Chainlink [LINK] hit a thirty-day excessive of $8.80 and revitalized its NFT trades quantity to a brand new excessive after it fell vehemently on the second day in November. Apparently, these developments got here after Chainlink introduced new digital collectible integrations.

⬡ DAILY WRAP-UP ⬡

⛓️ Integrations on #Ethereum and #Polygon ⛓️

• @Gustaves_NFT | VRF | Distributing #NFTs

• @itsdigits | VRF | Deciding on raffle winners

• @sigmaklaytn | VRF | Producing allowlist pic.twitter.com/CKhISfmZ97— Chainlink (@chainlink) November 4, 2022

In response to Chainlink, it built-in three NFT collections by way of its Polygon [MATIC] and Ethereum [ETH] subchain. Revealed by means of its “Each day Wrap-up,” the decentralized oracle community famous that ItsDigits, Sigma on Katlyn, and Gustaves NFT fashioned a part of the newest alliance.

Right here’s AMBCrypto’s Value Prediction for Chainlink for 2022-2023

A story of the fungible and non-fungible

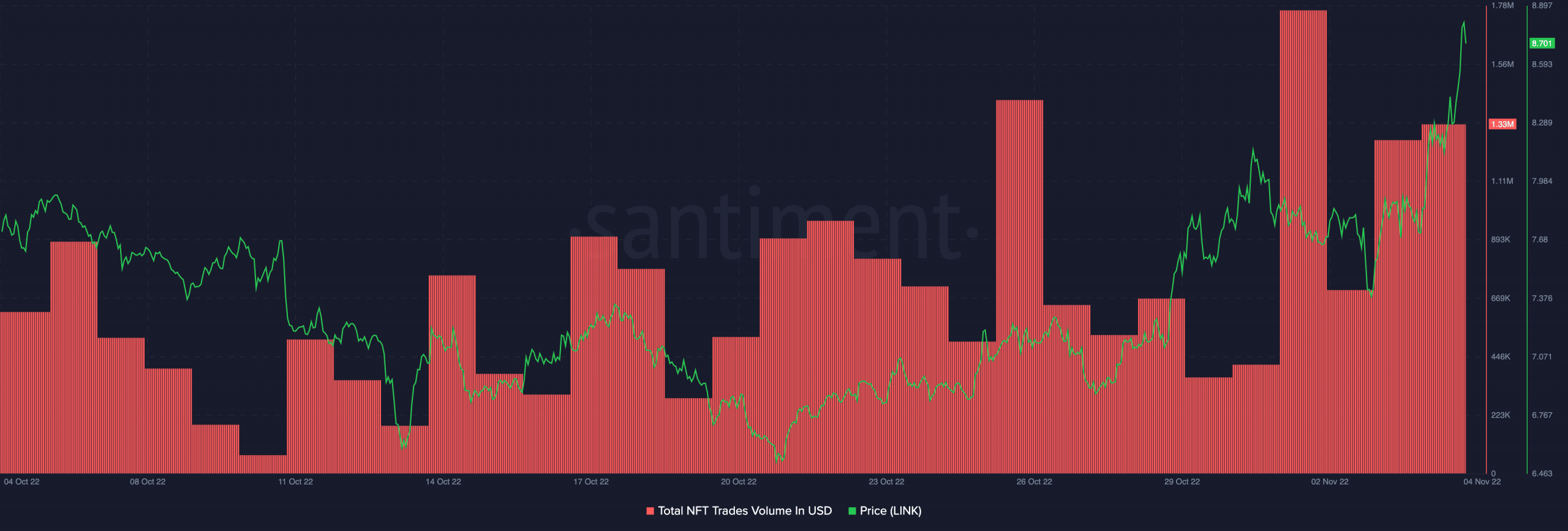

In response to Santiment, the NFT trades quantity was $1.33 million at press time. The on-chain analytic platform additionally revealed that the spike in quantity on 1 November decreased considerably within the final 4 days. Regardless of that, merchants had been in a position to rejuvenate their curiosity, particularly as the quantity at press time managed to beat the one on 3 November.

