Key Takeaways

- Whereas the Ethereum community is thought for the essential function it performs within the cryptocurrency ecosystem, ETH the asset is tougher to outline.

- ETH has beforehand been described as a “triple-point asset” and “extremely sound cash” in Ethereum circles because of its utility and shortage.

- Former BitMEX CEO Arthur Hayes argues that ETH might be valued like a bond when Ethereum completes the Merge to Proof-of-Stake.

Share this text

From a “triple-point asset” to “extremely sound cash,” Crypto Briefing explores how Ethereum’s native asset has been conceptualized and whether or not viewing it as a perpetual bond is likely to be the subsequent to realize traction.

Ethereum’s Evolution

Since Ethereum launched in 2015, the cryptocurrency market has engaged in debates over easy methods to outline it. The Ethereum community itself is commonly described as the bottom layer of Web3, however its native asset, ETH, doesn’t have such a transparent definition.

As with all new applied sciences, determining easy methods to conceptualize them in reference to current techniques is a degree of steady debate. Ethereum isn’t any totally different on this regard. The second-biggest blockchain has come a good distance since its inception, however with a roadmap that stretches out effectively into the present decade, it nonetheless has a far to go earlier than realizing its last imaginative and prescient.

In-between updates, Ethereum’s customers have had loads of time to consider the implications of every fork and speculate on the results of future upgrades. Snappy soundbites like “Triple-Level Asset” or “Extremely Sound Cash” have helped distill the customarily advanced nature of Ethereum into viral memes that seize consideration and supply a rallying name for many who consider in ETH the asset.

As Ethereum prepares to finish “the Merge” from Proof-of-Work to Proof-of-Stake, one outstanding determine within the crypto area believes conceptualizing Ethereum as a bond may very well be pivotal to its subsequent development stage. Arthur Hayes, the co-founder and former CEO of the crypto buying and selling platform BitMEX, is effectively revered in crypto circles for his insights into crypto and international monetary markets. Hayes argued that establishments may feasibly regard ETH as a bond as soon as Ethereum strikes to Proof-of-Stake in a recent Medium post. Primarily based on Hayes’ “Ethereum bond” classification, he believes the worth proposition of shopping for and staking ETH ought to see the asset hit $10,000 by the tip of 2022, sharing a well-liked view amongst Ethereum fans that ETH will change into a five-digit asset.

Classifying ETH

Earlier than exploring how ETH may maintain up as a bond, it’s important to grasp the concepts that led to Hayes’ notion.

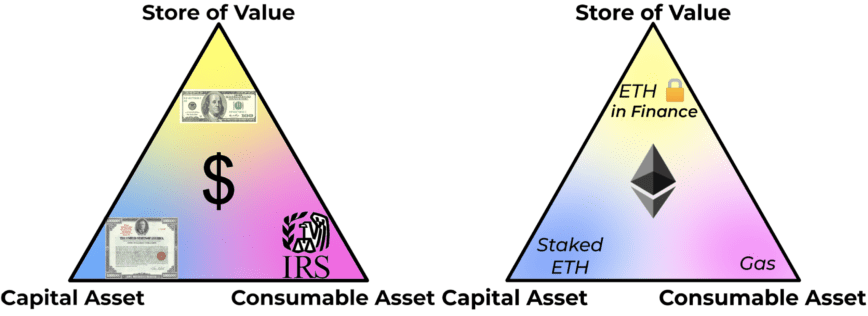

In 2019, Bankless co-host David Hoffman was one of many first to aim to outline ETH in reference to the standard financial system. In a blog post titled “Ether: The Triple-Level Asset,” Hoffman argued that ETH is the primary asset that falls below all three main asset superclasses: retailer of values, capital property, and consumable property.

He defined that ETH turns into a capital asset when it’s staked. It is because it generates yield and may subsequently be valued based mostly on its anticipated returns, much like bonds. When ETH is used as gasoline to pay for transactions, it takes on the function of a consumable asset, analogous to how U.S. {dollars} are used to pay taxes. Lastly, ETH acts as a retailer of worth when holders deposit it to DeFi protocols similar to Aave or Compound as collateral.

This triple-point asset definition types the bedrock of the Ethereum ecosystem. It represents the totally different forces influencing ETH’s value whereas additionally offering a path to additional adoption and development. It additionally reveals how ETH is analogous to key property in conventional economies. For instance, the trifecta of U.S. {dollars}, U.S. treasury bonds, and IRS taxes that kind the U.S. economic system will also be recognized within the Ethereum ecosystem.

Nevertheless, whereas Hoffman’s definition explains how ETH will be in comparison with capital property like bonds, it’s nonetheless a good distance from Hayes’ argument that it may well be valued like a bond. That is the place one other fashionable meme used to outline ETH, “extremely sound cash,” comes into play. The phrase was coined by the Ethereum Basis’s cryptographer researcher Justin Drake in early 2021 and has since change into a rallying name for Ethereum fans. Vitalik Buterin has beforehand stated that he thinks ETH is on a path to changing into extremely sound cash.

