One of many largest modifications to the crypto market in the present day in comparison with the final bear market is the various kinds of property that exist.

As a substitute of selecting between Sprint, Litecoin, Ethereum, Bitcoin, and many others., folks can spend money on NFTs and plots of digital land within the metaverse.

Frequent sense signifies that these new, experimental property are riskier in comparison with BTC and ETH. Whereas it’s troublesome to objectively measure danger, we are able to use on-chain information to evaluate value volatility.

With the bear market totally underway, now’s the right time to check these property and see what the final word blue-chip property may very well be going ahead: Crypto, NFTs, or metaverse land.

Right here, we’ll examine three hypothetical traders: Abe, Bob and Cathy. One yr in the past, every put their cash into a special asset class throughout the crypto area.

Abe’s portfolio: 50% BTC & 50% ETH.

Bob’s portfolio: 50% BAYC & 50% CryptoPunks.

Cathy’s portfolio: 50% Decentraland Land & 50% Sandbox parcels.

These comparisons arent’s 1-to-1 (shopping for 3 Bored Apes at $6,000 each yr in the past is a really totally different transfer than investing $6,000 in a longstanding “secure” token like ETH.) So, we’ve created 3 “cheap” portfolios alongside these 50/50 strains that aren’t precisely the identical. To be defined later.

On this article, we’ll monitor how every of those traders’ portfolio’s carried out and discover why a few of these investments are extra risky than others.

Abe’s Token Portfolio

One of many upsides of investing in tokens as a substitute of NFTs is liquidity and divisibility. We’re capable of put a exact USD greenback worth on BTC and ETH on any given day, purchase any quantity we would like, and obtain a good market charge.

On this present day a yr in the past, June 28, 2021, BTC value $35,867. For ease of calculation, we’ll spherical this to the closest hundred—$35,900. ETH was $2,160—rounded to $2,200.

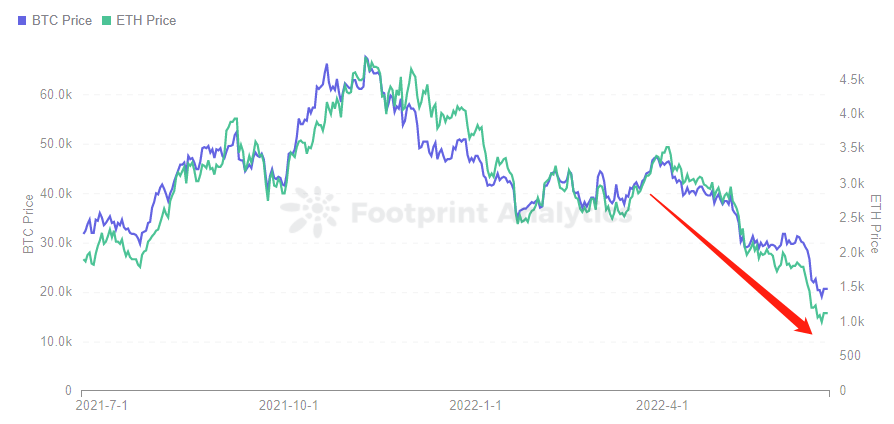

Our token investor selected a superb time to leap in. After the passion of the Coinbase itemizing on April 13, 2021, and the Federal Reserve dropping rates of interest to 0.25% to stimulate the financial system, the market roared. Nevertheless, it was quickly despatched crashing primarily on account of a wave of strict rules in China, and it was roughly right here when Abe aped in.

In hindsight, Abe purchased the underside of the cycle, placing $50,000 into BTC and $50,000 into ETH (getting about 1.39 BTC and 22.7 ETH.)

The insane climb upward continued till November 8, 2021, when Abe’s preliminary funding was price $203,767.52.

However then, speculative enthusiasm for cryptocurrencies began waning as retail and traders reduce on dangerous property.

From January to June, the Federal Reserve raised rates of interest by 75 foundation factors in fast succession, the biggest margin in 28 years.

In February, the battle in Ukraine triggered a downturn in macroeconomic situations, leading to a bearish setting for the crypto market.

To high it off, the flash crash of Terra Luna in Could regarded like the start of a sequence of blockchain business automotive wrecks.

