U.S. Treasury Secretary Yellen mentioned Bitcoin, as a retirement financial savings car, could be a “very dangerous” transfer, Bloomberg Information reported.

She added that it will be becoming for Congress to “deal with the hazard,” suggesting legislative modifications to retirement autos, resembling 401(okay)s, could possibly be on the playing cards to exclude digital property.

Constancy allows Bitcoin as 401(okay) funding possibility

The biggest supplier of retirement plans within the U.S., Constancy Investments, shocked the funding world in April by asserting plans to supply its 401(okay) clients the choice to put money into Bitcoin.

“Roughly 23,000 corporations use Constancy to manage their retirement plans, and Constancy presently has greater than $11 trillion in property below administration.”

The agency will permit retirement savers to assign as much as 20% of their account stability to the main cryptocurrency, with particular person fiduciaries capable of set their very own limits on worker contributions and allocations.

Constancy is presently constructing out its digital property platform, that means the choice gained’t be out there till later this yr.

Cryptocurrency advocates see this as one other step in direction of the legitimacy of digital property. However others have blasted the transfer as a horrible concept.

Senior Analysis Analyst at Morningstar, Madeline Hume, mentioned the distinction between shares and bonds in a retirement account versus BTC is that dividends and curiosity funds again the previous. Bitcoin pricing is essentially speculation-driven, which “makes it a nasty match” for retirement financial savings.

“The absence of fundamentals and valuations makes it a nasty match for a 401(okay) plan.”

BTC outperformed all different property over the previous decade

Regardless of the hostile rhetoric, proponents would argue that as the most effective performing asset of the earlier ten years, not together with Bitcoin in a retirement financial savings car could be overly cautious.

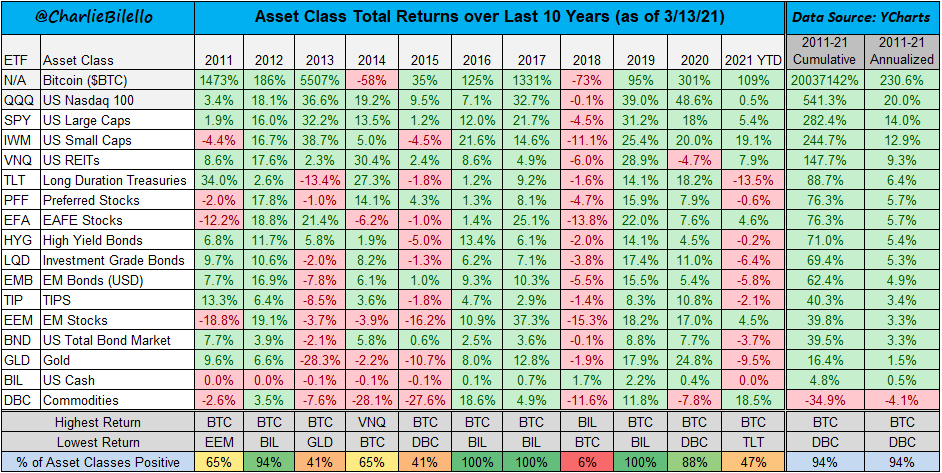

In 2021, the founding father of Compound Capital Advisors, Charlie Bilello, tweeted an evaluation of asset lessons exhibiting whole share returns from 2011 to 2021.

It confirmed optimistic yearly returns for Bitcoin in all however the years 2014 and 2018. Over the ten years, BTC’s cumulative return got here out at 20,037,142%, round 37,000 occasions greater than the following best-performing asset class- the Nasdaq 100.

A big proportion of those beneficial properties took place early in BTC’s life cycle when it was priced comparatively cheaply. Which means that comparable share strikes are unlikely to occur once more over the following ten years.

Nonetheless, with an annualized common of +230% beneficial properties, it’s tough to disregard Bitcoin as a car for capital development.