Lately, criticism of conventional monetary techniques has been on the rise, significantly within the case of the U.S. economic system. A outstanding narrative fueling Bitcoin’s rise is that it’s “sound cash” as a result of it has a restricted provide. In contrast to the U.S. greenback, which has undergone fast inflation because of the Federal Reserve’s cash printing, there’ll solely ever be 21 million Bitcoin in existence. Nevertheless, the extremely sound cash thesis takes this concept a step additional. What may very well be a greater funding than an asset with a finite quantity? An asset that truly will increase in shortage and ultimately turns into deflationary because it sees extra use. That is the idea that the extremely sound cash meme represents.

In August 2021, Ethereum shipped an replace that paved the way in which for ETH to change into extremely sound cash. The London hardfork launched EIP-1559, an important replace designed to vary how Ethereum’s price market labored. Earlier than EIP-1559, customers must bid to get their transactions included in new blocks within the chain. Now, they pay a base price and pays an extra tip to miners. The bottom price will get burned, considerably lowering the ETH provide over time. This offsets the approximate 4.5% inflation that comes from mining and staking rewards. EIP-1559 hit 2 million ETH burned final month.

It’s essential to notice that burning transaction base charges alone is presently not sufficient to make ETH a deflationary asset outdoors of moments of utmost community congestion. Nevertheless, as soon as Ethereum merges with its Proof-of-Stake chain, it’s going to cease paying block rewards to miners. At that time, which is slated for someday this yr, the quantity of ETH burned from transactions may surpass the quantity paid to validators with sufficient exercise on the community. That might make ETH internet deflationary.

The transfer to Proof-of-Stake will even unlock a significant performance wanted for ETH to be considered as a bond. At present, sending ETH to the Ethereum staking contract is a one-way course of—funds which are staked can’t but be withdrawn. Nevertheless, quickly after the Merge takes place, withdrawals from the ETH staking contract might be activated.

The First Perpetual Bond

Bonds are fixed-income devices that present round 1 to 2% low-risk yield in conventional markets. Forex bonds are normally issued by their corresponding governments and symbolize the belief that the federal government will be capable to repay its money owed sooner or later. Conventional bonds even have a time to maturity, starting from one to 30 years, with yields growing on increased time-frame bonds.

Viewing ETH as a bond doesn’t indicate it turns into a debt instrument like government-issued business paper. It simply compares the chance profile and future yields of staking ETH to conventional bonds.

For ETH, the staking yield is significantly increased than the curiosity earned on bonds. The present price sits between 4 and 5% and is predicted to extend to round 8% following the Merge. One other key distinction is that whereas conventional bond yield charges are time-dependent, ETH staking rewards are usually not. This makes it higher to think about ETH staking as a “perpetual bond” and should be accounted for when valuing it.

Hayes makes use of yield measurement metrics utilized in bond markets in his weblog put up, mixed with ETH’s projected post-Merge yield. The consequence implies that if institutional traders take into consideration ETH in the identical approach they give thought to overseas forex bonds, it’s presently undervalued.

Hayes additionally factors out that the present charges for hedging an ETH “bond” pay out a optimistic premium, making the commerce much more profitable. He states that the one issues presently holding asset managers again from coming into the Ethereum market are the lack to withdraw staked ETH and Ethereum’s excessive power consumption—each of which might be fastened by the Merge.

Whereas the argument for viewing ETH as a bond is compelling, it additionally begs the query: If ETH will be valued as a bond, why can’t different Proof-of-Stake tokens which are already extra environmentally pleasant and let stakers withdraw their funds?

Two causes emerge within the context of classifying ETH as a triple-point asset and extremely sound cash. Firstly, no different Ethereum competitor fulfills all three necessities to change into a triple-point asset. To make use of Solana for instance, SOL holders can stake their tokens to generate a yield of round 6 to 7%, fulfilling its function as a capital asset. SOL can be actively used as a retailer of worth asset to borrow in opposition to. Nevertheless, Solana’s low charges affect its capacity to behave as a consumable asset, eradicating a elementary worth proposition.

As different Proof-of-Stake tokens have fixed inflation with out the balancing issue of charges lowering the provision, they can’t be outlined as deflationary extremely sound cash like ETH. An asset with a provide that will increase on the identical price as its staking rewards can’t be valued as a bond because it has 0% actual yield. Comparatively, ETH turns into deflationary because it sees extra use, growing its worth proposition.

The concept institutional traders may quickly decide up ETH as a perpetual bond is undoubtedly a lovely proposition for ETH holders. Hayes’ math doesn’t lie, however a number of elements may affect his thesis. The most important hurdle might be convincing wealth managers to view ETH as a bond within the first place. No one can predict what market individuals will do, and the historic precedent of establishments turning as much as crypto late just isn’t a very good signal. One other problem to the ETH bond thesis will seemingly be liquidity for derivatives. As Hayes identified in his suppose piece, there’s “scant liquidity” for ETH/USD futures additional than three months forward. Whereas shopping for and hedging ETH could also be a optimistic carry commerce, an absence of liquidity may set again adoption.

Moreover, it’s value contemplating the affect of additional delays to the Ethereum Merge. Though growth seems to be on schedule now, the chance of one other setback must be accounted for. Regardless of these elements, the thought of conceptualizing ETH as a bond seems more likely to proceed gaining traction. Nevertheless, whether or not ETH will change into an important a part of institutional portfolios and soar to a five-figure valuation stays to be seen.

Disclosure: On the time of scripting this characteristic, the writer owned ETH, SOL, and several other different cryptocurrencies.