All these occasions have pushed down the value of BTC and ETH—property which, to the overwhelming majority of the non-crypto public, are stand-ins for the “value of crypto” itself.

On June 28, 2022, Abe’s 1.39 BTC and 22.7 ETH portfolio was price $54,197.7, down 45.8%. The drop from the all-time excessive was 73.4%.

The NFT Portfolio

Though NFTs are usually not as liquidity as BTC or ETH, they’re distinctive and collectible. And when the market is in a greater state, holders may also get a particular greenback worth from it.

What did the NFT market appear to be in June 2021?

- Germination and building interval:

In June 2017, CrytoPunks, the world’s first NFT challenge, was formally born, bringing the NFT idea to a climax. Led by OpenSea, NFT buying and selling has grow to be extra handy and ideal, making NFT software areas steadily broaden from video games and artworks.

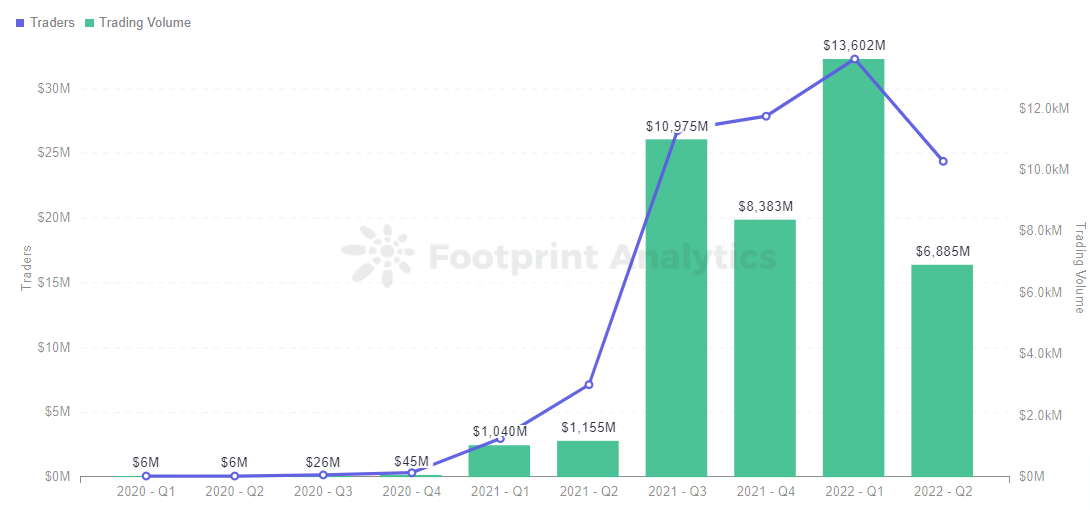

By 2021, Axie Infinity gross sales have been rising quickly, driving the expansion of the NFT market. The identical yr, BAYC was additionally established and entered the general public eye.

That is the right time for Bob to enter the market when NFTs are of their infancy. As a result of NFT abides by a rule, the earlier its attributes are rarer, the upper the worth and the decrease the value is extra balanced (the NFT buying and selling market is immature, and the transaction frequency is low).

