A broadly adopted crypto strategist is taking a look at one essential metric with a historical past of precisely calling Bitcoin (BTC) bottoms.

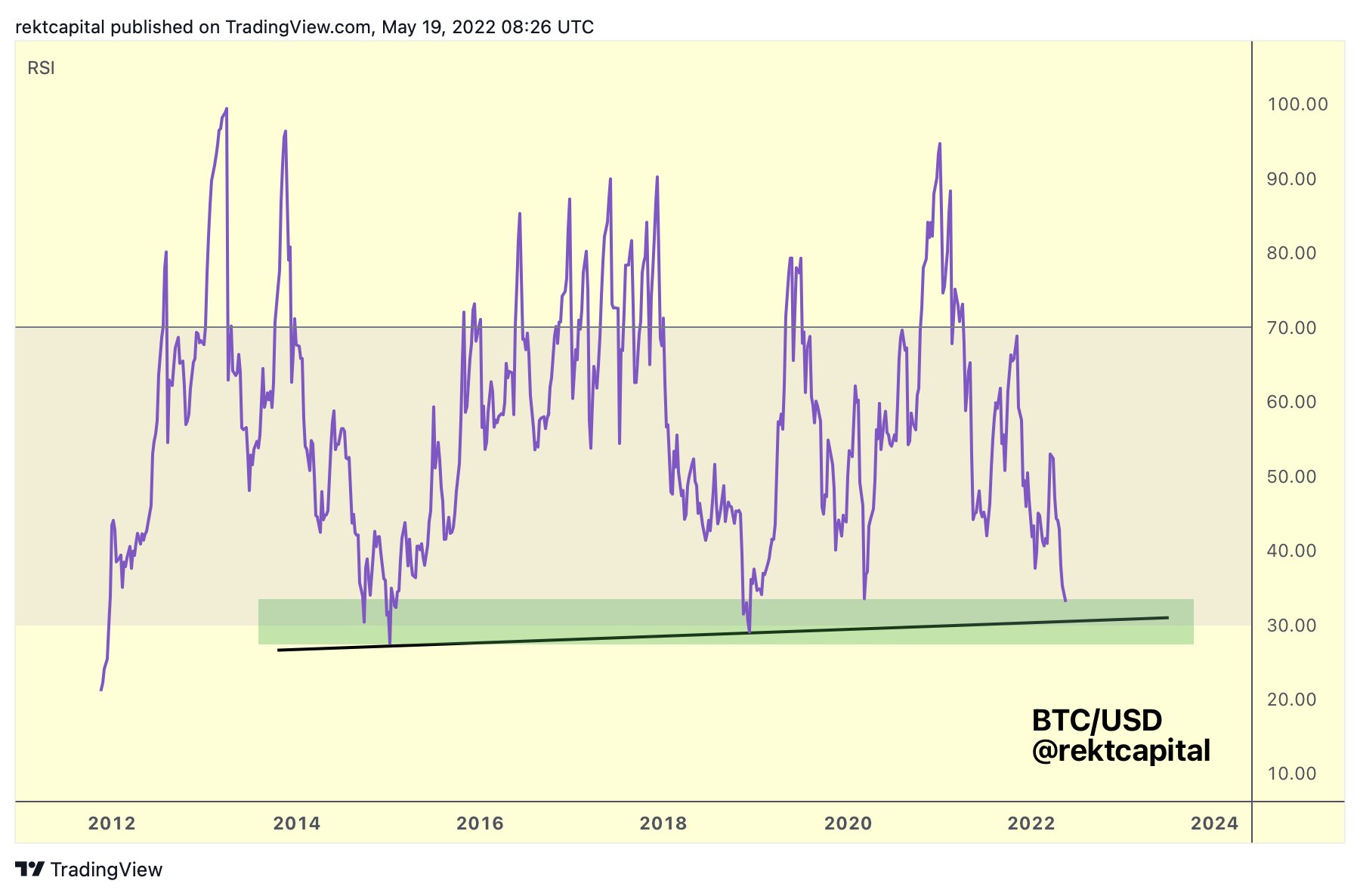

Pseudonymous dealer Rekt Capital tells his 303,000 Twitter followers that BTC’s Relative Energy Index (RSI) is reaching a stage that traditionally indicators a bounce may very well be on the horizon for the highest crypto asset by market cap.

“BTC’s RSI reaching March 2020 ranges represents a greatest case state of affairs for a BTC backside being very shut.

Nevertheless, RSI ranges dipped a lot decrease in 2015 and 2018 to achieve a bear market backside.

Ought to RSI ranges go decrease, [the] black increased low may very well be a degree of reversal.”

An asset’s RSI is a momentum indicator measuring current costs to find out whether or not it’s oversold or overbought in a particular timeframe.

In line with the crypto analyst, the earlier thrice Bitcoin’s RSI dipped to the realm it’s close to now, a bear market backside was discovered, igniting a restoration.

“Bitcoin RSI is now getting into a interval that has traditionally preceded outsized returns on funding for long-term buyers.

Earlier reversals from this space embody January 2015, December 2018, and March 2020.

All bear market bottoms.”

Rekt Capital says that BTC’s RSI just lately reached the identical stage it was in March 2020, earlier than the main digital asset kicked off a rally that noticed it climb up right through the tip of the yr.

Bitcoin is altering arms at $29,302 at time of writing, a 6.5% lower from its seven-day peak of $31,319.

Examine Worth Motion

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in online marketing.

Featured Picture: Sutterstock/Kit8.internet