intermediate

Decentralized finance, or DeFi, is undoubtedly one of the progressive functions of crypto and blockchain expertise. It’s extremely in style, too — on the time of writing, there have been over 40 billion {dollars} locked in numerous DeFi protocols. Yield farming, which we will likely be discussing on this article, has been a serious contributor to this business’s success.

How Does Yield Farming Work?

Yield farmers don’t until any land — as a substitute, you possibly can think about them as agricultural magnates who hire out fields and look ahead to the crops to develop in demand and thus turn out to be extra worthwhile. In a means, yield farming will be seen as another funding: shopping for property and ready for his or her worth to develop whereas additionally incomes some curiosity alongside the best way.

Nevertheless, in contrast to conventional financial institution deposits, yield farming operates utilizing sensible contract expertise. To place it merely, yield farming is a option to earn a passive revenue out of your cryptocurrency funds. It entails crypto buyers placing their tokens and cash in decentralized functions, or dApps. These apps will be crypto wallets, decentralized exchanges (DEXs), and extra.

The buyers who deposit their funds — stake them or lock them up — are known as liquidity suppliers. They’re incentivized by issues like the proportion of transaction charges, curiosity, or revenue in governance tokens. All of their potential returns are expressed with the APY metric — the annual share yield.

The extra liquidity suppliers a liquidity pool (a spot that yield farmers lock their property in) has, the less rewards every investor receives.

Yield Farming vs. Staking

Yield farming could seem very comparable at first look — and, actually, staking could be a type of yield farming. The 2 should not fully the identical, nevertheless. Basically, staking is much more beginner-friendly than yield farming. Listed below are a number of the different key variations between the 2.

Staking is often used with proof-of-stake cryptocurrencies, whereas yield farming requires automated market makers (AMMs).

Yield farming is much more unstable than staking: with the latter, you all the time know the way a lot you’ll get. Your rewards from yield farming, however, will rely in your chosen liquidity pool and the property you’ve invested in.

As yield farming is usually extra rewarding than staking, it’s naturally riskier, too. In spite of everything, your rewards will rely on how nicely the property you’ve locked up will carry out.

Staking requires you solely to earn curiosity on one token, whereas yield farming allows you to lock up buying and selling pairs. Moreover, yield farming sometimes doesn’t have a minimal lock-up interval — in contrast to staking, which frequently doesn’t enable buyers to withdraw their funds proper after they’ve staked them.

Please observe that yield farmers should deposit an equal quantity of each cash/tokens within the buying and selling pair they’re locking up.

Wanna see extra content material like this? Subscribe to Changelly’s publication to get weekly crypto information round-ups, worth predictions, and data on the most recent tendencies immediately in your inbox!

Keep on prime of crypto tendencies

Subscribe to our publication to get the most recent crypto information in your inbox

Yield Farming Metrics

Once you begin researching DeFi protocols, you may run into abbreviations that you simply don’t acknowledge. Listed below are the highest 3 most typical ones.

Whole Worth Locked (TVL)

TVL, or the whole worth locked, is the whole quantity of cryptocurrency locked in a selected protocol. Often expressed in USD, it’s primarily the quantity of customers’ funds at present deposited on the DeFi platform.

Annual Share Yield (APY)

APY, or the annual share yield, is the estimated price of return that may be gained over a interval of 1 yr on a particular funding.

Annual Share Price (APR)

APR, or the annual share price, is the projected price of return on a selected funding over a interval of 1 yr. In contrast to APY, it doesn’t embrace compound curiosity.

Compounding is the act of reinvesting your features to get larger returns.

Kinds of Yield Farming

There are a number of methods in which you’ll be able to have interaction in yield farming.

1. Liquidity supplier

Liquidity suppliers are customers that deposit two cryptocurrencies to a DEX to offer liquidity. At any time when any individual exchanges these two tokens or cash on a decentralized change, the liquidity supplier will get a small lower of the transaction charge.

