newbie

Decentralized finance (DeFi) has been altering the world of finance as we all know it. However what’s subsequent for this fast-growing trade?

DeFi 1.0 noticed the creation of platforms that allowed for peer-to-peer buying and selling, borrowing, and lending with cryptocurrencies used as collateral. Nevertheless, because of the fast evolution of blockchain know-how and rising calls for from customers, DeFi has undergone a significant improve and fashioned what we now name DeFi 2.0.

On this complete information, we take a deep dive into DeFi 2.0 and discover its new options and capabilities that would revolutionize not solely monetary providers but additionally different industries within the close to future. So buckle up, and let’s discover what’s subsequent for decentralized finance collectively.

DeFi 1.0: Early DeFi Developments

DeFi (decentralized finance) 1.0 refers to early developments of decentralized monetary purposes and protocols constructed on prime of blockchain networks, comparable to Bitcoin or Ethereum.

The primary iterations of DeFi — tasks like MakerDAO — primarily centered on cryptocurrency exchanges and peer-to-peer lending platforms that aimed to offer a decentralized various to conventional monetary providers, enabling customers to lend, borrow, commerce, and trade cryptocurrencies with out intermediaries. As well as, the primary stablecoins had been created throughout this era. These are digital currencies pegged to an asset (e.g., the US greenback), offering stability inside a unstable market because of the hyperlink with its worth.

DeFi 1.0 had limitations that slowed down its progress and adoption, however these early developments served as constructing blocks for additional innovation in DeFi know-how, resulting in the emergence of extra superior and various monetary devices inside DeFi ecosystems.

What are the constraints of DeFi 1.0?

DeFi 1.0 has been profitable in some ways, and it has confirmed to be a viable various to conventional finance. Nevertheless, it has some limitations that stop it from reaching its full potential. Listed below are a number of the key limitations of DeFi 1.0.

Centralization Points

Decentralization is without doubt one of the core ideas of blockchain know-how; it underpins the decentralized finance sector.

Nevertheless, within the DeFi 1.0 period, many protocols had been centralized round a number of people or entities that managed the platform’s improvement and decision-making. For instance, the MakerDAO platform, which points the DAI stablecoin, had a small group of people with important voting energy to find out the protocol’s route. This centralization of energy in DeFi 1.0 raises considerations about transparency, censorship resistance, and belief.

Scalability

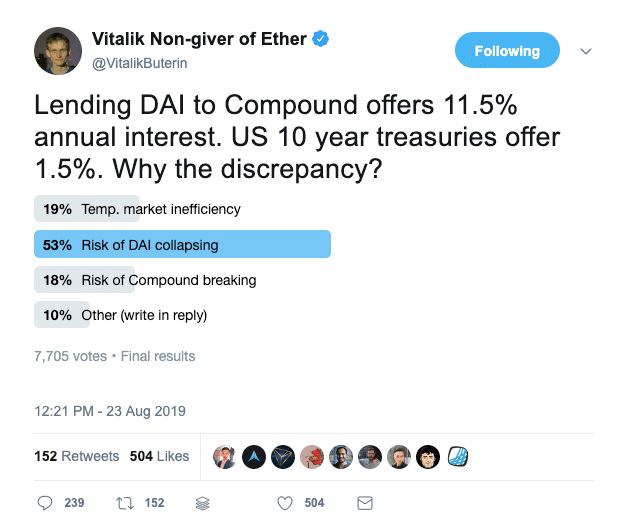

One of many greatest limitations of DeFi 1.0 is scalability. Many DeFi platforms run on the Ethereum blockchain, which struggles with excessive fuel charges and community congestion throughout peak utilization occasions. This makes it tough for DeFi platforms to deal with giant volumes of transactions and assist a rising consumer base.

Safety

DeFi protocols are constructed on good contracts, that are automated pc applications that execute transactions based mostly on predefined guidelines. Whereas good contracts are designed to be safe, they aren’t infallible. Hackers have exploited vulnerabilities in good contracts to steal tens of millions of {dollars} value of crypto property previously.

