newbie

Circulating provide is a crucial metric that will get talked about very often in crypto market evaluation. You’ve got most likely heard stuff like “Bitcoin’s circulating provide” being stated a thousand occasions earlier than — however what does it imply, and the way is it totally different from a cryptocurrency’s complete provide?

Understanding Circulating Provide

Circulating provide refers back to the complete variety of cash which can be at the moment in circulation and can be found to the general public. This quantity can fluctuate relying on the variety of new cash or tokens being minted or mined and the quantity that will get destroyed by burning.

Circulating provide is especially used for calculating market capitalization. All it’s important to do is multiply it by the crypto asset’s present market worth. It can be used to gauge a coin’s or a token’s shortage, though it doesn’t at all times straight correlate with an asset’s worth.

Wanna see extra content material like this? Subscribe to Changelly’s e-newsletter to get weekly crypto information round-ups, worth predictions, and knowledge on the newest tendencies straight in your inbox!

Keep on prime of crypto tendencies

Subscribe to our e-newsletter to get the newest crypto information in your inbox

What Is Whole Provide in Crypto?

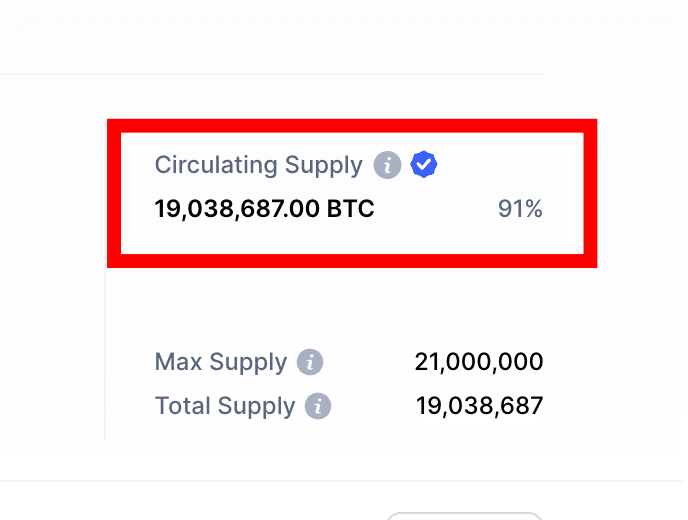

Whole provide refers back to the variety of cash which have already been launched for a selected cryptocurrency. It’s a sum of the crypto asset’s circulating provide and any cash or tokens at the moment out of circulation. The overall provide doesn’t embody cash which have been burned or in any other case destroyed.

Since at the moment locked up cash and tokens don’t have an effect on the cryptocurrency’s worth motion, this determine normally doesn’t get included in any analyses or calculations of the asset’s market cap.

What Is Max Provide in Crypto?

The max provide in crypto is the full variety of cash that may ever be in circulation. This quantity is normally set on the time of the coin’s launch and can’t be modified afterward. The max provide can provide you an concept of how scarce a selected crypto asset is. For instance, Bitcoin has a most provide of 21 million BTC, which implies that there’ll solely ever be 21 million BTC in existence, and no extra cash can ever be created. This makes Bitcoin fairly scarce and explains why its worth is so excessive. Ethereum, however, has a max provide of 100 million ETH, which implies that the demand for ETH is relatively decrease.

Why is the circulating provide utilized in figuring out the market capitalization as a substitute of the complete provide?

The circulating provide is the variety of cash at the moment out there for commerce. The overall provide is the variety of cash that exist on the crypto markets this present day however should not essentially in circulation. It doesn’t embody cash that could be locked up or inaccessible to the general public in another means. The market capitalization is decided by the worth of the coin multiplied by its circulating provide. It really works this fashion as a result of the market cap offers you an concept of the full worth of all of the cash which can be at the moment in circulation. The circulating provide is a extra correct reflection of the variety of cash which can be really being traded, so it’s a higher indicator of market capitalization.

FAQ

Does circulating provide matter in crypto?

The circulating provide in crypto can provide you an concept of how scarce a selected asset is. The scarcer the asset is, the upper its worth is prone to be.

What’s the distinction between complete provide and most provide in crypto?

The overall provide in crypto is the variety of cash that may ever be in circulation, whereas the max provide is the variety of cash that may ever be in circulation. The overall provide is normally set on the time of the coin’s launch and can’t be modified, whereas the max provide might change relying on the protocol of the coin.

What determines the worth of crypto?

The worth of crypto is decided by various components, together with the circulating provide, complete provide, most provide of the coin, and the demand for the coin.

How does circulating provide have an effect on cryptocurrency?

The circulating provide in crypto can provide you an concept of how scarce a selected asset is. The scarcer the asset is, the upper its worth is prone to be. Ethereum, for instance, has a circulating provide of over 100 million ETH, which makes it a lot much less scarce than Bitcoin.

Does staking cut back circulating provide?

When a crypto asset is staked, it’s locked up and unavailable for commerce. This could cut back the circulating provide of the coin, which might, in flip, improve its worth.

Why are market cap and circulating provide vital?

The market cap of the coin is the worth of the coin multiplied by the circulating provide. This metric is vital as a result of it offers you an concept of the full worth of all of the cash in circulation. The circulating provide issues as a result of it suggests how scarce a selected asset is. The scarcer the asset is, the upper its worth is prone to be.

Disclaimer: Please be aware that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.