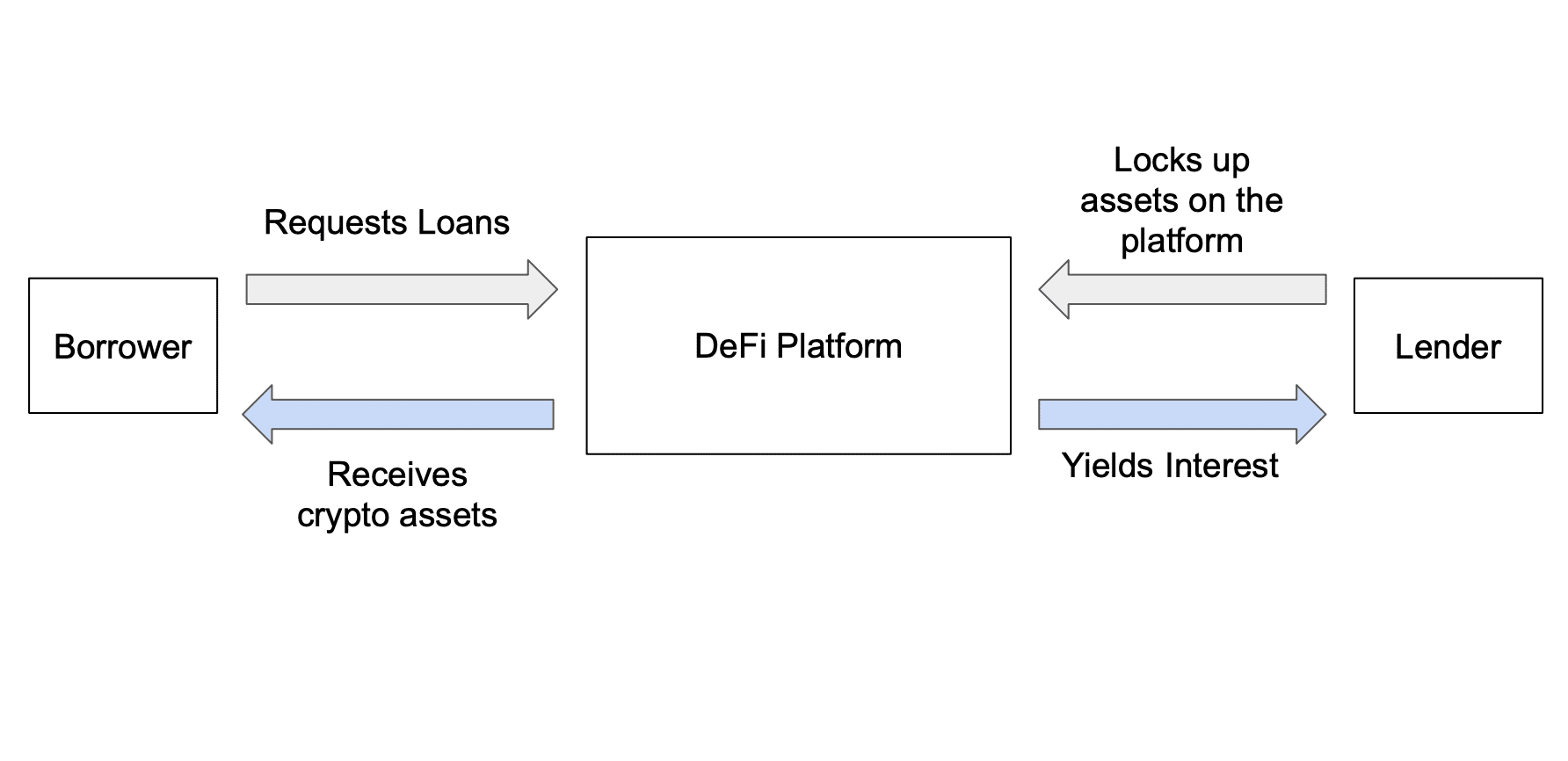

2. Lending

Buyers can lend their tokens and cash to debtors utilizing sensible contracts. This permits them to earn yield from the curiosity that debtors pay on their loans.

3. Borrowing

Buyers can lock up their funds as collateral and take a mortgage on one other token. This borrowed token can then be used to farm yield.

4. Staking

Staking in DeFi is available in two flavors: staking on proof-of-stake blockchains that we now have already talked about above and staking the tokens you earned by depositing funds to a liquidity pull. The latter permits buyers to earn yield twice.

How one can Calculate Yield Farming Returns

The very first thing it’s essential learn about yield farming returns is that they’re normally annualized: this implies they’re calculated for a one-year interval.

Yield returns are sometimes measured utilizing the APR (annual share price) and the APY (annual share yield). Please observe that, in contrast to the latter, the previous doesn’t account for compound curiosity.

The APR method is pretty easy:

APR = (Annual Return / Funding) * 100%

The APY is slightly more durable to calculate. To start with, you will want to know the way usually your curiosity will likely be compounded — how usually your returns will likely be reinvested into the liquidity pool.

Right here’s the method for it:

APY = Invested Quantity * {(1 + Price / Variety of Compounding Durations) ^ Variety of Compounding Durations – 1}

Please observe that normally, you gained’t have to make use of the method your self as a result of most platforms these days robotically calculate projected returns for you.

Yield Farming Protocols

There are numerous yield farming protocols on the market. Though going for the most well-liked ones is normally the most effective concept for newcomers, a few of them could not go well with you as an investor.

Here’s a quick overview of a number of the greatest yield farming platforms.

MakerDAO

MakerDAO is among the hottest yield farming protocols: on the time of writing this text, it had the biggest quantity of worth locked in it worldwide. Like many different comparable protocols, it was constructed on Ethereum.

Maker (as it’s also known as) permits anybody to generate debt in DAI (its token) towards collateral akin to ETH or BAT. DAI you borrow incurs an curiosity paid to the investor once they repay the mortgage.

PancakeSwap

PancakeSwap is among the greatest decentralized exchanges within the business. Constructed on the Binance Good Chain, it’s used for swapping BEP-20 tokens. PancakeSwap makes use of the AMM mannequin.