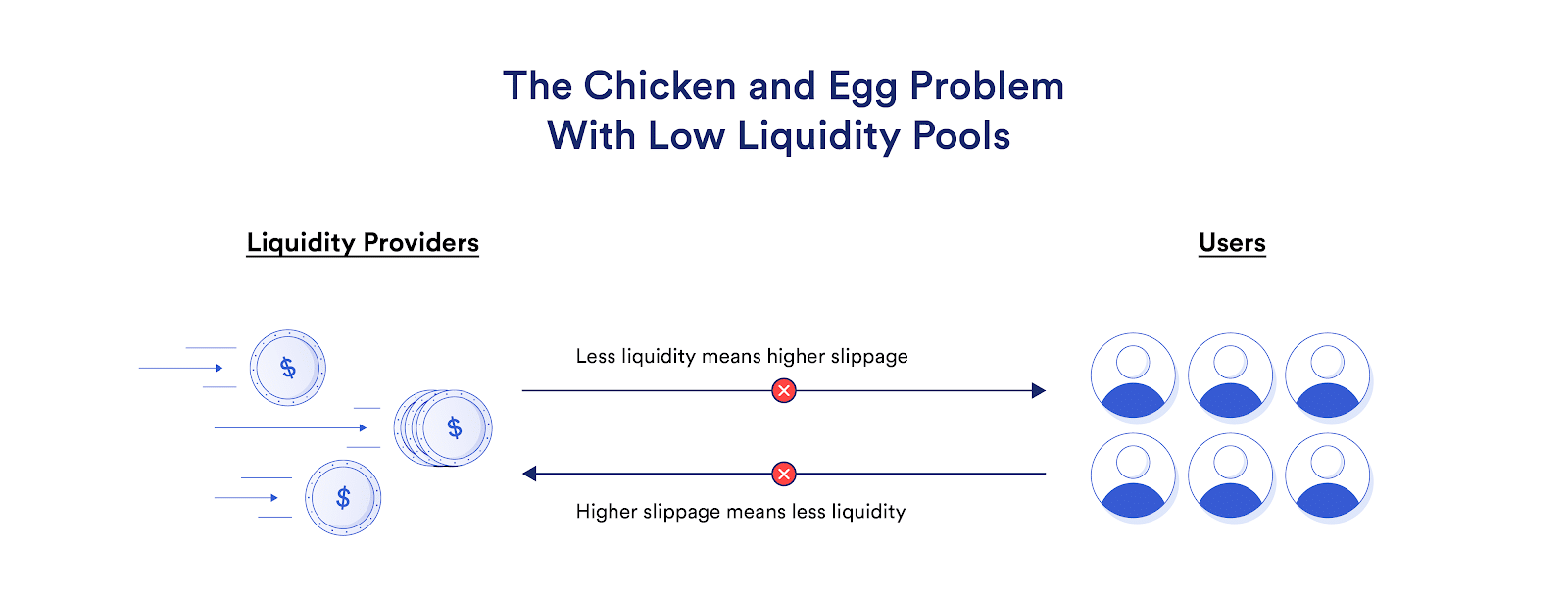

Liquidity

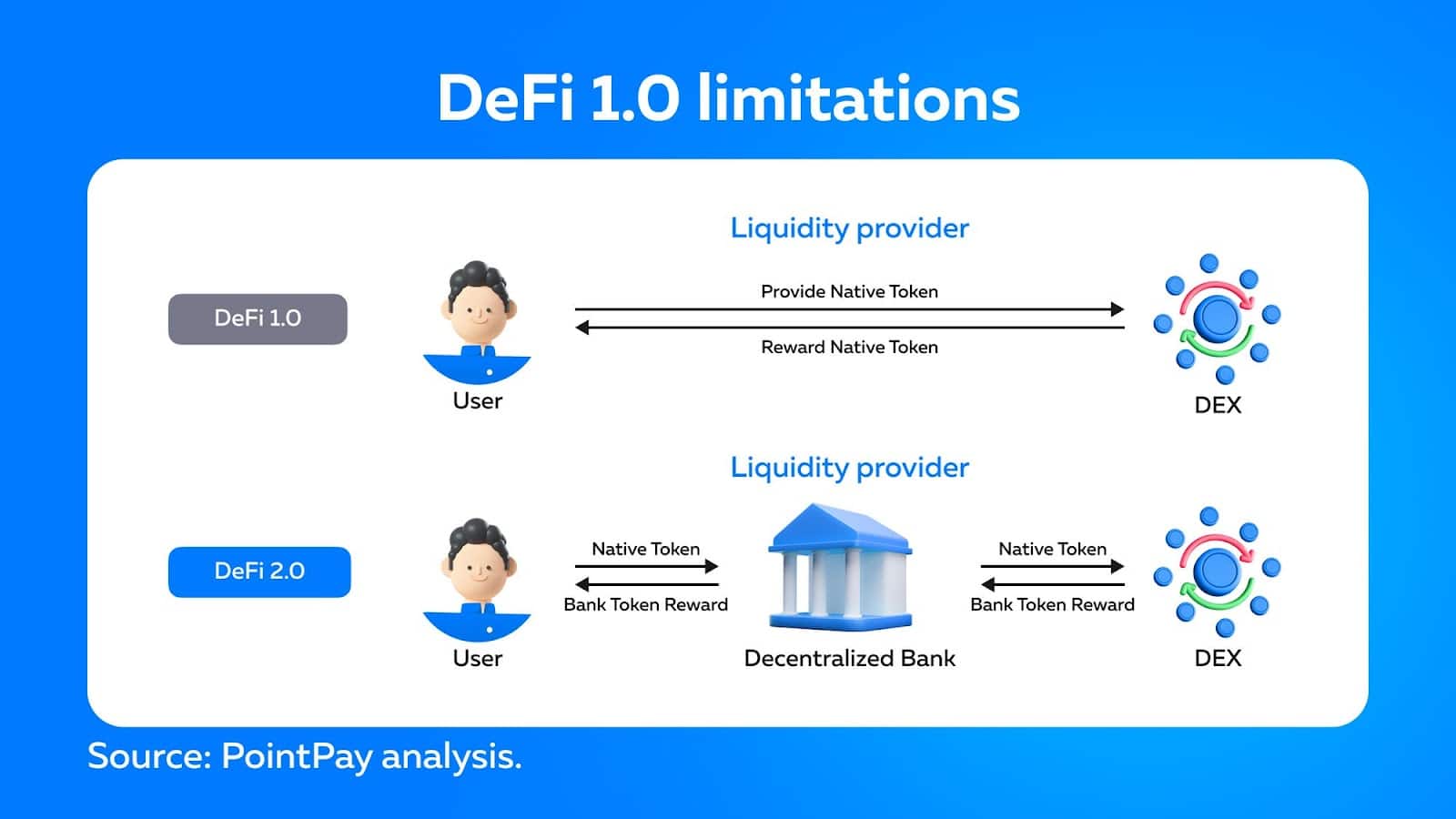

DeFi 1.0 encountered a big problem in liquidity, which prevented its widespread adoption. In conventional monetary markets, market makers preserve stability by buying and promoting property repeatedly. In distinction, DeFi liquidity is supported by liquidity suppliers pooling their property right into a liquidity pool for buying and selling functions.

Nevertheless, DeFi 1.0 confronted a number of obstacles associated to its liquidity suppliers. Probably the most notable difficulties was the fragmentation of liquidity throughout varied protocols, resulting in decrease particular person protocol liquidity. In consequence, merchants needed to carry out a number of steps to commerce amongst various protocols, making it extra complicated and costly to have interaction in buying and selling actions and resulting in capital inefficiency.

Hackers Menace to DeFi 1.0

DeFi 1.0 tasks had been susceptible to hacker assaults for a number of causes. One of many most important causes is that many earlier DeFi providers had been constructed on centralized infrastructure, that means that they relied on a single level of failure. For instance, a decentralized trade (DEX) could have had a wise contract that facilitated trades, however the consumer interface for interplay with a wise contract could have relied on a centralized server to speak with the blockchain. If that server had been compromised, a thriving DeFi ecosystem could be in danger.