Supply: Santiment

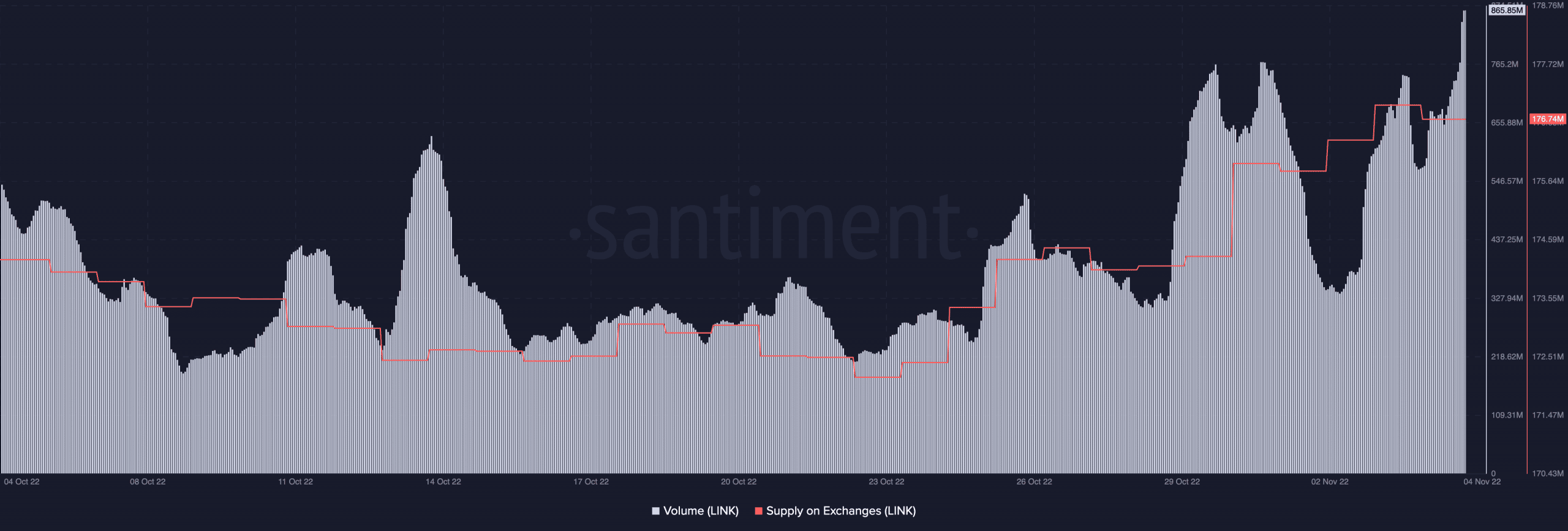

As for the value uptick, there was no denying that the quantity additionally performed its half. Santiment confirmed that the LINK quantity had surged by 19% to $865.85 million. This rise meant that buyers had chosen LINK as one of many cryptocurrencies to make use of for translations no matter revenue or loss. Along with the quantity enhance, the availability on exchanges indicated that the LINK pump had led buyers into attempting to take income.

As of this writing, the alternate provide was 174.74 million. With an growing charge of move, it was seemingly that LINK buyers had been within the mode of selling off what was gained these days. As such, LINK could possibly be on the verge of promoting strain resulting in an ease of the uptick. At press time, the indicators had been already beginning to present.

Moreover, CoinMarketCap information revealed that LINK’s value had decreased to $8.67 as an aftereffect of the alternate provide hike.