This protocol focuses on the gamification facet of crypto and blockchain and closely invests in lotteries, workforce battles, and NFTs.

Curve Finance

Curve Finance is a decentralized change that lets customers swap stablecoins making the most of low charges, low slippage, and truthful charges. Constructed on the Ethereum blockchain, Curve Finance makes use of its personal distinctive market-making algorithm.

As this protocol principally has stablecoin swimming pools, it typically has decrease APY than different platforms on this checklist. Nevertheless, it is also so much safer, as there may be much less likelihood that it could actually lose its peg.

Compound

Compound, an algorithmic cash market protocol, focuses on enabling customers to borrow and lend digital property towards collateral. Aside from letting buyers earn adjusted compound rates of interest, it additionally gives them a chance to earn its governance token, COMP.

Compound’s charges are adjusted robotically based mostly on provide and demand. It has numerous markets, together with however not restricted to USDC, ETH, and BAT.

Aave

Aave is an open-source non-custodial lending and borrowing protocol constructed on the Ethereum blockchain. The yield customers can earn on any crypto property they provide to the platform is adjusted robotically and algorithmically and relies on provide and demand.

Aave helps so-called “flash loans” — borrowing and repaying an asset inside one-block time. The protocol has a governance token, AAVE. You should purchase it on Changelly, similar to many different tokens launched by protocols on this checklist — for instance, UNI and COMP.

Uniswap

Uniswap is among the world’s most well-known decentralized exchanges and AMMs. Its fame is partially as a result of its mascot, a white-and-pink unicorn, and partially as a result of its reliability as an change for ERC-20 tokens and Ethereum itself.

On Uniswap, any person can create a liquidity pool for a buying and selling pair made up of ETH and one of many ERC-20 tokens. The pool creator can then set the change price, which will likely be adjusted by the protocol’s signature fixed product market maker mechanism. When the liquidity of 1 aspect of the buying and selling pair reduces in relation to the opposite, the worth adjustments. This generates extra buying and selling alternatives for buyers.

Yield Farming Dangers

Like another funding enterprise that may carry you 1,000% earnings, yield farming is extremely dangerous.

Along with being reliant on cryptocurrency costs, yield farming additionally has a couple of different dangers related to it. One of many greatest ones for newcomers is the inherent complexity yield farming has: it’s not one thing you can soar into unprepared. Any such passive revenue has a excessive entry barrier each by way of normal data and understanding of how yield farming platforms work.

Fortunately, a lack of understanding is among the best issues to unravel. Different dangers, nevertheless, aren’t as simple to mitigate: a few of them will stay, regardless of how good your technique is. Nonetheless, there are undoubtedly methods to reduce the probabilities of them inflicting you to lose your funds.

Rug Pulls

A rug pull occurs if the event workforce of a cryptocurrency challenge decides to desert their challenge out of the blue and sells/removes its liquidity. This threat is particularly widespread in DeFi initiatives, that are simpler to create and should not regulated.

If the rug pull occurs and liquidity dries up, all buyers who deposited their funds to the challenge will likely be unable to promote their tokens at a good worth — or in any respect.

To keep away from rug pulls, take note of the workforce behind the protocol: are they overhyping their challenge on social media regardless of it not being lively or in style for that lengthy? Have they got a very good popularity and historical past? Are the challenge’s tokenomics, roadmap, and so forth sound and clear?

DYOR and completely study each challenge you’re planning to spend money on to reduce the danger of dropping your funds to a rug pull.

Good Contract Points

Though sensible contracts are a comparatively dependable expertise, hacks are nonetheless extremely widespread. As they’re the inspiration of all yield farming, it is just pure that any points with them put yield farmers’ investments in danger.

This isn’t one thing that may be mitigated since even investing in essentially the most dependable and mainstream liquidity swimming pools could not prevent from potential sensible contract hacks. Nevertheless, researching any platform earlier than working with it’s nonetheless a good suggestion that may prevent from potential theft. And in the event you can’t choose how good their safety is your self, you possibly can learn critiques on-line.

Regulatory Danger

This type of threat is a bit bizarre. On the one hand, the crypto business as an entire and DeFi, particularly, are so-called grey zones: they don’t seem to be regulated that strictly but, however governments are actually maintaining a tally of them and eager about the right way to maintain the market in verify.

Nevertheless, decentralized finance was constructed to face up to regulation stress and authorities management, so it shouldn’t be closely affected by new legal guidelines and laws.

FAQ

What’s the greatest cryptocurrency to yield farm?

Yield farming entails investing in liquidity swimming pools that include buying and selling pairs, not particular person crypto tokens or cash. One of the best digital asset to farm will all the time be the one which fits your yield farming technique.

The place can I yield farm crypto?

The preferred yield farming platforms embrace PancakeSwap, Uniswap, Curve Finance, Maker DAO, and extra.

Is yield farming nonetheless worthwhile?

Yield farming can nonetheless be worthwhile so long as you handle your investments and the danger nicely.

Disclaimer: Please observe that the contents of this text should not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.