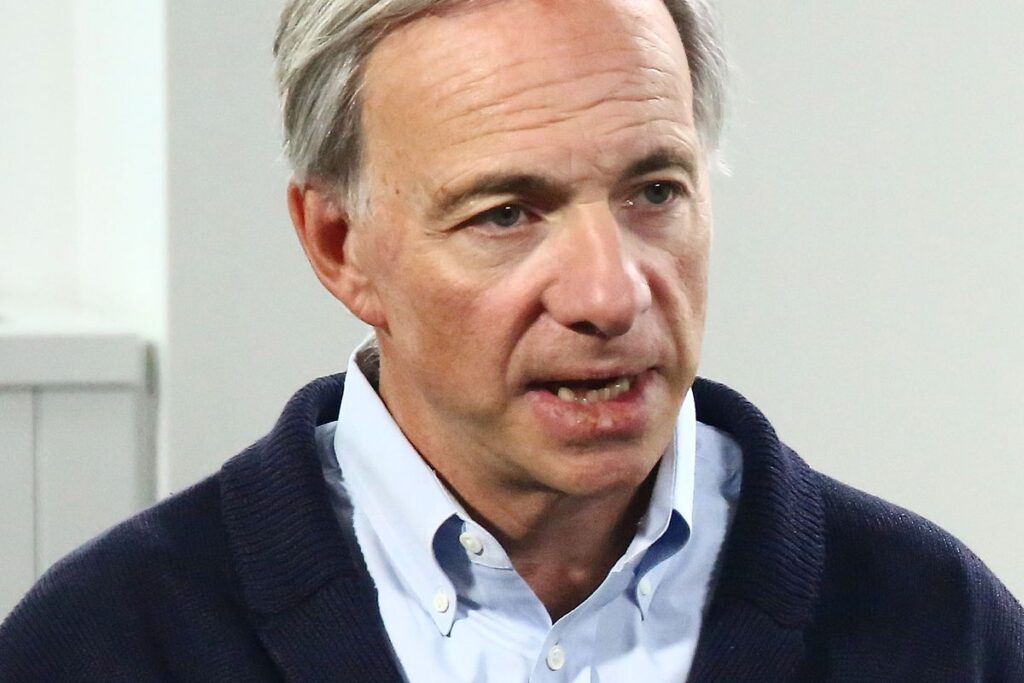

Billionaire Ray Dalio, the CEO of $150 billion hedge fund, has just lately made it identified that he nonetheless has a bullish stance on Bitcoin. In a current interview with CNBC, Dalio maintains that fiat continues to be very inferior.

Ray Dalio Nonetheless huge on Bitcoin and bearish on fiat

Ray Dalio reiterated his positioned on Bitcoin whereas talking to CNBC’s “I believe that cryptocurrencies specifically, let’s name it a digital gold. I believe a digital gold [would be a Bitcoin type of thing] has a bit of spot relative to gold.”

He added that the economical local weather is altering in such a manner that the query about what new cash is, will come up. He proceeded to elucidate why fiat is not going to rise with the tide, explaining that its utilization for items and providers will deplete with time.

His sentiments recommend, like many different cryptocurrency proponents have identified prior to now, that the traits of fiat currencies aren’t sustainable for the long run, within the method that cryptocurrencies are.

Excerpt of the interview reads ;

“After I say money is trash, what I imply is that each one currencies, in relationship to the Euro and in relationship to the Yen, all of these like within the Nineteen Thirties, might be currencies that may go down, in relationship to items and providers.”

He predicts that shifting cash inside international locations with ease, together with currencies being a major retailer of worth are necessities that any surviving foreign money might be required to own.

Ray Dalio has at all times been bullish on Bitcoin

The billionaire’s convictions on Bitcoin have dated to way back to Might of 2021. The billionaire revealed that he owned some Bitcoin and later admitted that regardless of proudly owning it, the cryptocurrency was too unstable.

Again in March of 2022, Coindesk reported that the billionaire was stated to have reportedly been investing a minuscule quantity in a cryptocurrency fund. The case of Ray Dalio is one just like that of many, who had been beforehand Bitcoin skeptics, however ultimately turned a Bitcoin pioneer.

The offered content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.