Mining

If the previous week is any indication, efforts are ramping as much as provide mortgage capital to bitcoin miners as they cope with a troublesome enterprise local weather.

Icebreaker Finance, which introduced a $300 million lending pool for bitcoin miners final week, is concentrating on a subset of the market and in search of stability over time in energy prices.

“We do not see this pool offering some type of index publicity to the entire market,” the corporate’s CEO and founder Glyn Jones instructed The Block. “What we’re in search of is companies are going to be resilient by means of a variety of market situations.”

One other lending fund particularly geared in the direction of bitcoin miners was introduced this week, coming at a time when the trade is fighting slimmer working margins. The primary $50 million funding comes from none aside from bitcoin mining agency Bitdeer. Bitdeer chairman Jihan Wu is searching for to lift an extra $200 million from outdoors buyers.

“The fund measurement is 250M and the returns will depend upon the hashrate worth when the market recovers within the subsequent bull run,” stated Matt Linghui Kong, the CEO of Bitdeer Group. “Curiosity is predicted from establishments which can be open to alternatives in mining and driving the market cycle, however do not have direct entry or operational experience, for e.g. various funding funds, household places of work and enterprise capital.”

Icebreaker’s Jones referred to miners that may nonetheless handle to generate sufficient money circulate in a market with suppressed bitcoin pricing and elevated hash charges. Manufacturing prices — power particularly — stick out as an necessary issue and miners with long-term energy contracts at a set price can provide extra safety for the time period of the mortgage.

“The market’s essentially modified,” Jones stated. “If I am going again six months in the past, there have been quite a lot of lenders within the house. Market pricing was I feel extraordinarily aggressive (…) Probably not reflecting the dangers being embodied.”

