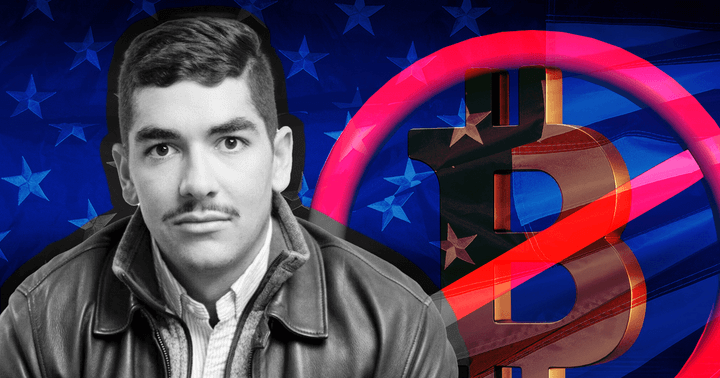

CoinMetrics co-founder Nic Carter alleged that the U.S. authorities is utilizing the banking sector to execute a widespread crackdown in opposition to the crypto business.

Nic Carter mentioned in a Jan. 8 visitor put up for PirateWires that crypto companies are discovering it more and more tough to acquire entry to onshore banking programs because of unfriendly authorities laws. Carter mentioned:

“Particularly, the Biden administration is now executing what seems to be a coordinated plan that spans a number of businesses to discourage banks from coping with crypto companies.”

For context, anti-crypto lawmaker Elizabeth Warren reportedly issued a letter to Silvergate on Dec. 6, reprimanding the agency for offering banking providers to FTX.

Barely 24 hours later, the crypto-friendly Signature financial institution knowledgeable its prospects that it might shut down their crypto accounts and return their cash. In consequence, Binance introduced that it might solely course of fiat transactions value greater than $100,000.

In the same transfer, Metropolitan Business Financial institution introduced a complete shutdown of its crypto-related providers.

Moreover, the Federal Reserve reportedly denied crypto financial institution Custodia’s utility to turn out to be a member of the Federal Reserve System because of excessive threat.

From a coverage perspective, the Fed, the FDIC, and the OCC launched a joint assertion on Jan. 3 stating the dangers banks face by partaking with crypto companies. Banks had been strongly discouraged from doing so, citing “security and soundness” dangers.

Though the authorities didn’t brazenly ban banks from coping with crypto shoppers, Carter mentioned that the stringent insurance policies and the DOJ’s latest investigations in opposition to Silvergate function a deterrent to different banks.

Carter additional defined that the latest regulatory faceoff with crypto companies could possibly be a resurgence of Operation Choke Level (OCO). In 2013, federal officers used OCO to use stress on banks to close down accounts of companies they had been ideologically against.

In consequence, many Poker corporations and Payday lenders came upon that their financial institution accounts had been terminated with little clarification other than “regulatory stress.”

Carter cautioned that if U.S. regulators don’t rethink their stress on banks, they threat shedding extra crypto companies and U.S. traders to areas with much less refined jurisdictions.