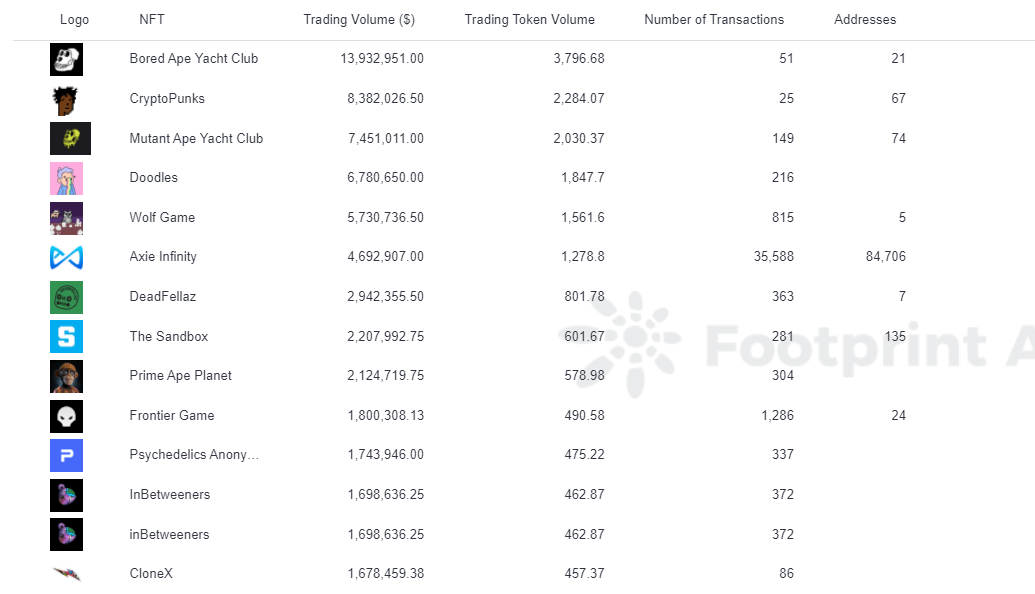

BAYC and CryptoPunks rank among the many high NFTs when it comes to trading volume in 2021.

Assuming Bob buys 1 BAYC (3.5713 ETH) and 1 CryptoPunk (28.9191 ETH) on June 28, 2021, at a median value, his preliminary funding is price $71,478.88 at the moment.

In 2021, world financial improvement was severely impacted by the epidemic, and monetary easing in main economies introduced inflation and forex devaluation, driving customers to crypto markets reminiscent of art work, NFT, and BTC. buying and selling exercise within the NFT market continued to extend from August to March 2021.

If Bob had adopted ETH and bought it at its peak on November 8 (ETH at $4,826.25), when the typical costs of BAYC and CryptoPunk have been 43.8835 ETH and 98.5848 ETH, respectively, his portfolio would have been price $687,587.63, a rise of 861.95%.

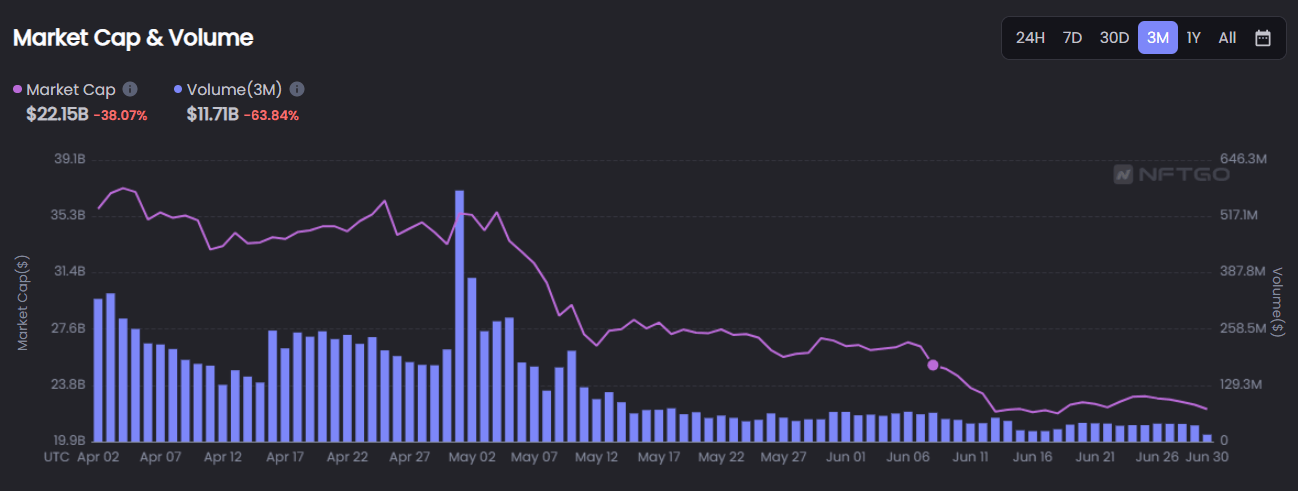

The Crypto market crash led to a decline in investor curiosity in NFT, considerably impacting its total buying and selling quantity and market cap decline. Over the previous 90 days, complete buying and selling quantity has fallen by 63.84% and complete market capitalization by 38.07%.