Another excuse why DeFi 1.0 tasks had been susceptible to hacker assaults was that a lot of them had been constructed on Ethereum’s good contracts. Open-source good contracts are publicly accessible, which signifies that anybody can view the code and doubtlessly establish vulnerabilities. Whereas this may be useful for figuring out and fixing points, it additionally signifies that hackers can simply examine the code and discover methods to take advantage of it.

Requirement of a Non-public Key

In DeFi 1.0, one of many most important challenges confronted by customers was the requirement to have a non-public key to entry and handle their property. Non-public keys are lengthy strings of characters that function distinctive identifiers and passwords for customers’ wallets. This requirement created a barrier for brand spanking new customers who had been unfamiliar with the technicalities of managing non-public keys and will simply lose their funds in the event that they misplaced or forgot their keys.

Person Expertise

Moreover, DeFi 1.0 platforms sometimes lacked user-friendly interfaces, which made it much more tough for customers to handle their non-public keys and navigate complicated processes concerned in executing transactions. This led to a excessive diploma of centralization, with solely a small group of technically proficient customers in a position to take part in DeFi.

Additionally, the shortage of intuitive interfaces could be a barrier to entry for many individuals unfamiliar with the crypto world.

Ethereum’s Dominance

DeFi 1.0 relied closely on the Ethereum blockchain, leading to congestion points and excessive fuel charges. DeFi 2.0 goals to supply extra blockchain choices, such because the Binance Good Chain, to mitigate these points.

Collateralization

In most DeFi 1.0 lending transactions, the requirement was that the collateral worth needed to be equal to or larger than the mortgage quantity, making it tough for many individuals to qualify for DeFi loans. In consequence, this restricted the quantity of people that may apply for a DeFi mortgage and in addition restricted the variety of people prepared to simply accept one.

Transition from DeFi to DeFi 2.0

Unsurprisingly, all these shortcomings led to the seek for new options within the DeFi house. DeFi 2.0 is the subsequent technology of tasks that search to beat the constraints of DeFi 1.0 by introducing new protocols and options. DeFi 2.0 intends to offer a extra dependable, safe, and environment friendly monetary ecosystem that allows broader adoption. Let’s check out what this new imaginative and prescient has to supply.

What Is DeFi 2.0?

DeFi 2.0 is the subsequent evolution of decentralized finance, constructing on the inspiration established by DeFi 1.0. Whereas DeFi 1.0 primarily centered on creating decentralized monetary services, DeFi 2.0 facilities on enhancing scalability, safety, and consumer expertise to create a extra mature and sustainable ecosystem.

Who’s answerable for DeFi 2.0?

DeFi 2.0 goals to construct decentralized ecosystems the place no single entity is in management. As a substitute, liquidity suppliers and token holders have management over the DeFi platforms they use.

The purpose of DeFi 2.0 is to create a extra decentralized and clear monetary system that gives monetary freedom to everybody. DAOs play a big position in reaching this purpose by giving the neighborhood extra management over the protocol’s improvement and administration, thus lowering the centralization danger.

Some DeFi 2.0 tasks, comparable to Compound, Aave, and Uniswap, have already carried out DAOs as a part of their governance fashions. The governance tokens issued by these protocols enable holders to vote on adjustments to the platform, comparable to rates of interest, liquidity swimming pools, and even protocol upgrades.

Examples of DeFi 2.0 Protocols

Among the standard DeFi 2.0 protocols embrace Curve Finance, Olympus Treasury, ChainLink, and Superfluid. We’ll take a better have a look at promising decentralized finance protocols a little bit later.

DeFi 1.0 vs DeFi 2.0

Decentralized finance (DeFi) has come a good distance since its inception, and we are actually within the DeFi 2.0 period. Whereas DeFi 1.0 centered on making a primary infrastructure for decentralized monetary providers, DeFi 2.0 is about enhancing current protocols and platforms to make sure its customers get extra refined monetary services. A few of these options embrace protocol-controlled liquidity, self-repaying loans, and yield farming.

