TRON community not too long ago launched its newest weekly replace, one that you just may wish to look into particularly if you’re a TRX dealer/investor. Actually, some argue that these developments may affect the demand for TRX going ahead.

Right here’s AMBCrypto’s Worth Prediction for Tron (TRX)for 2023-24

The community introduced a collaboration with standard crypto-exchange Kraken, one via which customers will have the ability to deposit or withdraw USDC. This implies TRON may safe sufficient volumes to affect demand for TRX, on condition that Kraken is without doubt one of the market’s prime exchanges.

The #TRON Weekly Replace is right here! ?

Watch the video under to study what occurred this previous week at #TRON! ?

Remember to love and share this video! #TronStrong? pic.twitter.com/mzZNMqHt5U

— TRON DAO (@trondao) November 2, 2022

The community additionally confirmed that Binance has rolled out a brand new staking platform, one that may enable TRX holders to stake and earn passively. A staking platform may encourage customers to carry on to their TRX for the long-term as a way to earn passive earnings. Such an end result would have a constructive impression on TRX demand, in addition to worth, with a big sufficient staking pool.

Whereas these are constructive developments, the community nonetheless requires strong volumes and utility for them to affect TRX demand dynamics. Happily, the Tron community has been quickly rising and this was additionally highlighted within the replace.

It revealed that the variety of person accounts crossed the 117 million milestone. As well as, community transactions crossed the 4.1 billion mark. Whereas these developments additional implement TRX’s bullish case, can they contribute to the elements at the moment favoring a bullish pivot?

What of TRX’s worth motion?

TRX has retraced for the final 5 days after a wholesome bull run in direction of the top of October. It was buying and selling at $0.061, at press time, and demonstrated a return of bullish momentum following its most up-to-date pullback.

Supply: TradingView

TRX’s worth motion additionally notably skilled a return of demand after touching the 50-day shifting common. The latter usually acts as a psychological pivot zone and the not too long ago launched weekly replace may affect a good sentiment shift.

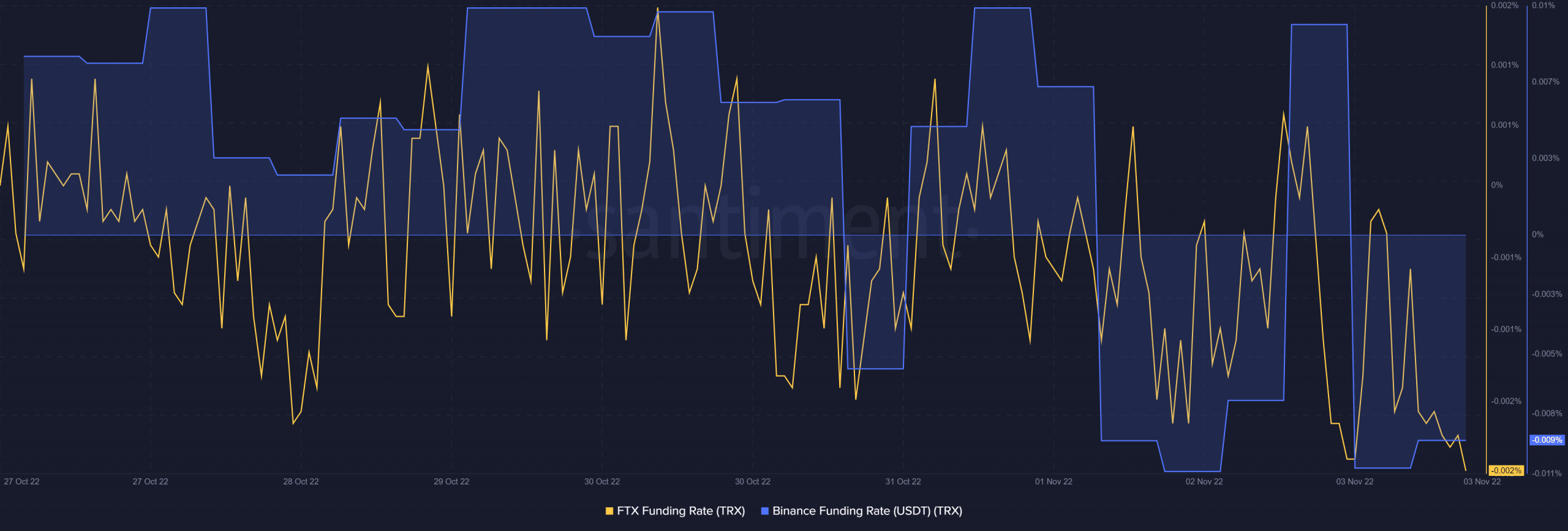

Demand for TRX, particularly within the derivatives market, didn’t exhibit indicators of restoration. This, regardless of the observations on the chart indicator. Each the Binance and the FTX funding charges had been caught across the backside stage of their weekly ranges, confirming low demand from the derivatives market.

Supply: Santiment

Conclusion

Latest observations recommend that TRX is likely to be about to register an upside. Nonetheless, the shortage of a substantial demand shift may point out low shopping for exercise.

Demand within the derivatives market usually mirrors that of the spot market. If the identical logic holds true for the prevailing TRX demand ranges within the spot market, then we’d not get to see a big upside.