As of June 28, 2022, ETH is buying and selling at $1,144, BAYC at 113.5035 ETH, and CryptoPunk at 77.6991 ETH. Bob’s portfolio is price $218,735.77, up 206.01% year-over-year. It’s down 68.19% from its all-time excessive.

Clearly, blue-chip NFTs, as of the start of summer time 2022, aren’t as risky as many individuals assume in comparison with the so-called “secure” crypto investments BTC and ETH.

*Since investing half your portfolio into BAYC NFTs would have been fairly insane in June 2021, we’re taking a special strategy to 50/50 on this portfolio. Bob purchased 1 Punk and 1 Ape.

The Land Portfolio

By being within the metaverse in June 2021, Cathy may be thought of an early adopter. At the moment, the phrase “metaverse” had not but grow to be a family identify.

Fb’s rebranding to Meta was nonetheless 4 months away.

Was the metaverse some new model of Second Life? Did you want a VR headset to entry it? Nearly no person who wasn’t deep within the crypto rapithole already knew.

However the rumblings have been there. On June 4, Sotheby’s opened a digital gallery in Decentraland, and the sport made waves as the primary to interrupt 1 million in a metaverse land sale.

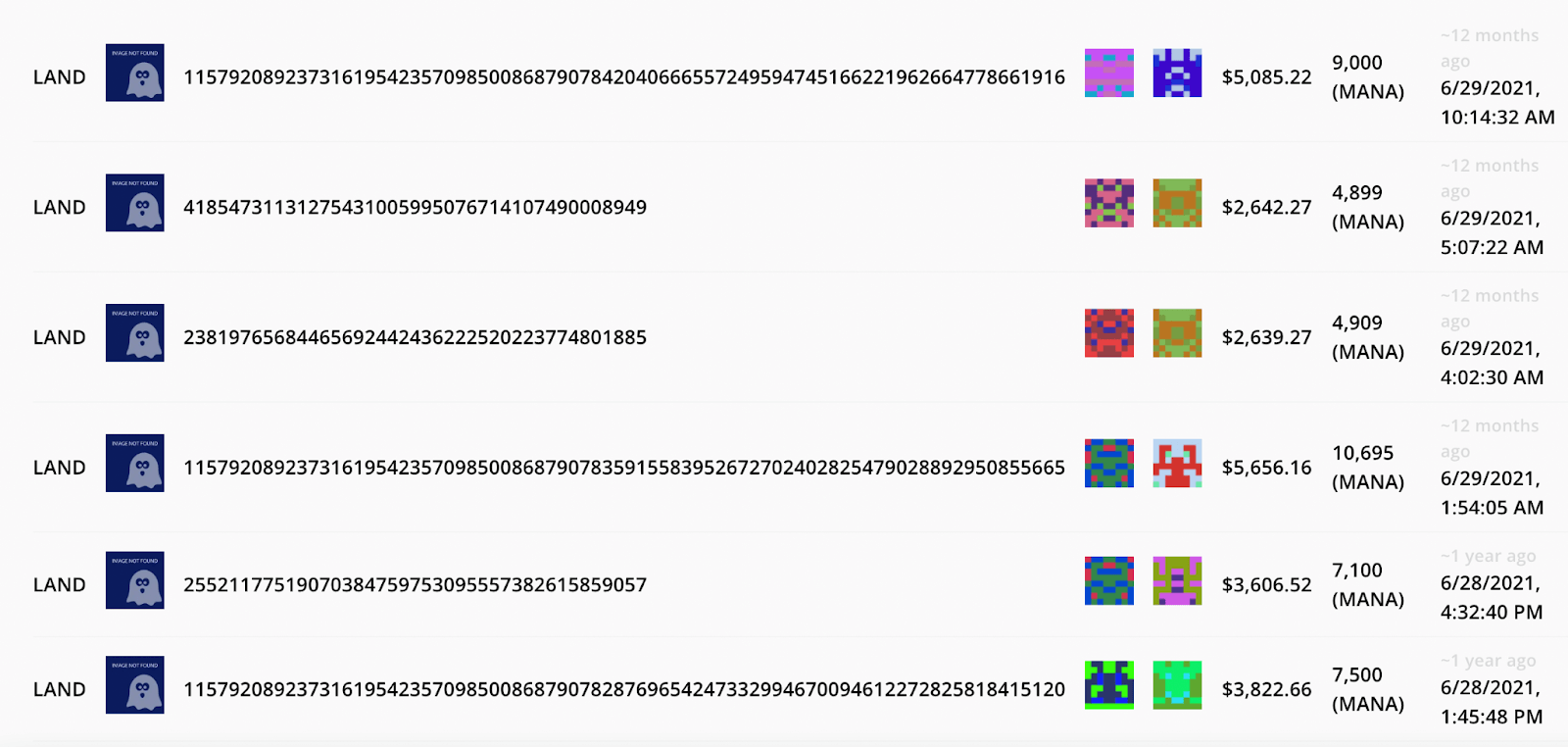

On June 28, 2021, Cathy turned a metaverse landlord. Her buy was certainly one of 37 NFT gross sales in Decentraland, which generated $148,500 in complete.

As a result of all of the transactions on the blockchain are on a public ledger, we are able to truly see and analyze all of the LAND bought on this date.

The common sale value on June 28 was about $4,000, which looks like an inexpensive evaluation taking a look at these gross sales. (I.e., if there have been a single sale at an astronomical value, it will make the typical a foul yardstick for the way a lot Cathy might have paid.)

So, dipping her toes into the metaverse, Cathy purchased one plot of land for $4,000—maybe this one:

