Fast abstract:

- In response to CoinShares, digital asset funding merchandise noticed document weekly inflows of $274 million final week

- Bitcoin additionally noticed $299 million in inflows within the final week

- Establishments noticed the current crypto market meltdown brought on by USTs depegging as a shopping for alternative

The crypto market meltdown of final week catalyzed by the depegging of TerraUSD (UST) and the inflation of LUNA that quickly adopted was considered by institutional buyers as a shopping for alternative.

In response to a report by the staff at CoinShares, the sell-off resulted in digital asset funding merchandise seeing document weekly inflows for this 12 months, hitting $274 million final week. The report reiterated that institutional buyers noticed ‘the current UST steady coin de-peg and its related broad sell-off as a shopping for alternative.’

Moreover, Bitcoin was the most important benefactor of the turmoil seeing inflows of $299 million in the identical time interval. The report concluded that the buying of Bitcoin hinted that ‘buyers have been flocking to the relative security of the most important digital asset.’

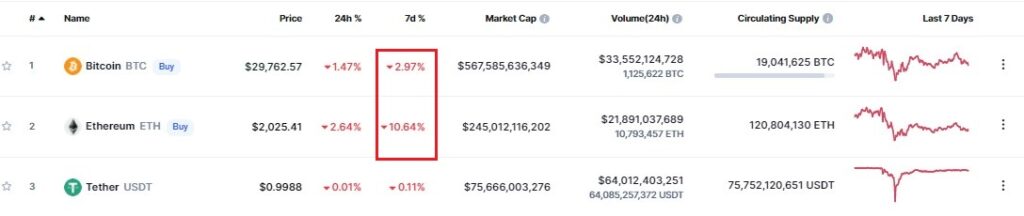

Bitcoin Has Been Comparatively Steady within the Final Week

With respect to stability, Bitcoin has been comparatively steady within the final seven days, experiencing a 2.97% drop in worth in comparison with Ethereum, which has seen a ten.64% decrement in value in the identical interval.

A Retest of $28k is Possible for Bitcoin, so is a Transfer Again to $32k

The 4-hour BTC/USDT chart under additional confirms Bitcoin’s stability within the final week because it ranges between the native low of $26,700 and the $32k resistance stage. Additionally, from the chart, it may be noticed that Bitcoin’s subsequent transfer is considerably unclear as its MFI and RSI are within the impartial territory of fifty and 48, respectively.

Bitcoin’s MACD on the 4-hour chart is exhibiting some indicators of weak spot, with its histograms confirming a discount in shopping for exercise. Consequently, Bitcoin might retest the $28k assist stage if patrons don’t step as much as the plate.

On the identical time, Bitcoin is making an attempt to recapture the 4-hour 50 transferring common (white) as assist that might open the doorways to a push in the direction of $32k.

Subsequently, a wait-and-see method is perhaps the most effective plan of action for the subsequent 24 or 48 hours, given the combined indicators being exhibited by Bitcoin on the 4-hour chart.

[Feature image courtesy of Unsplash.com]