DeFi 2.0 tasks are constructed on prime of DeFi 1.0 and supply a extra seamless and environment friendly consumer expertise. The main focus is on making a thriving DeFi ecosystem that’s accessible to everybody and might compete with conventional monetary providers.

Safety from Monetary Losses

Impermanent loss insurance coverage is a brand new function provided by some DeFi 2.0 protocols. It seeks to deal with the problem of impermanent loss that liquidity suppliers face. Impermanent loss happens when a liquidity supplier’s funding in a liquidity pool loses worth in comparison with tokens held outdoors the pool. This occurs as a result of the worth of the tokens within the pool adjustments relative to the worth outdoors the pool.

Some DeFi 2.0 protocols supply insurance coverage merchandise that compensate DeFi customers for any losses they might expertise as a result of impermanent loss. Primarily, these insurance coverage merchandise act as a security web for liquidity suppliers, permitting them to tackle extra danger with out concern of dropping their funding.

By offering impermanent loss insurance coverage, DeFi 2.0 protocols scale back the dangers related to offering liquidity, which may entice extra liquidity suppliers to their platforms. This, in flip, may improve the liquidity and buying and selling quantity of the platform, making it extra engaging to merchants and buyers.

A Better Worth from Staked Funds

DeFi 2.0 protocols purpose to supply customers a larger worth from staked property by introducing revolutionary options, comparable to yield farming. Platforms with a novel method additionally broaden yield farming’s incentives and utility by permitting yield farm LP tokens for use as collateral for loans. These alternate methods of liquidity mining are nonetheless of their early levels, however they signify a step in the fitting route.

Self-Repaying Loans

Self-repaying loans are an revolutionary idea in DeFi 2.0. They permit debtors to take out loans eliminating the necessity for guide repayments. In these kinds of loans, collateral is offered by the borrower and held in a wise contract. The good contract then robotically repays the mortgage by promoting a number of the collateral as wanted in an effort to cowl the excellent stability plus any curiosity accrued. This leads to a system that’s extra reliable and environment friendly than conventional lending programs because it removes the necessity for paperwork, intermediaries, and credit score verify processes. Furthermore, self-repaying loans allow extra seamless and dynamic use circumstances by eradicating human intervention within the compensation course of.

The best way to Spend money on DeFi 2.0 Initiatives?

Investing in DeFi 2.0 includes varied methods, together with:

- Yield farming

- Lending

- Liquidity mining

- Staking

- DEX buying and selling

Yield farming includes incomes rewards for offering liquidity to the liquidity pool for the token pair, whereas lending includes offering funds to the lending protocol and incomes curiosity. Liquidity mining entails incomes rewards for offering liquidity to the DeFi platform, whereas staking includes locking up tokens in a wise contract to earn rewards. DEX buying and selling includes buying and selling cryptocurrencies on a decentralized trade.

Dangers of DeFi 2.0 and The best way to Stop Them

DeFi 2.0 has the potential to revolutionize the monetary trade by offering decentralized options which might be extra environment friendly and accessible than conventional finance. Nevertheless, like several rising know-how, it comes with its personal set of dangers. Listed below are a number of the dangers of DeFi 2.0 and concepts on learn how to stop them:

- Good contract dangers: Good contracts are the spine of DeFi protocols. They’re self-executing contracts with the phrases of the settlement between consumers and sellers being straight written into traces of code. The code is saved on a blockchain and executed robotically, which eliminates the necessity for intermediaries. Nevertheless, this spine could have a backdoor: it may be susceptible to bugs, hacks, or exploits that can lead to the lack of funds. Whereas good contracts are audited regularly, odd software program upgrades and modifications can regularly result in outdated and redundant data, even from credible DeFi safety firms like CertiK. To stop good contract-associated dangers, customers ought to solely work together with respected decentralized finance tasks and train due diligence earlier than investing.

- Regulatory dangers: DeFi 2.0 operates in a largely unregulated surroundings, which leaves buyers susceptible to regulatory adjustments. Regulatory dangers can manifest within the type of authorities bans, authorized actions, or new legal guidelines that affect the DeFi ecosystem. To mitigate this danger, buyers ought to keep knowledgeable about regulatory adjustments and make investments solely the funds they’ll afford to lose.