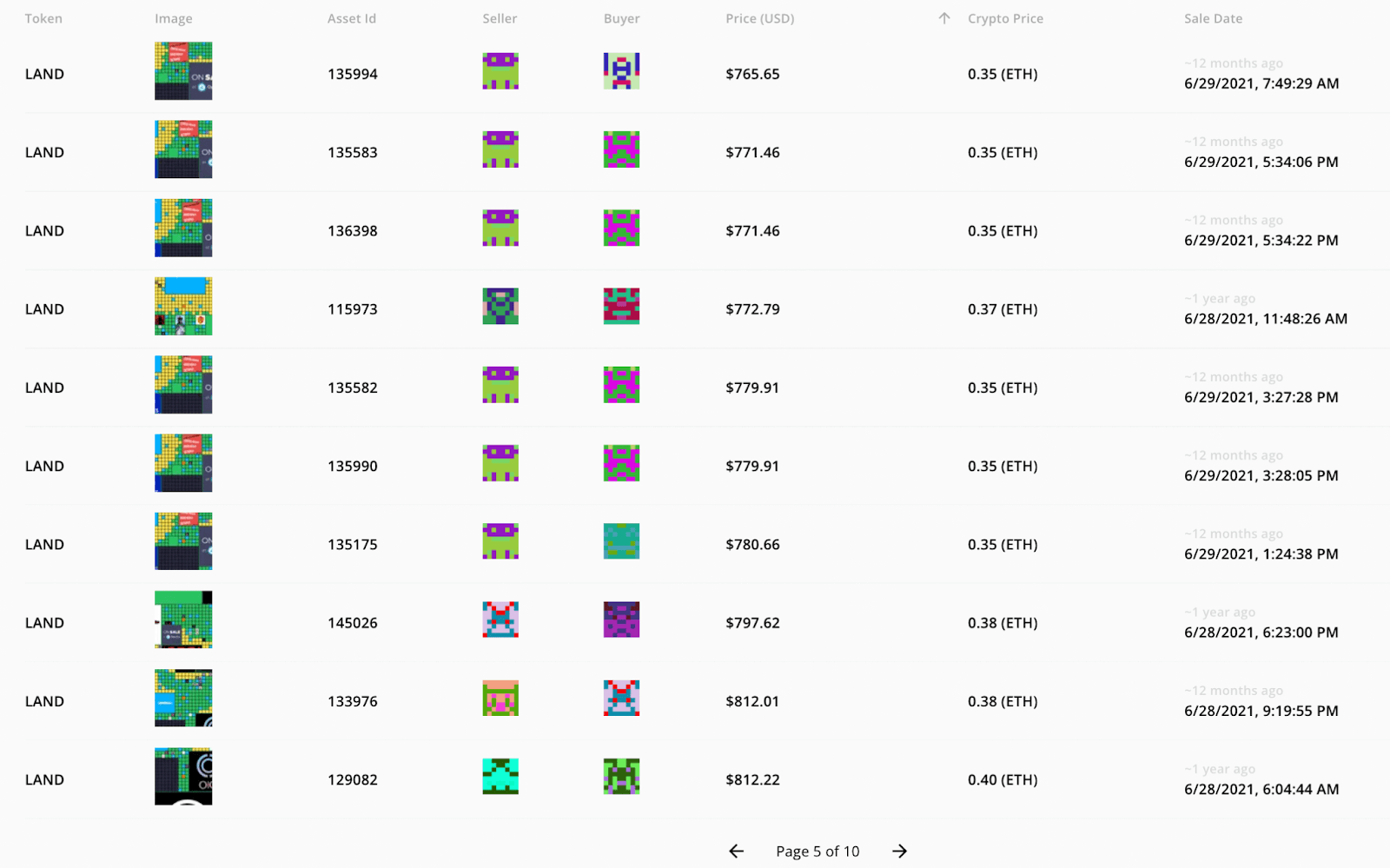

She additionally added a parcel in The Sandbox. At the moment, the search time period “Sandbox” hardly delivered to thoughts the metaverse title that may take over information headlines in just some months for the 3842% soar in its token value.

On June 28, 46 NFTs have been bought, bringing in $43,500, a median value of $945. It is a few hundred greater than the median value for the day however remains to be correct sufficient to do a common evaluation.

So, to take care of an almost 50/50 allocation within the two biggest-name merchandise within the asset class, Cathy purchased one plot of Decentraland land at $4,000 and 4 Sandbox lands at $945 every—a complete metaverse land portfolio of $7,780.

Her judgment would show visionary. By November 8, 2021, when ETH BTC peaked, the typical sale value in Decentraland elevated by 3.0469 ETH to $14,705. The common value of The Sandbox land skyrocketed to $6,096, a 734.62% % improve.

If we’re simply going by averages, her 1 Decentraland plot and 4 Sandbox parcels can be price $39,089.

If we as a substitute take a look at the actual asset proven above that value slightly below $4,000 on June 28, 2021, then it elevated by $59,135. It flipped palms for $55,313 on November 15, 2021, the closest sale to the ETH peak.

Over the following yr, the costs of metaverse land declined sharply as the quantity in Decentraland and The Sandbox decreased to ATLs by 76.81% and 79.03% respectively.

On June 28, 2022, Cathy’s portfolio was down by $14,811 from ATH (-62%). A giant hit, however nonetheless method up from her authentic funding. Metaverse land is clearly extraordinarily risky and might nonetheless be referred to as a Hail Mary play slightly than a secure blue-chip.

Abstract

