On-chain information exhibits the Bitcoin alternate whale ratio has remained at a excessive worth lately, an indication that could possibly be bearish for the crypto’s worth.

Bitcoin Alternate Whale Ratio On Verge Of Getting into “Very Excessive Danger” Zone

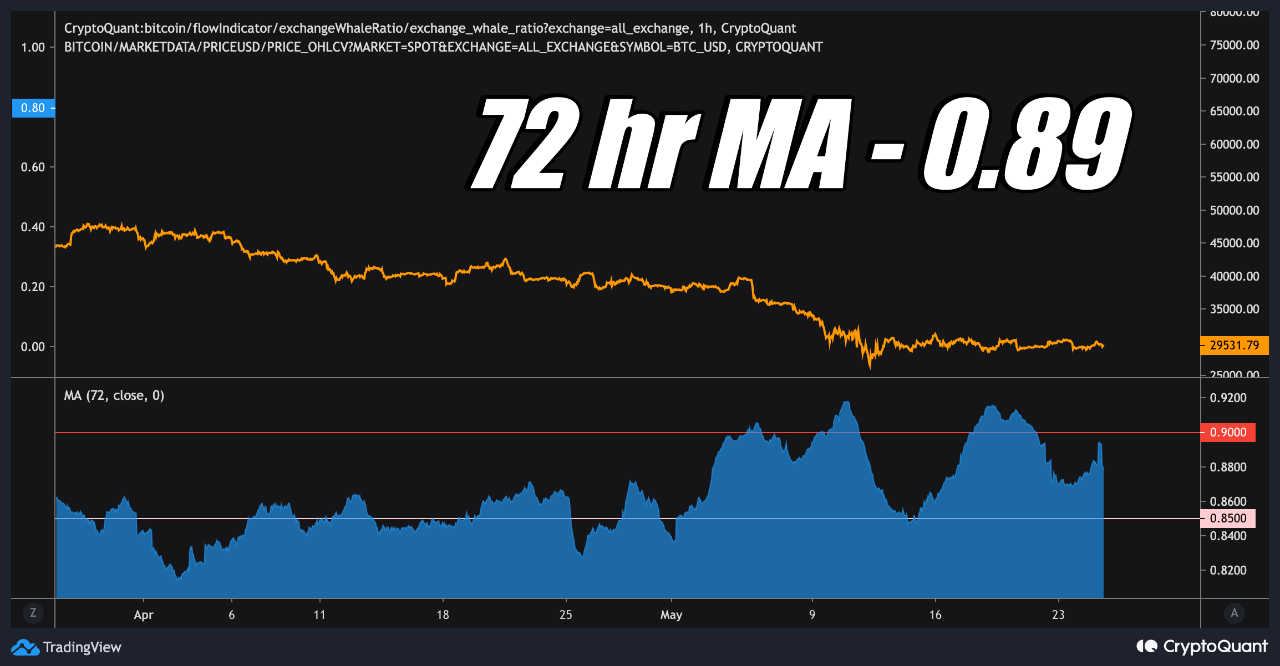

As defined by an analyst in a CryptoQuant post, the 72-hour MA whale ratio is close to 0.90, the very excessive danger zone.

The “alternate whale ratio” is an indicator that’s outlined because the sum of prime ten inflows to exchanges divided by the whole inflows.

In less complicated phrases, this metric tells us what a part of the whole inflows are contributed by the ten largest transactions, which usually belong to the whales.

When the worth of this indicator is above 0.85, it means whales occupy a really massive proportion of alternate inflows proper now.

As traders often switch their Bitcoin to exchanges for promoting functions, such a pattern is usually a signal that whales are dumping for the time being.

The indicator’s worth often stays above this threshold throughout BTC bear markets, or pretend bull for mass dumping.

Associated Studying | Bitcoin Buying and selling Quantity Plummets Down From Latest High

Then again, values under the 0.85 mark often signify that whale inflows are at present in a more healthy steadiness with the remainder of the market. The ratio’s worth often stays on this area throughout bull runs.

Now, here’s a chart that exhibits the pattern within the Bitcoin alternate whale ratio (72-hour MA) over the previous couple of months:

It appears just like the indicator has been at a excessive worth lately | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin alternate whale ratio has a worth of about 0.89 proper now, above the 0.85 threshold.

Based on the quant within the submit, values above 0.90 could also be thought of the “very excessive danger” zone. So, the present worth of the indicator may be very near that.

Associated Studying | Traders Could Count on Draw back For Bitcoin And Ethereum Market For The Subsequent 3 Months

On this month up to now, the ratio’s worth has virtually all the time remained above the 0.85 line, with a few spikes above the 0.90 stage.

The analyst believes whales are lively proper now because of the FED Could Assembly Minutes, and if the ratio stays excessive within the close to future, then it might spell hassle for Bitcoin.

BTC Value

On the time of writing, Bitcoin’s worth floats round $28.8k, down 2% within the final seven days. Over the previous thirty days, the crypto has misplaced 30% in worth.

The under chart exhibits the pattern within the worth of the coin during the last 5 days.

Looks as if the value of the coin has plunged down during the last couple of days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com