Bitcoin traits greater in the previous couple of days because it approaches the mid space round its present ranges. The benchmark crypto has seen some reduction up to now days however appears unlikely to completely reclaim its earlier bullish momentum.

Associated Studying | Information: Bitcoin Lengthy-Time period Holder Provide Has Stagnated Since October Excessive

On the time of writing, Bitcoin trades at $42,500 with a 4% revenue within the final day and a 12% revenue during the last two weeks.

As NewsBTC has been reporting, Bitcoin appears to be reacting to the U.S. Federal Reserve (FED) shift in financial coverage and the armed battle between Russia and Ukraine. The monetary establishment introduced a charge hike of 25 fundamental factors (bps) for the approaching months.

This increment meets market expectations. No main announcement is predicted from the FED within the quick time period.

As for the armed battle, makes an attempt to achieve a diplomatic answer have failed, with no clear winner on the battlefield. The events appear to be at a stalemate.

This tense calm has moved to the market and the uncertainty may lead Bitcoin into additional consolidation between its present ranges, and the excessive space round $30,000.

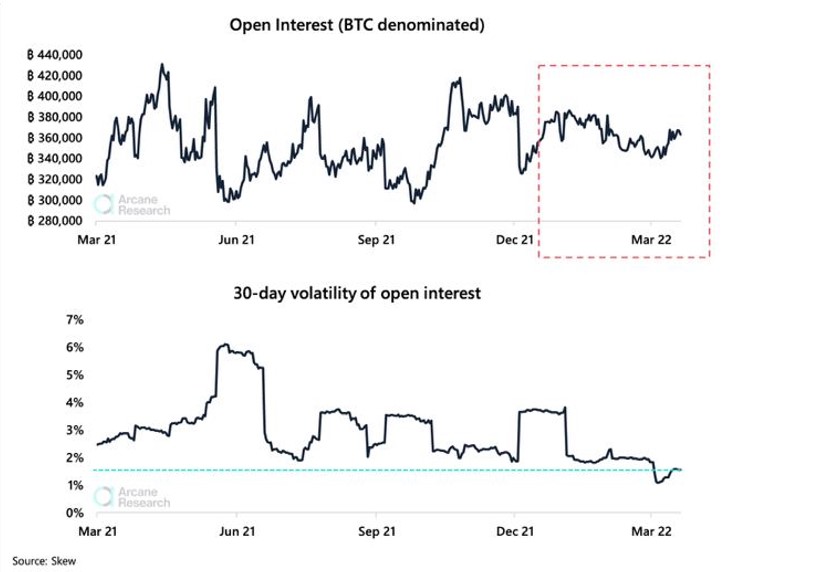

In help of this thesis, Arcane Analysis information no main actions in Open Curiosity (OI) for the BTC-based derivatives sector. This metric has remained secure at round 360,000 BTC and 380,000 BTC for the reason that begin of 2022.

As seen under, the OI for BTC futures has been transferring sideways alongside the worth of Bitcoin, because it registers a lower in volatility. In different phrases, the BTC market may very well be experiencing a interval of low exercise which suggests no essential traits in both route.

The Final Time Bitcoin Open Curiosity Hinted At Consolidation

The 30-day volatility for Bitcoin OI futures, as Arcane Analysis reported, noticed a 1% low in March, and has trended a bit greater within the final two weeks. The metric at present stands at 1.5%.

The analysis agency claims present buying and selling exercise has been decrease than throughout the same interval of consolidation in 2021. Arcane Analysis added:

General, the BTC denominated open curiosity stays comparatively lofty at 370,000 BTC. We’ve not often seen open curiosity being maintained at such ranges for such an extended length with none main squeeze setbacks akin to these skilled through the spring and fall bull markets and bitcoin’s quick squeeze in July.

Extra information offered by Santiment indicates Bitcoin’s provide on exchanges has been trending down as the worth of BTC consolidates.

In June 2021, this metric noticed a 6-month low because the market recovered from bearish value motion. As BTC’s value moved additional up, the availability adopted, however the cryptocurrency managed to attain a brand new all-time excessive close to $70,000.

Associated Studying | Ethereum Traditional Positive factors 60% In One Week, Why The Merge Might Push Its Value Larger

The chart under may very well be hinting at the same pattern as provide on exchanges decreases, and the worth consolidates.