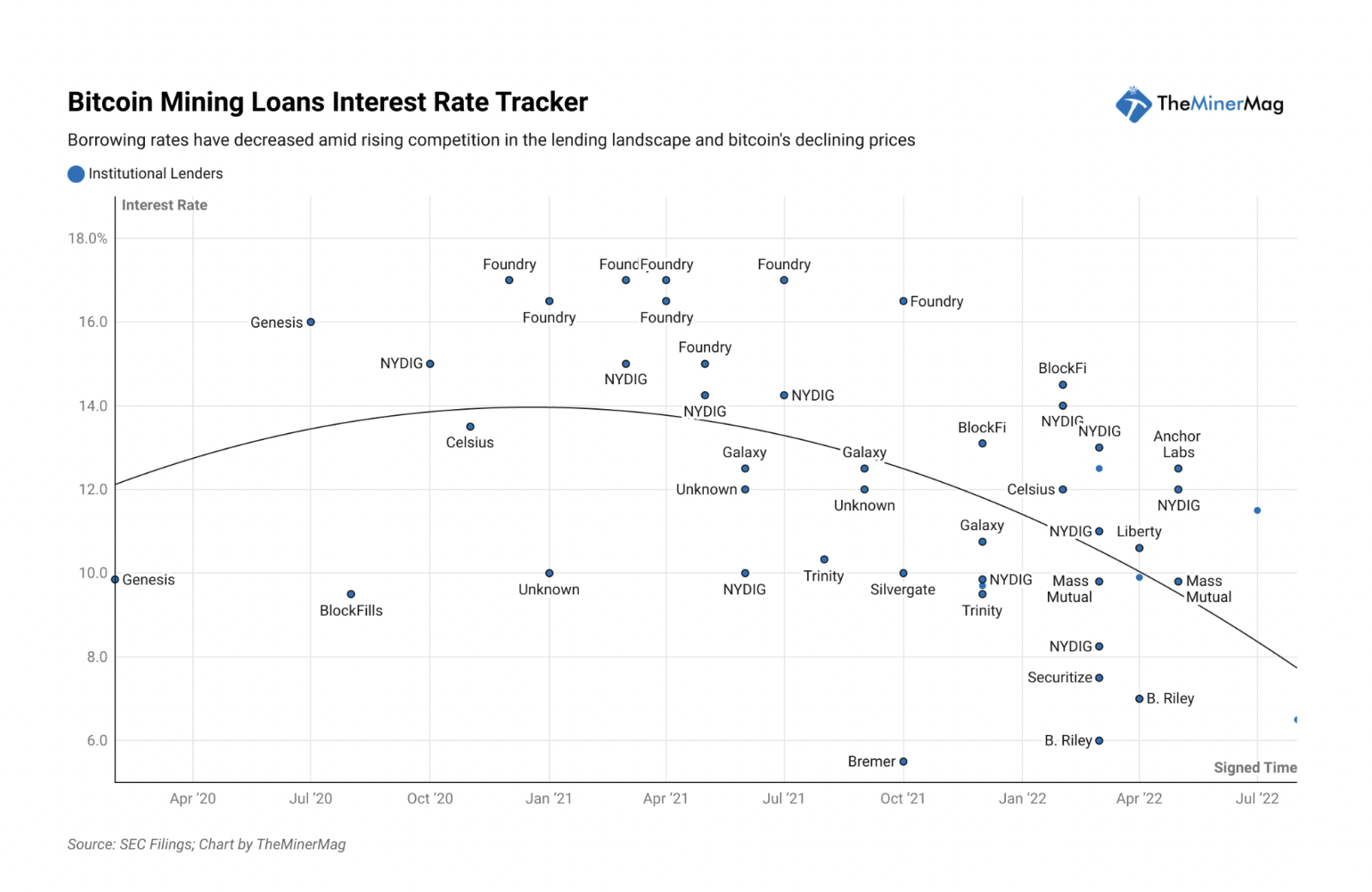

The charges that Icebreaker Finance is now providing (15% to twenty%, with 12 to 18 months maturity) are on the upper finish at the very least in comparison with different loans seen this yr from public miners — for instance, Iris Power in March (11% rate of interest from NYDIG), Argo Blockchain in Might (12% from NYDIG), Bitfarms in June (12% from Galaxy Digital), Marathon in July (with a variable rate of interest then priced at 7.25% from Silvergate Financial institution). Bitdeer didn’t disclose extra particulars about the way it will construction offers.

But rates of interest for public miners have usually trended downward since January 2020, based on information compiled by public relations agency BlocksBridge in its Miner Weekly publication. It additionally factors out that different variables included within the mortgage phrases ought to be considered.

“Many of the loans we analyzed had a maturity time period starting from 24 to 36 months whereas a number of had been short-term bridge notes, lasting from 1 to six months,” the publication stated. “A number of the loans additionally included particular covenants on a borrower’s monetary well being like protection ratios, which supplied extra shade on how TradFi organizations consider mining firms.”

Icebreaker’s rates of interest mirror present market situations, the place the hashrate is reaching report highs whereas the coin is down 70% from its report worth, stated Strahinja Savic, head of information and analytics at FRNT Monetary.

“The potential of bitcoin shifting decrease signifies that lenders within the mining house are being extraordinarily cautious. There’s loads of danger proper now,” Savic stated.

Savic went on to spotlight a “solvency disaster” within the crypto house, which latest authorized strikes within the sector exhibit.

Bitcoin mining internet hosting supplier Compute North filed for Chapter 11 chapter final week. Compute North’s CFO stated in a corresponding courtroom submitting that the agency “has been unable to take care of enough liquidity to convey deliberate initiatives in improvement on-line and pay all of its obligations on a present foundation.”

The agency has between $100 million-$500 million each in estimated liabilities and estimated property, based on the submitting. It’s going through at the very least one lawsuit from one among its collectors, NBTC Restricted.

Miners deleveraging

The trade noticed a number of the greatest public miners promote massive parts of their bitcoin holdings, particularly in June, because the cryptocurrency plunged, placing stress on bitcoin-backed loans.

A few of these firms had traditionally maintained a coverage of holding on to the bitcoin they mined. But Bitfarms bought 3,000 BTC in June to pay down a $100 million bitcoin-backed mortgage from Galaxy, whereas Argo bought 637 BTC and CleanSpark 328 BTC.

“The corporate made the strategic choice to derisk the legal responsibility of the bitcoin-backed mortgage and cut back our publicity,” stated Argo CEO Peter Wall in the course of the firm’s second-quarter earnings name. “We didn’t wish to get right into a place the place we needed to liquidate our bitcoin at very low costs.”

Regardless, Argo continues to be “properly positioned to have the ability to entry the debt markets,” CFO Alex Appleton stated, including that the corporate has modified its debt profile. It just lately began energization at its flagship web site in Texas, after securing hundreds of thousands in financing for the growth over the previous yr. “You may’t use your machines as collateral till you even have them in your possession. You may’t use infrastructure till you’ve gotten it constructed,” he stated.

At the same time as miners had been deleveraging earlier in the summertime, Marathon — which has kept away from promoting its bitcoin — closed a brand new $100 million time period mortgage with Silvergate Financial institution in July and refinanced an current $100 million revolving line of credit score.