Is there a solution to earn extra cryptocurrencies from the prevailing crypto holding? The reply is likely to be sure, and that is what underpins the idea of yield farming.

Yield farming or passive earnings from cryptos means making returns with out liquidating holding. Right here, the holder can lend cryptos in a decentralised setting, additionally known as decentralised finance (DeFi). For taking part in lending and thereby including “liquidity” out there, a “liquidity supplier” or an LP is rewarded with extra cryptos.

Amid a part the place many related service suppliers like Celsius Community and Voyager Digital have suspended operations, DeFi participant Inverse Finance is making optimistic information. Its linked INV token is rising in worth, with one-day commerce quantity up nearly 2,000%, as of writing. Allow us to discover Inverse Finance.

What’s Inverse Finance cryptocurrency?

Inverse Finance is into DeFi lending and borrowing companies, with added deal with stablecoins. It claims to be a “optimistic sum DeFi”, which might present passive earnings to cryptocurrency holders.

Whereas gamers like Celsius Community are thought of centralised as customers would not have governance powers, Inverse Finance is alleged to be a DAO. A DAO or decentralised autonomous organisation normally has a local token which might be staked by the person to vote on governance issues. Inverse Finance states on its web site that by staking the native token, rewards with over 150% APY may accrue.

The challenge’s main DeFi protocol is Frontier, which makes use of a stablecoin to allow lending and borrowing companies.

INV token

Inverse Finance’s native cryptocurrency is INV, whereas stablecoin for DeFi operations is titled DOLA.

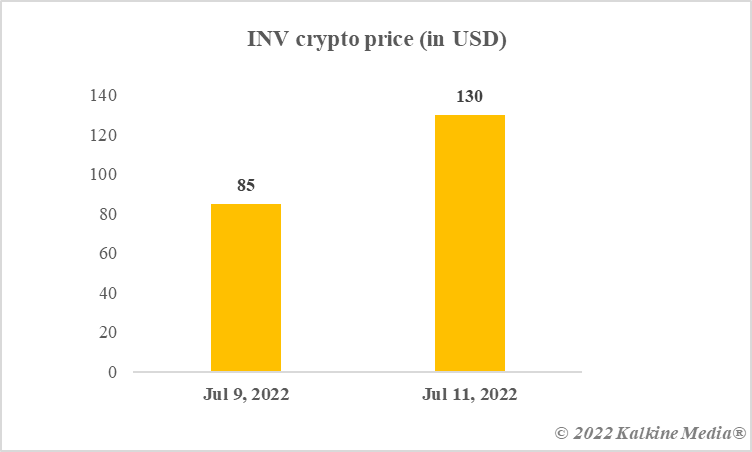

The INV token is a high-price per token cryptocurrency in comparison with friends like DOGE and SHIB. As of writing, the INV token is buying and selling at almost US$130. The market cap of INV is over US$12 million, which makes it a small-cap crypto compared to DOGE and SHIB.

In accordance with CoinMarketCap, the value even touched US$160 a number of hours again. It’s notable that a few days again, the INV token was buying and selling at beneath US$100.

Information offered by CoinMarketCap.com

Why is the INV token gaining?

One of many possible causes might be the APY offered by its DOLA stablecoin. The newest tweets by Inverse Finance point out that DOLA-3POOL APY was within the vary of over 50% on Convex Finance. Moreover, the INV token was added to Coinbase earlier this yr, making it simple for fans to commerce it.

Backside line

Inverse Finance is a low-market cap and high-price per token cryptocurrency. It has INV and a stablecoin DOLA to offer yield farming companies. The continuing rally might be attributed to latest excessive APY, however warning is essential.

Additionally learn: What are blue-chip cryptos? Listed below are high 3 based mostly on YTD returns

Danger Disclosure: Buying and selling in cryptocurrencies entails excessive dangers together with the chance of shedding some, or all, of your funding quantity, and will not be appropriate for all traders. Costs of cryptocurrencies are extraordinarily risky and could also be affected by exterior components similar to monetary, regulatory, or political occasions. The legal guidelines that apply to crypto merchandise (and the way a specific crypto product is regulated) might change. Earlier than deciding to commerce in monetary instrument or cryptocurrencies you have to be absolutely knowledgeable of the dangers and prices related to buying and selling within the monetary markets, fastidiously think about your funding aims, degree of expertise, and threat urge for food, and search skilled recommendation the place wanted. Kalkine Media can’t and doesn’t signify or assure that any of the knowledge/knowledge obtainable right here is correct, dependable, present, full or applicable on your wants. Kalkine Media won’t settle for legal responsibility for any loss or injury because of your buying and selling or your reliance on the knowledge shared on this web site.