-recent rally. This was because of the indications of the Market Worth to Realized Worth (MVRV) ratio.

The on-chain analytics platform confirmed that the thirty-day MVRV ratio plunged from 39.81% on 29 October to a miserly 4.47%. The development meant that current days led traders to losses slightly than income.

Moreover, DOGE short-term traders may need additionally had an affect contemplating the potential for sell-offs after making excessive positive aspects inside a brief interval.

Supply: Santiment

Contemplating this place, it’s evident that DOGE whales had little affect on what was successfully an uptick. Nonetheless, the MVRV ratio was not the one affected sufferer.

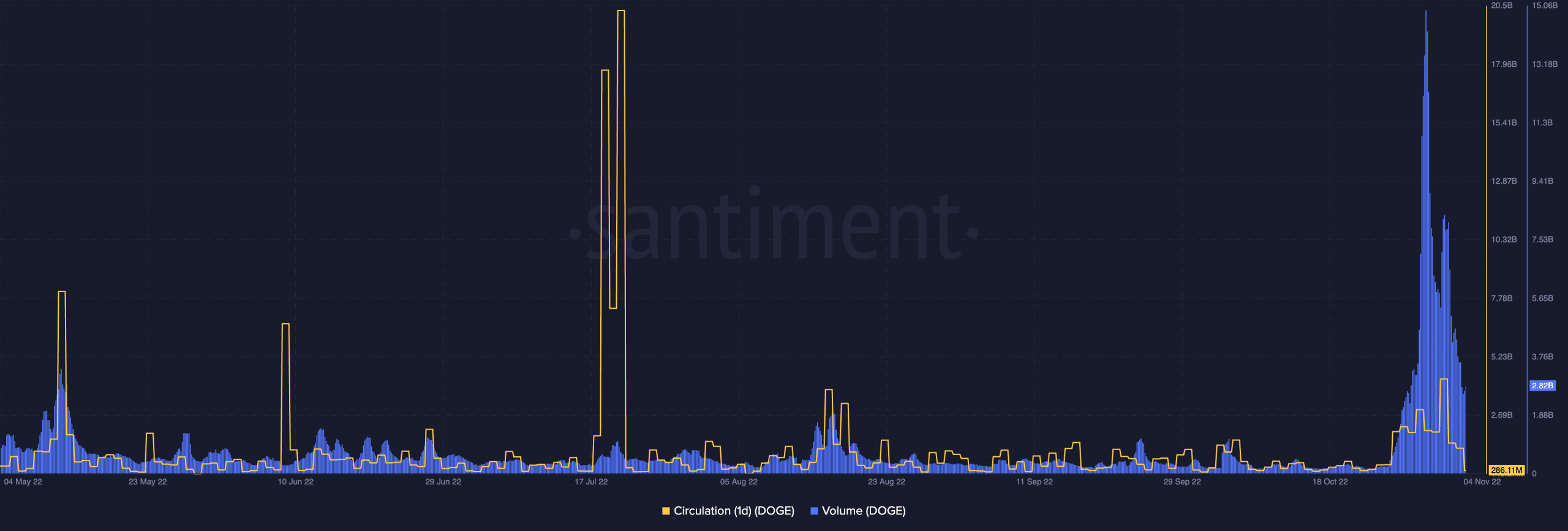

Santiment additionally revealed that DOGE was hit by a decline on different fronts too.

It’s a November fall season

On assessing the one-day circulation, Santiment disclosed that the 4.05 billion worth on 2 November dipped considerably. At press time, Dogecoin’s one-day circulation was 286.11 million. This lower implied that traders have slowed their use of Dogecoin for transactions or any exercise during the last 24 hours.

In related circumstances, DOGE’s quantity fell by 27.10%. With a worth of $2.81 billion, it grew to become manifestly clear that Twitter’s hesitation alone won’t be the only real purpose for the plunge. Therefore, the dip quantity signified that traders had an impact on Dogecoin’s mixture revenue or loss transactions.

Supply: Santiment

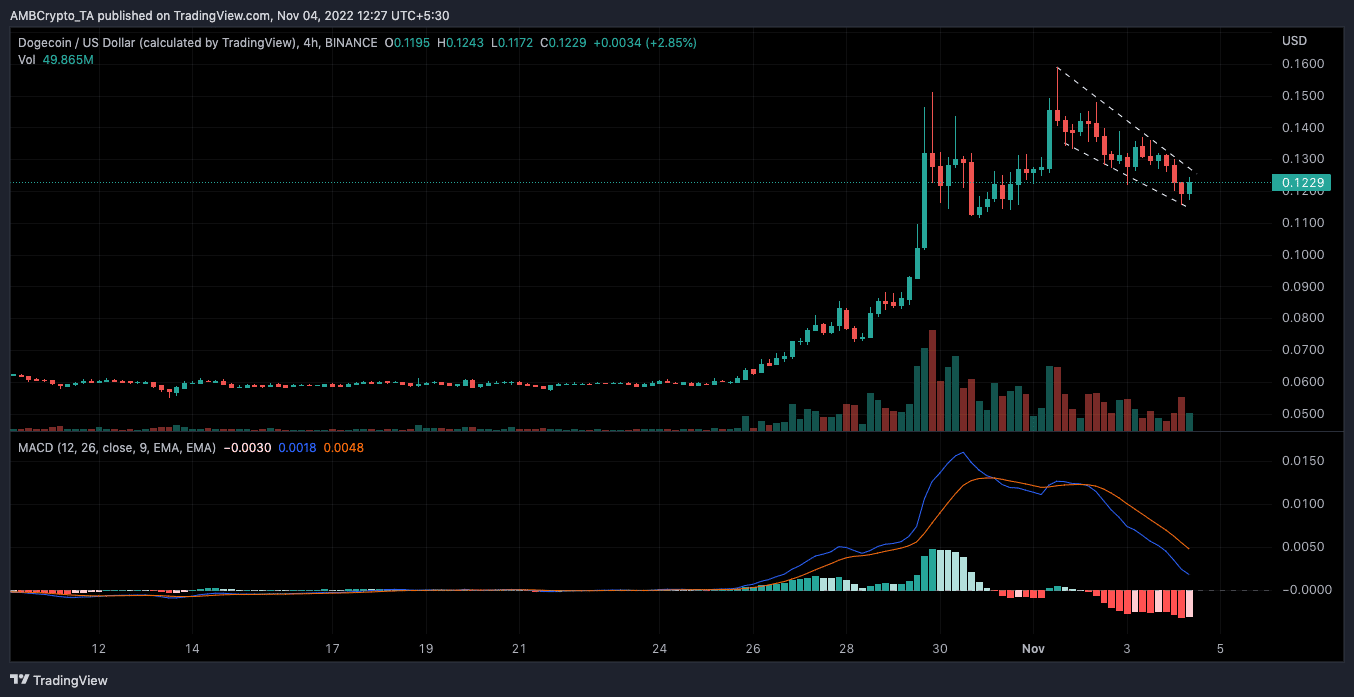

On the four-hour chart, it didn’t appear to be DOGE was close to restoration. This, as a result of the coin regularly misplaced its assist zone, falling from $0.1254 to $0.1147 at press time.

As well as, the Transferring Common Convergence Divergence (MACD) indicated that sellers (orange) have been now in command. Apart from the promoting energy, the 12 to 26 EMA remaining under the histogram midpoint nearly licensed that DOGE is perhaps bearish within the quick time period.

Supply: TradingView