- Impermanent loss: Impermanent loss is a danger that arises when an investor offers liquidity to the DeFi platform and the worth of the property adjustments throughout that point. It happens when the investor withdraws their liquidity from the platform, leading to a loss in comparison with holding the property. To stop the impermanent loss, buyers can use methods comparable to restrict orders, hedging, or offering liquidity to much less unstable property.

- Issue find and accessing consumer funds: Decentralized finance operates on the blockchain, which signifies that customers have full management over their funds. Nevertheless, this additionally signifies that in the event that they lose their non-public keys or pockets addresses, they might lose entry to their funds endlessly. To stop this, customers ought to take additional precautions to guard their non-public keys and retailer them in safe areas.

DeFi 2.0 Initiatives that Would possibly Take Off in Nearest Future

There are a number of DeFi 2.0 tasks which might be value keeping track of within the close to future. Listed below are a number of the most promising ones:

Olympus DAO

Olympus DAO is really a pioneer within the DeFi 2.0 area. Launched in 2021, it’s a decentralized finance 2.0 undertaking that goals to offer a secure and sustainable forex, OHM, by its incentivization mechanism. The protocol leverages the idea of staking, the place customers lock up their OHM tokens in return for each day rewards distributed by the community.

The Graph (GRT)

The Graph is a decentralized indexing protocol that permits builders to entry information from a number of blockchain networks. It offers a seamless consumer expertise and permits for the event of refined DeFi merchandise.

Uquid (UQC)

Uquid is a DeFi undertaking constructing a platform with a variety of monetary providers, together with lending, borrowing, and staking.

Synapse (SYN)

Synapse is a decentralized identification and entry administration platform that lets customers securely handle their digital identification and management entry to their information.

Rarible (RARI)

Rarible is a decentralized market for getting, promoting, and creating distinctive digital property. It permits creators to monetize their content material and permits collectors to personal and commerce NFTs.

Tokemak (TOKE)

Tokemak is a liquidity provision protocol that intends to offer extra capital-efficient liquidity swimming pools.

Frax Protocol (FXS)

Frax Protocol is a stablecoin protocol that makes use of a fractional reserve system to keep up the soundness of its native token.

Abracadabra (SPELL)

Abracadabra is a yield optimizer that permits customers to earn excessive yields on their cryptocurrency holdings. It makes use of a novel method that mixes liquidity provision with yield farming and in addition affords self-repaying loans.

Convex Finance (CVX)

Convex Finance is a yield optimizer that gives liquidity to Curve Finance liquidity swimming pools and focuses on Curve liquidity suppliers’ pursuits.

Centrifuge (CFG)

Centrifuge (CFG) is a decentralized finance (DeFi) platform that permits companies to entry liquidity by issuing real-world property as tokens on the blockchain.

In search of an trade to accumulate the very best DeFi cash? Look no extra! Changelly affords a user-friendly and intuitive interface that makes shopping for cryptocurrencies a simple course of. Moreover, Changelly helps a variety of cryptocurrencies, together with standard choices like Bitcoin, Ethereum, and Litecoin, in addition to 400+ different property. Lastly, Changelly is thought for its quick transaction occasions and aggressive charges, making it a terrific choice for anybody trying to purchase cryptocurrency rapidly and at an inexpensive price. Strive it your self now!

Closing Ideas: What Does the Way forward for DeFi 2.0 Look Like?

DeFi 2.0 is taking the crypto world by storm, and its future appears shiny. As extra folks develop into conscious of the advantages of DeFi, we are able to anticipate to see a thriving DeFi ecosystem that rivals conventional monetary providers. Moreover, DeFi 2.0 tasks such because the Olympus Treasury and Curve Finance are exploring revolutionary options (e.g., self-repaying loans and protocol-controlled liquidity) to keep up worth stability and allocate sources effectively. With continued innovation and improvement, DeFi 2.0 has the potential to revolutionize the monetary trade and grant larger entry to monetary providers for folks around the globe.

Disclaimer: Please observe that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.