Blockchain

In response to a press launch printed on Feb. 8, blockchain carbon credit score transaction community Carbonplace has secured $45 million in an funding spherical from its 9 founder banks with a mixed $9 trillion in property beneath administration. The banks are BBVA, BNP Paribas, CIBC, Itaú Unibanco, Nationwide Australia Financial institution, NatWest, Commonplace Chartered, SMBC, and UBS. The London-based fintech has additionally introduced that it’s going to grow to be an impartial entity, led by new CEO Scott Eaton.

As informed by Carbonplace, the corporate will use the funding to strengthen its platform and workforce, permitting it to scale its companies to a bigger consumer base of economic establishments and search partnerships with different carbon market gamers, resembling registries and inventory exchanges world wide. Carbonplace has been described because the SWIFT [Society for Worldwide Interbank Financial Telecommunications] of carbon markets that may enable individuals to share carbon knowledge in actual time, making certain a safe and traceable settlement of transactions.

Commenting on the event, Robert Begbie, CEO of NatWest Markets, cited knowledge from McKinsey exhibiting that international demand for voluntary carbon credit is prone to improve by an element of 15 within the subsequent a number of years. He mentioned Carbonplace is uniquely positioned to satisfy that demand by offering scalable expertise to environmentally-conscious companies.

Whereas the service is anticipated to launch later this yr, Carbonplace has already piloted trades with firms resembling Visa and Local weather Affect X. Carbonplace makes use of its owndistributed ledger expertise to facilitate offset transactions and has hailed digital wallets as a software to allow house owners to reliably reveal possession to the market, decreasing the dangers of double counting and simplifying reporting.

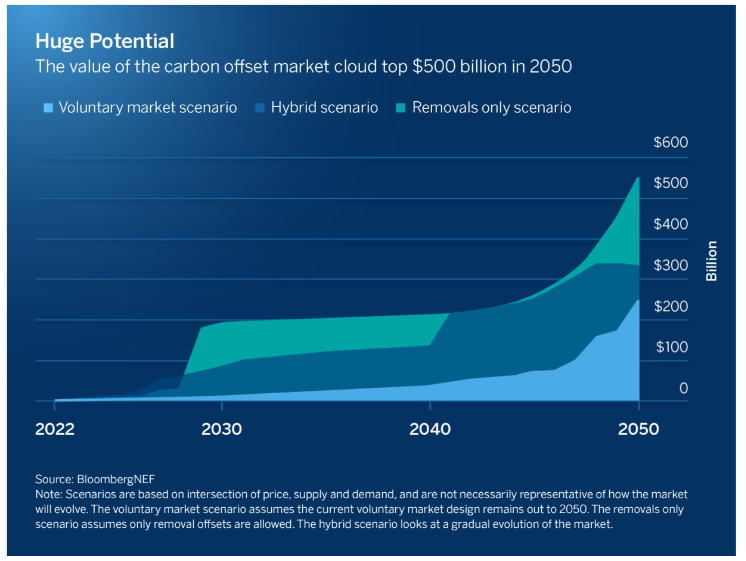

Projections of the worldwide carbon offset market | Supply: BBVA, BloombergNEF