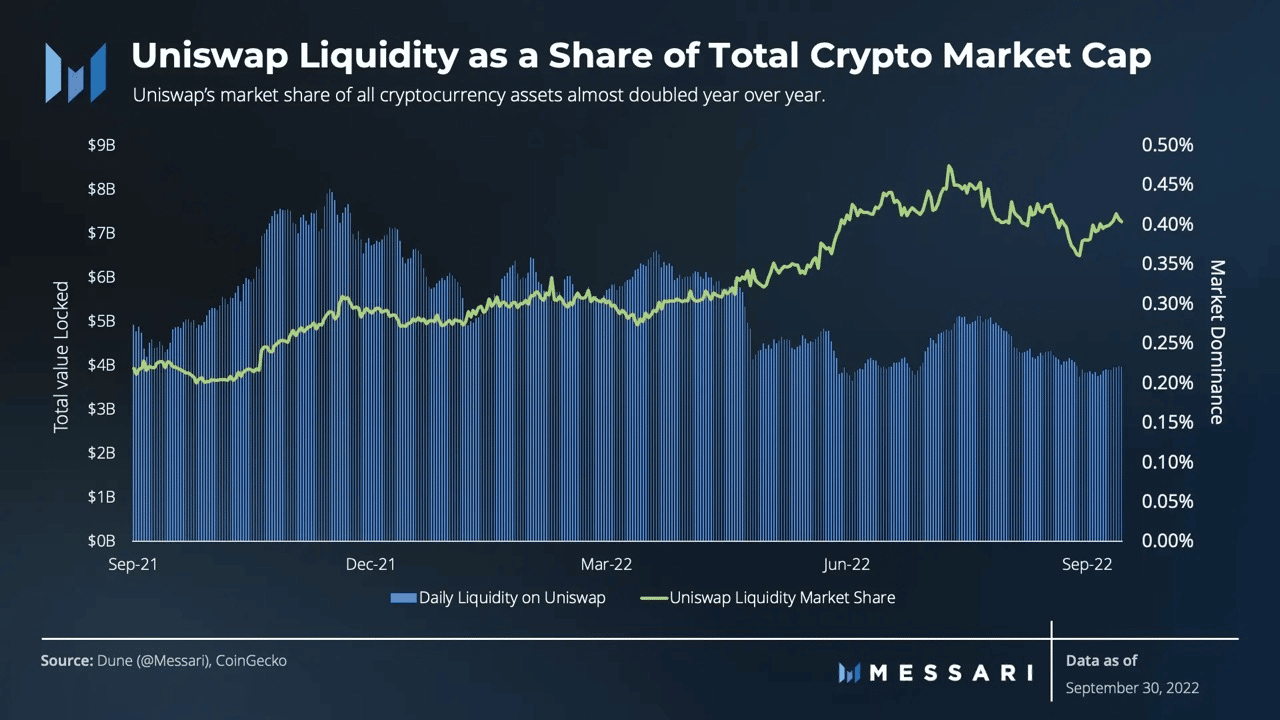

Uniswap’s [UNI] liquidity market share has grown tremendously over the previous quarter, as per a tweet posted on 7 November by crypto analytics agency Messari

Liquidity on @Uniswap almost doubled its share of the full crypto market cap during the last 12 months and settled at 0.4% market dominance as of the top of Q3.

This internet acquire in market share highlights Uniswap’s capability to draw liquidity. pic.twitter.com/ecBgyVox8E

— Messari (@MessariCrypto) November 7, 2022

Right here’s AMBCrypto’s Value Prediction for Uniswap for 2022-2023

Placing the “quid” in Liquid

Regardless of Uniswap’s every day liquidity declining, its market share when it comes to liquidity saved rising, as may be seen from the picture under. Thus, UNI vastly outperformed different DEX’s on this regard.

On the time of writing, Uniswap’s liquidity settled at 0.4% market dominance as of the end of Q3.

Supply: Messari

Nevertheless, regardless of the expansion when it comes to liquidity, its TVL wasn’t impacted a lot and its motion remained flat over the previous few months. On the time of writing, the full worth locked by Uniswap was $4.45 billion, in response to information offered by DeFiLlama.

Together with that, the full charges collected by Uniswap continued to say no as effectively. In keeping with Token Terminal, the charges generated by Uniswap depreciated over the previous seven days by 12.2%. Within the final 24 hours, the full income collected by the DEX was $1.1 million.

In congruence with these developments, Uniswap’s provide aspect income depreciated by 4.99% as effectively. At press time, the general provide aspect income collected was $3.43 million.