Supply: Santiment

In different phrases…

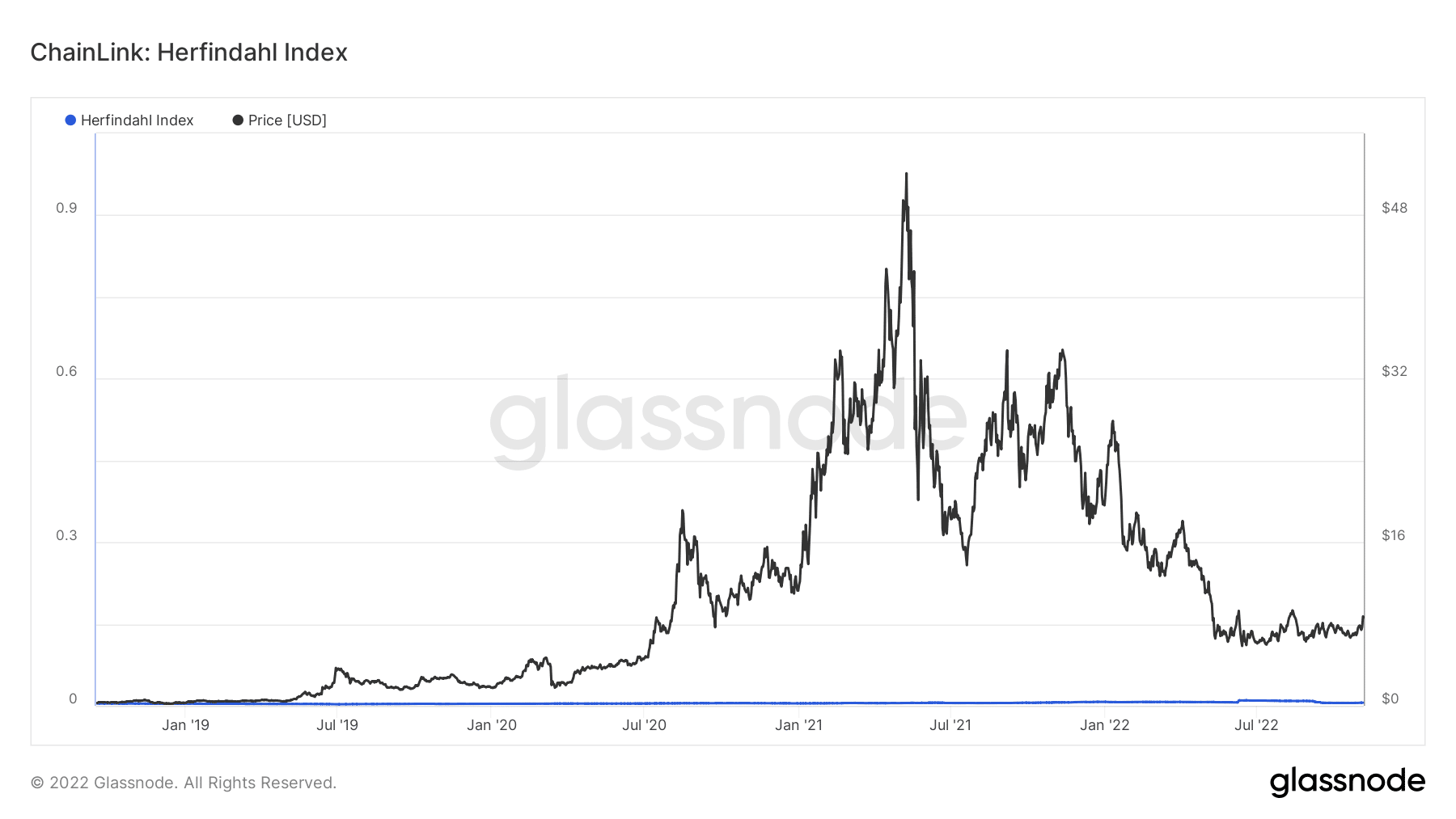

Per different components of the Chainlink ecosystem, Glassnode had some updates in retailer. In response to the on-chain platform, the Herfindahl Index was at a low worth of 0.005. At that time, Chainlink provide focus was reasonably distributed throughout addresses.

As well as, this signified that the underlying LINK property had balanced the weighted addresses on the community. Therefore, Chainlink had opted to adapt to the calls for of its decentralization goals.

