The U.S. Client Worth Index (CPI) for June jumped to 9.1%, in accordance with data launched by the Bureau of Labor Statistics right this moment, July 13. The rise in CPI began a liquidation chain throughout the crypto market, in addition to inventory markets.

In truth, worth pressures will drive the Federal Reserve is most certainly to go huge on the rate of interest hike later this month. The CME’s FedWatch instrument signifies the likelihood of a 100 bps rate of interest hike on the Fed’s assembly on July 27.

Crypto costs tumbled massively after the U.S. Bureau of Labor Statistics introduced a 9.1% CPI for the month of June. Bitcoin (BTC) and Ethereum (ETH) costs tumbled to $18,990 and $1019, respectively. That is the best inflation seen within the U.S. within the final 40 years. The recession worry can be rising as that is the fourth-straight month of rising inflation.

The present state of affairs confirms a 75 bps fee hike by the Ate up July 27. Nonetheless, the primary concern is an increase within the likelihood of a 100 bps rate of interest hike. The CME’s FedWatch instrument signifies a forty five% likelihood of 75 bps and a 55% likelihood of 100 bps.

The crypto market, which is already underneath strain because of the bearish circumstances and liquidity disaster, might tumble considerably because of the rising rates of interest. The rate of interest hike by central banks worldwide within the final months had dwindled buyers’ curiosity in crypto, in addition to equities.

The cryptocurrencies have been carefully monitoring shares for the previous couple of quarters. As buyers have decreased their publicity to macroeconomic threat, they’ve offered off crypto together with equities.

A survey launched by Goldman Sachs on Wednesday revealed that 93% of small enterprise homeowners assume the U.S. will enter a recession within the subsequent six months.

A pullback could also be seen from retail and institutional buyers as a consequence of a “delicate recession this 12 months,” says Financial institution of America economists.

Rise in Liquidations Amid Curiosity Fee Hike And Recession Concern

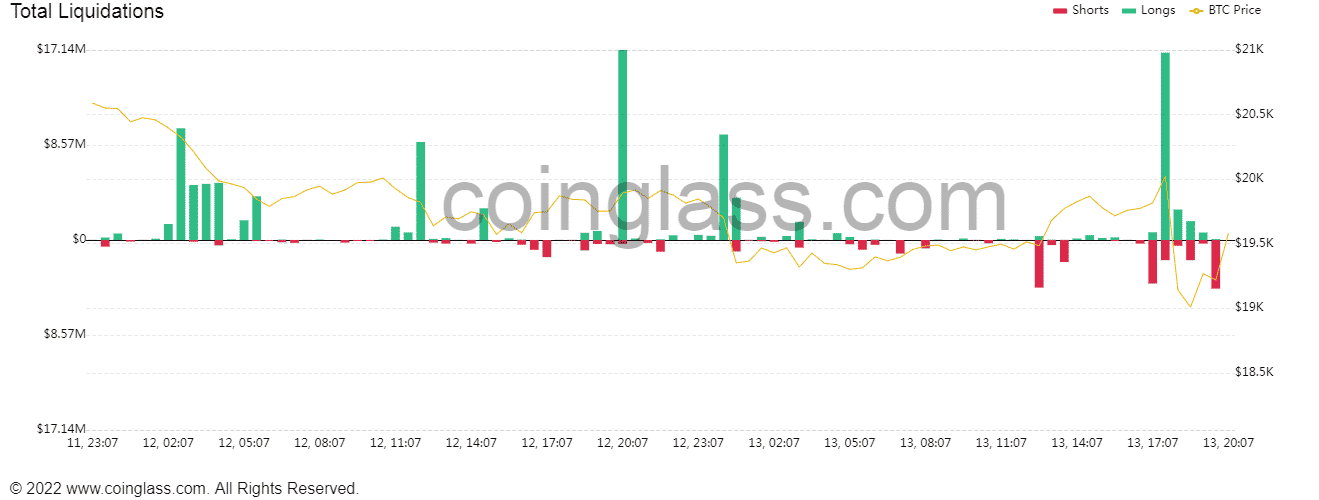

The worldwide crypto market cap declines additional to $867.54 billion after the most recent CPI report. The rise in costs throughout the crypto market is faux as a consequence of brief promoting by merchants and institutional buyers. Institutional buyers have been piling into brief positions on BTC forward of the inflation information.

The full crypto liquidation jumps over $250 million, with Ethereum and Bitcoin witnessing 88 million and 87 million liquidated within the final 24 hours.

In keeping with the MLIV Pulse survey, 60% of the Wall Avenue specialists surveyed assume BTC might fall to $10,000 as a consequence of rising inflation.