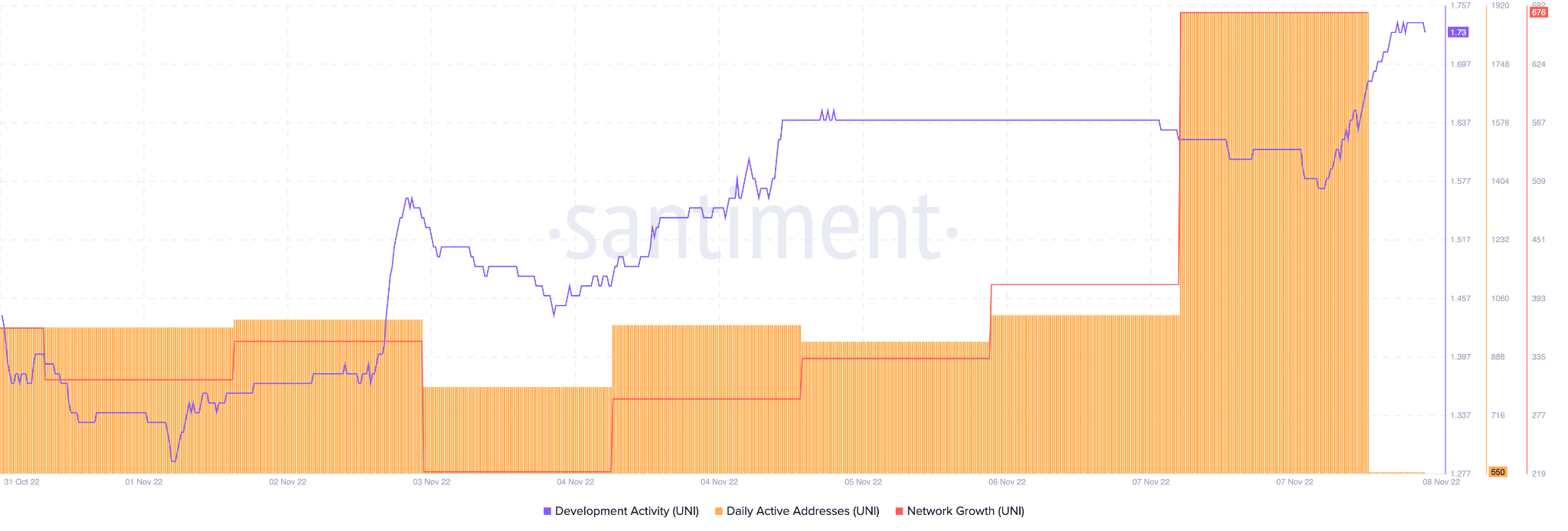

However, Uniswap’s community progress witnessed an enormous uptick over the previous couple of days, as may be seen from the picture under.

This indicated that the variety of new addresses that transferred a UNI token for the primary time had elevated, exhibiting an curiosity in UNI from new customers.

However that’s not all, Uniswap additionally noticed a spike in its growth exercise during the last week. Thus, suggesting that the builders have been more and more contributing to Uniswap’s GitHub. So there could also be new updates and upgrades on their method for UNI.

Supply: Santiment

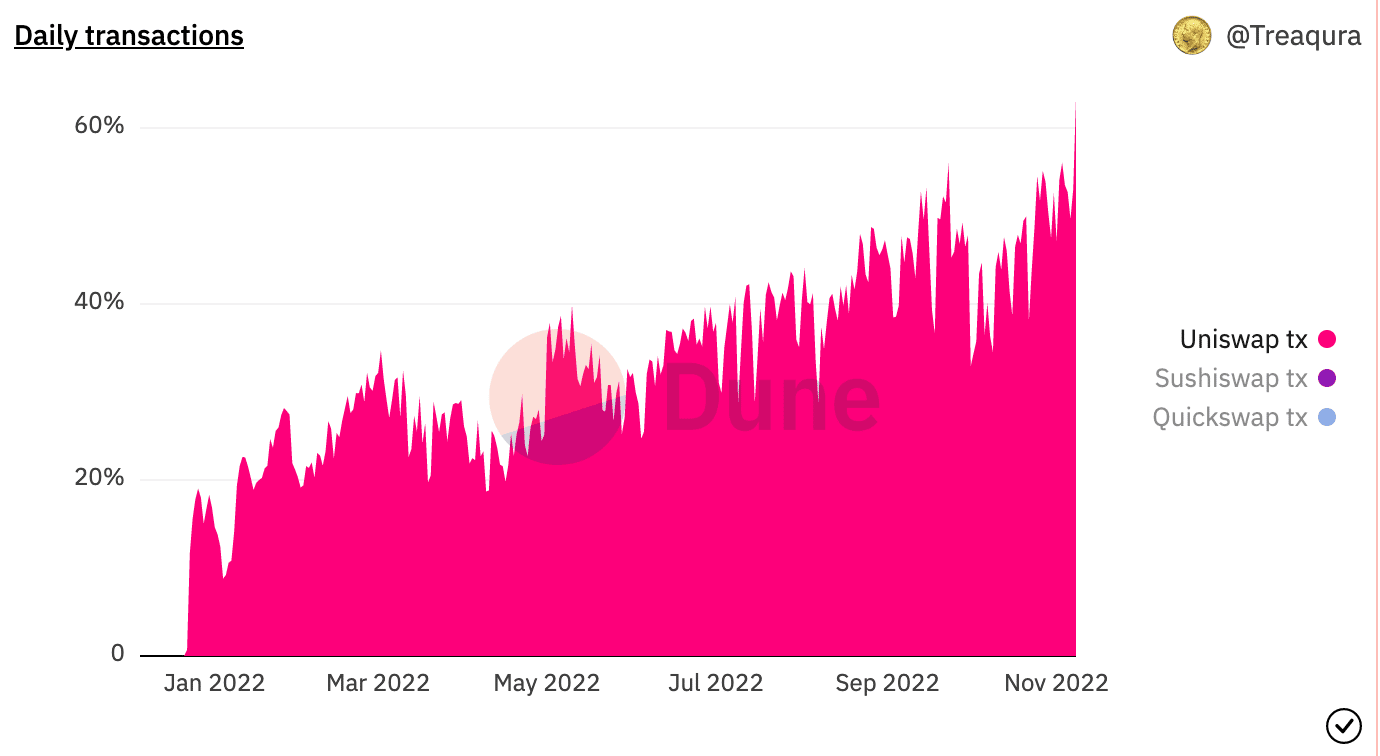

As evidenced by the chart under, it may be seen that the variety of every day transactions on the UNI community grew considerably in the previous couple of months.

Supply: Dune Analytics

Sadly, regardless of these constructive developments, UNI’s worth continued to say no. On the time of writing, UNI had depreciated by 9.45% during the last 24 hours, in response to CoinMarketCap. Nevertheless, its quantity continued to develop and appreciated by 14.4% throughout the identical time interval.