Supply: Glassnode

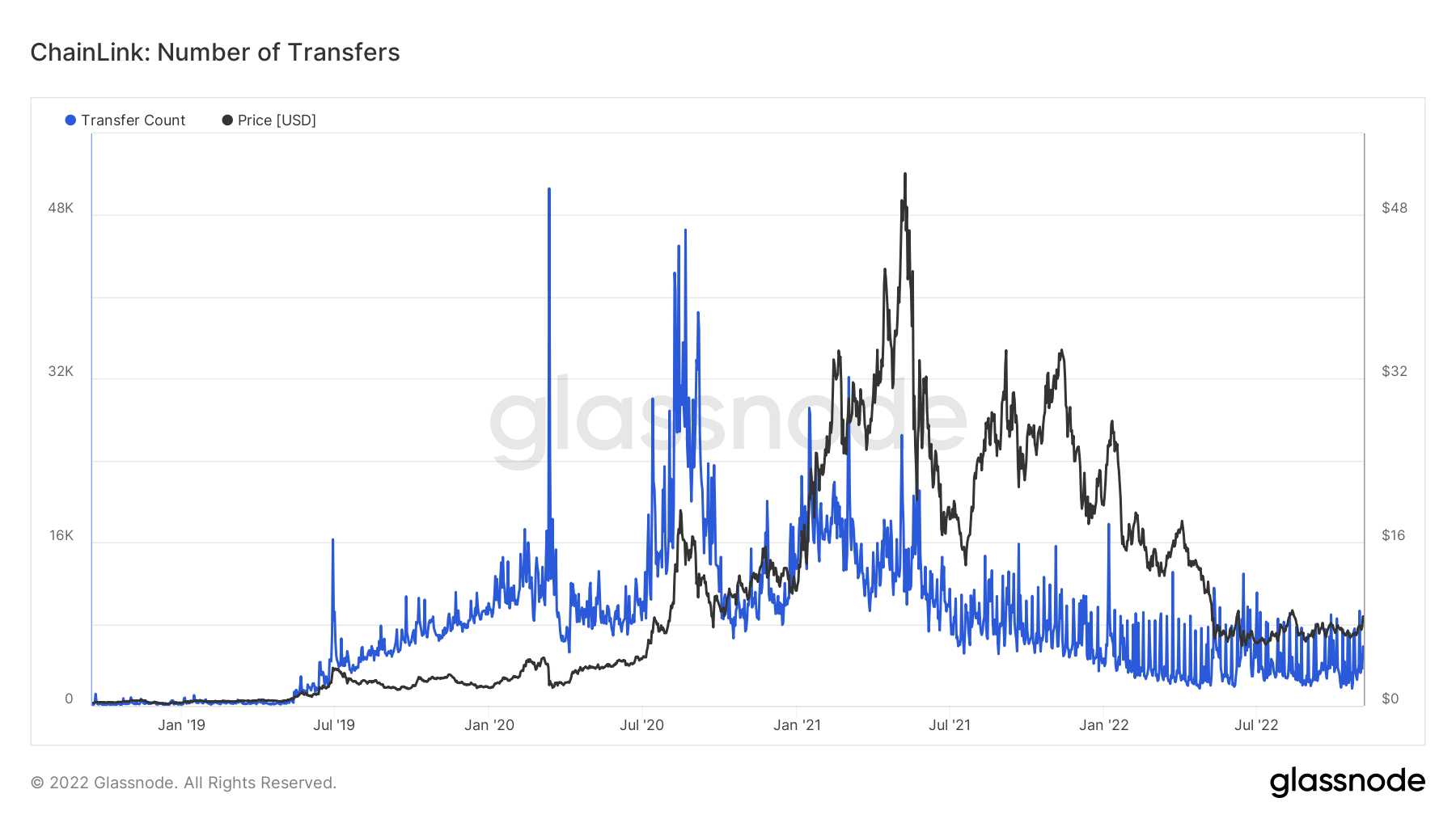

Moreover, Glassnode revealed that Chainlik’s switch charge had improved not too long ago. With an increase to 9,290, this metric indicated that buyers had had extra profitable non-zero LINK transactions than the primary few days of November.

At press time, LINK was nonetheless down 85.1% from its All-Time Excessive (ATH). Even so, making an attempt to inch nearer to the very best level would require extra uptick from these metrics.

Supply: Glassnode