Whereas the bull market noticed monumental positive aspects for NFTs and metaverse land, the on-chain information for high tasks signifies that costs are usually not as risky as many individuals imagine relative to “secure” property like BTC and ETH.

On this article, we created three hypothetical portfolios and located that the secure crypto wager had a steeper fall from ATH (as of June 28) than investments into NFTs and metaverse land. The positive aspects over the bull market would have additionally been considerably greater for the latter two “riskier” property.

Whereas there are a number of doable explanations for this (e.g., tougher for establishments to push down the costs of NFTs and land), this information helps the concept thesis that the highest NFTs and metaverse land tasks have carried out exceptionally nicely by the whole thing of the final yr—booms, busts, crashes and all.

Date & Creator: July 7, 2022, Vincy

Knowledge Supply: Footprint Analytics – BTC & ETH Trend Analysis

This piece is contributed by the Footprint Analytics group.

The Footprint Neighborhood is a spot the place information and crypto fanatics worldwide assist one another perceive and acquire insights about Web3, the metaverse, DeFi, GameFi, or some other space of the fledgling world of blockchain. Right here you’ll discover lively, numerous voices supporting one another and driving the group ahead.

What’s Footprint Analytics?

Footprint Analytics is an all-in-one evaluation platform to visualise blockchain information and uncover insights. It cleans and integrates on-chain information so customers of any expertise degree can shortly begin researching tokens, tasks, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anybody can construct their very own personalized charts in minutes. Uncover blockchain information and make investments smarter with Footprint.